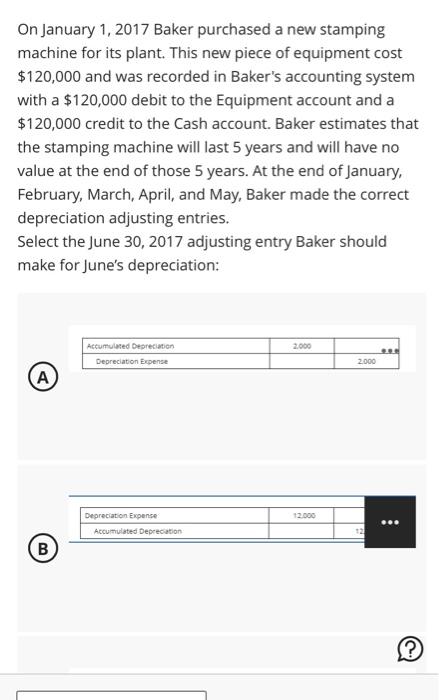

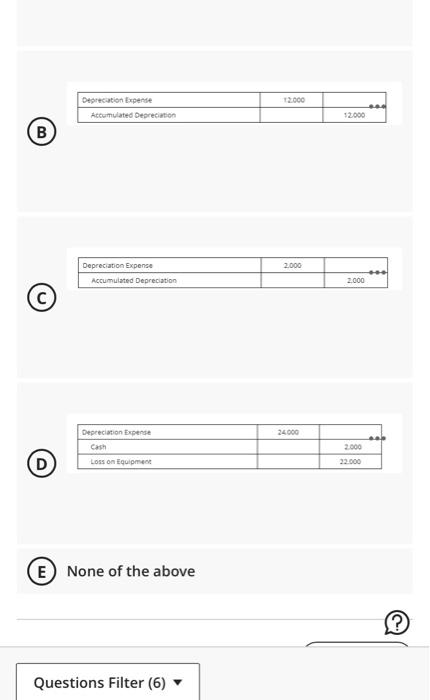

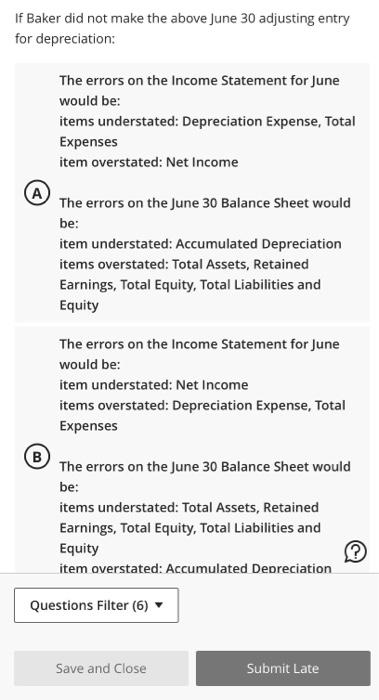

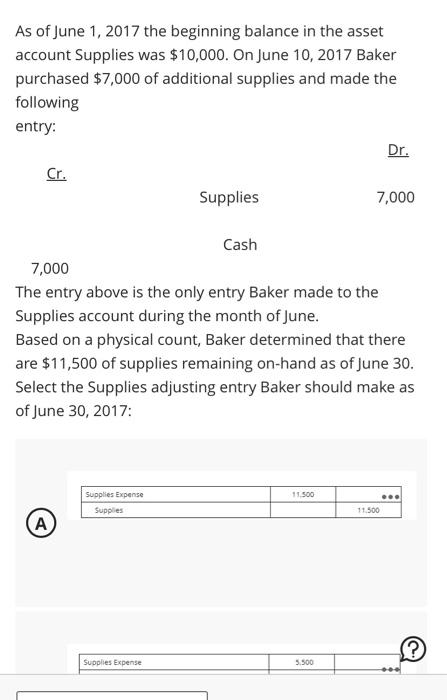

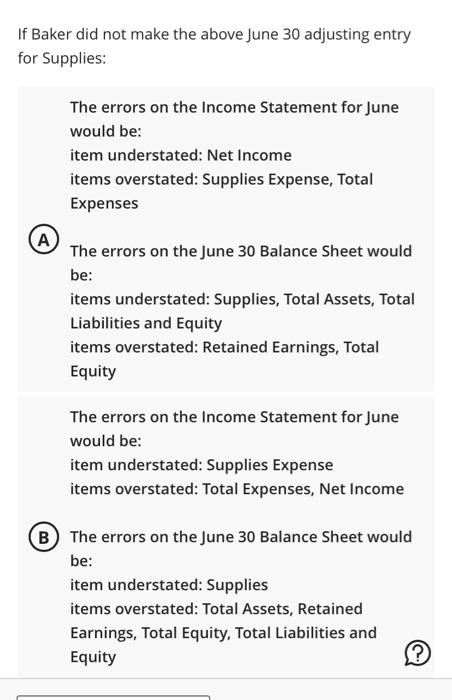

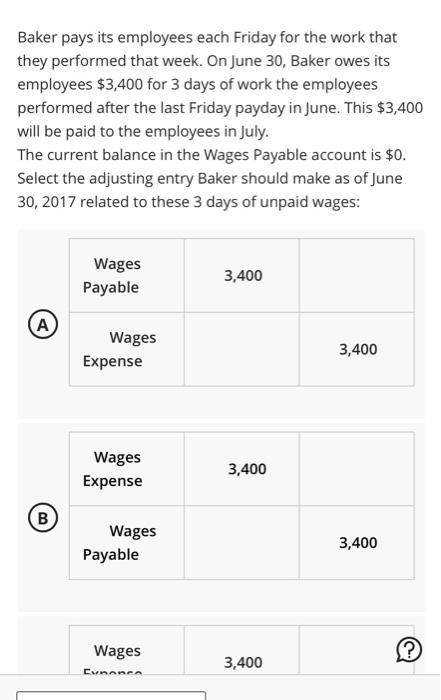

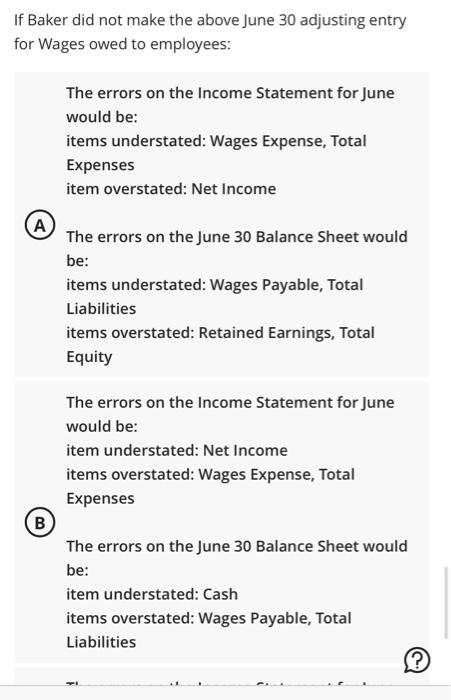

On January 1, 2017 Baker purchased a new stamping machine for its plant. This new piece of equipment cost $120,000 and was recorded in Baker's accounting system with a $120,000 debit to the Equipment account and a $120,000 credit to the Cash account. Baker estimates that the stamping machine will last 5 years and will have no value at the end of those 5 years. At the end of January, February, March, April, and May, Baker made the correct depreciation adjusting entries. Select the June 30, 2017 adjusting entry Baker should make for June's depreciation: B (c) (D) (E) None of the above If Baker did not make the above June 30 adjusting entry for depreciation: The errors on the Income Statement for June would be: items understated: Depreciation Expense, Total Expenses item overstated: Net Income (A) The errors on the June 30 Balance Sheet would be: item understated: Accumulated Depreciation items overstated: Total Assets, Retained Earnings, Total Equity, Total Liabilities and Equity The errors on the Income Statement for June would be: item understated: Net Income items overstated: Depreciation Expense, Total Expenses B The errors on the June 30 Balance Sheet would be: items understated: Total Assets, Retained Earnings, Total Equity, Total Liabilities and Equity item overstated: Accumulated Deoreciation As of June 1, 2017 the beginning balance in the asset account Supplies was $10,000. On June 10, 2017 Baker purchased $7,000 of additional supplies and made the following entry: 1,000 The entry above is the only entry Baker made to the Supplies account during the month of June. Based on a physical count, Baker determined that there are $11,500 of supplies remaining on-hand as of June 30 . Select the Supplies adjusting entry Baker should make as of June 30,2017 : If Baker did not make the above June 30 adjusting entry for Supplies: The errors on the Income Statement for June would be: item understated: Net Income items overstated: Supplies Expense, Total Expenses (A) The errors on the June 30 Balance Sheet would be: items understated: Supplies, Total Assets, Total Liabilities and Equity items overstated: Retained Earnings, Total Equity The errors on the Income Statement for June would be: item understated: Supplies Expense items overstated: Total Expenses, Net Income B The errors on the June 30 Balance Sheet would be: item understated: Supplies items overstated: Total Assets, Retained Earnings, Total Equity, Total Liabilities and Equity Baker pays its employees each Friday for the work that they performed that week. On June 30 , Baker owes its employees $3,400 for 3 days of work the employees performed after the last Friday payday in June. This $3,400 will be paid to the employees in July. The current balance in the Wages Payable account is $0. Select the adjusting entry Baker should make as of June 30,2017 related to these 3 days of unpaid wages: If Baker did not make the above June 30 adjusting entry for Wages owed to employees: The errors on the Income Statement for June would be: items understated: Wages Expense, Total Expenses item overstated: Net Income (A) The errors on the June 30 Balance Sheet would be: items understated: Wages Payable, Total Liabilities items overstated: Retained Earnings, Total Equity The errors on the Income Statement for June would be: item understated: Net Income items overstated: Wages Expense, Total Expenses B The errors on the June 30 Balance Sheet would be: item understated: Cash items overstated: Wages Payable, Total Liabilities