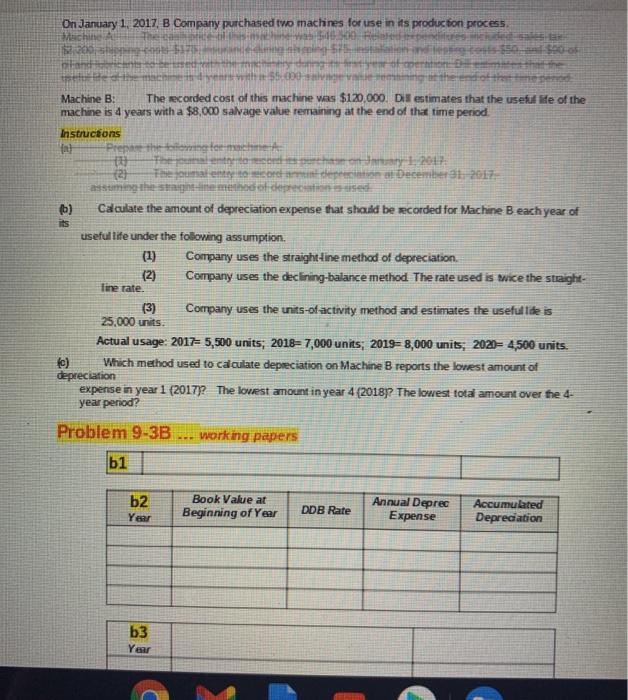

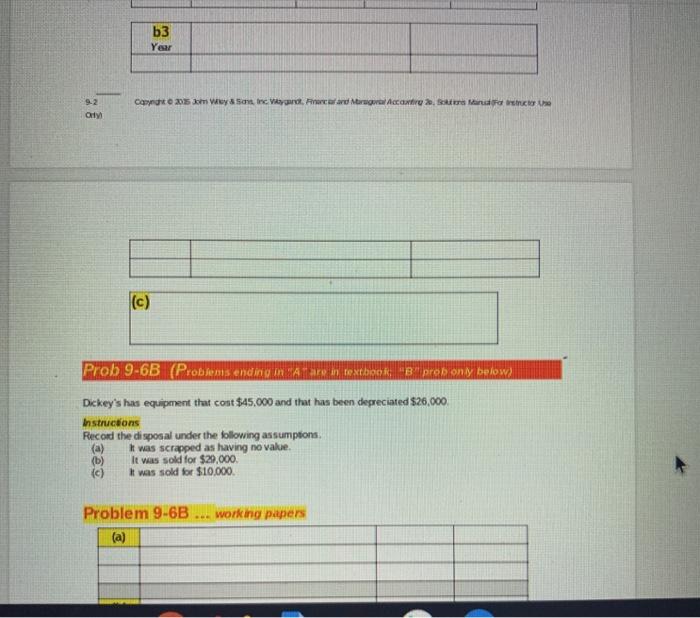

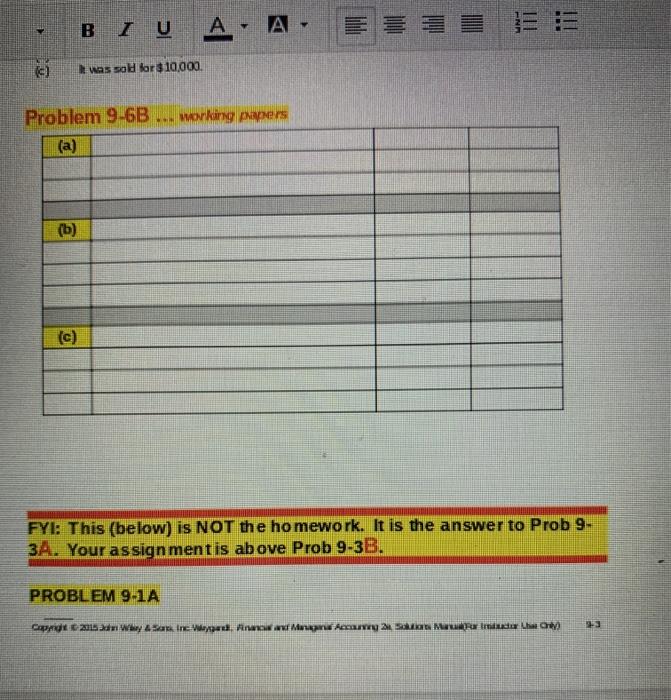

On January 1, 2017, B Company purchased two machines for use in its production process. M200, 2003 its Machine B: The recorded cost of this machine was $120.000. Dis estimates that the useful life of the machine is 4 years with a $8,000 salvage value remaining at the end of that time period. Instructions Prepare the tu ory 1, 2017 2 December 2017 mmg the b) Calculate the amount of depreciation expense that should be recorded for Machine B each year of useful life under the following assumption (1) Company uses the straight-line method of depreciation (2) Company uses the declining balance method. The rate used is wice the straight- Tine rate. (3) Company uses the units of activity method and estimates the useful lide is 25,000 units. Actual usage: 2017= 5,500 units; 2018=7,000 units; 2019= 8,000 units; 2020= 4,500 units. c) Which method used to calculate depreciation on Machine B reports the lowest amount of depreciation expense in year 1 (2017)? The lowest amount in year 4 (2018)? The lowest total amount over the 4- year period? Problem 9-3B ... working papers b1 b2 Year Book Value at Beginning of Year DDB Rate Annual Deprec Expense Accumulated Depreciation b3 Your b3 Year Cat 25 m Wyson Inc Vikander Margal Accountre 2. Sot Mac Only (c) Prob 9-6B (Problems ending in textbook prob on below) Dickey's has equipment that cost $45.000 and that has been depreciated $26,000 Instructions Record the disposal under the following assumptions (a) I was scrapped as having no value (b) It was sold for $29,000 (c) It was sold for $10.000 Problem 9-6B ... working papers (a) I was sold for $10,000. Problem 9-6B ... working papers (a) ( b) (c) FYI: This (below) is NOT the homework. It is the answer to Prob 9. 3A. Your assignment is above Prob 9-3B. PROBLEM 9-1A 3 2015 Wwy 4 Sarine Wipes www Magic 2 Mimido What Buildings Other Accounts Land $4,000 $690,000 $5,000 Property Tax Expense 145,000 Item 1 2 3 4 5 6 7 8 9 10 35,000 10,000 2,000 14,000Land Improvements 25,000 (3,500) $172,500 $735,000 PROBLEM 9-3A (b) (1) Recorded cost 180,000 Less: Salvage value 10,000 Depreciable cost $170,000 Years of useful life + 4 Annual depreciation S 42,500 (2) Book Value at DDB Annual Depreciation Accumulated Begin of Year Rate Expense Depreciation $180,000 50%* $90,000 $ 90,000 90,000 50% 45,000 135,000 45,000 50% 22,500 157,500 22,500 50% 12,500** 170,000 *100% + 4-year useful life = 25%; 25% X 2 = 50%.32 *$170,000-$157,500. (3) Depreciation cost per unit - ($180,000 - $10,000)/125,000 units = $1.36 per unit Annual Depreciation Expen se 2017: $1.36 X 45,000 = $61,200 BI U A. A 2018: 1.36 X 35,000 - 47,600 2019: 1.36 X 25,000 = 34,000 2020:1.36 X 20,000 = 27,200 (c) The declining-balance method reports the highest amount of depreciation expense the first year while the straight-line method reports the lowest. In the fourth year, the straight-line method reports the highest amount of depreciation expense while the declining-balance method reports the lowest No matter which of the three methods is used, the same total amount of depreciation expense will be recognized over the four-year period. PROBLEM 9-6A (a) Accumulated Depreciation Equipment Loss on Disposal of Plant Assets Equipment 80,000 50,000 30,000 (b) Cash 21,000 Accumulated Depreciation Equipment Loss on Disposal of Plant Assets Equipment 80,000 50,000 9,000 (c) Cash 31,000 Accumulated Depreciation Equipment Gain on Disposal of Plant Assets Equipment 80,000 50,000 1,000