Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, a company began constructing a new asset. It borrowed $1,000,000 to finance the construction with an annual interest rate of

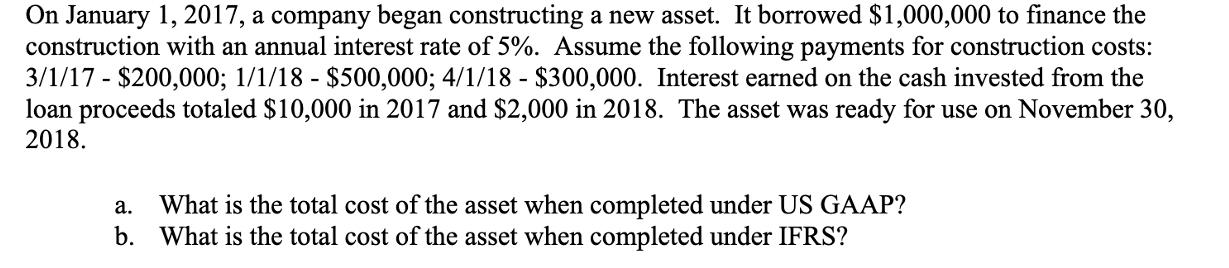

On January 1, 2017, a company began constructing a new asset. It borrowed $1,000,000 to finance the construction with an annual interest rate of 5%. Assume the following payments for construction costs: 3/1/17 $200,000; 1/1/18 - $500,000; 4/1/18 - $300,000. Interest earned on the cash invested from the loan proceeds totaled $10,000 in 2017 and $2,000 in 2018. The asset was ready for use on November 30, 2018. a. What is the total cost of the asset when completed under US GAAP? b. What is the total cost of the asset when completed under IFRS?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the total cost of the asset under US GAAP and IFRS we need to consider the const...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started