Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, Carly Fashions Inc. enters into a contract with a regional retail company to provide 500 blouses for $20,000 over the next

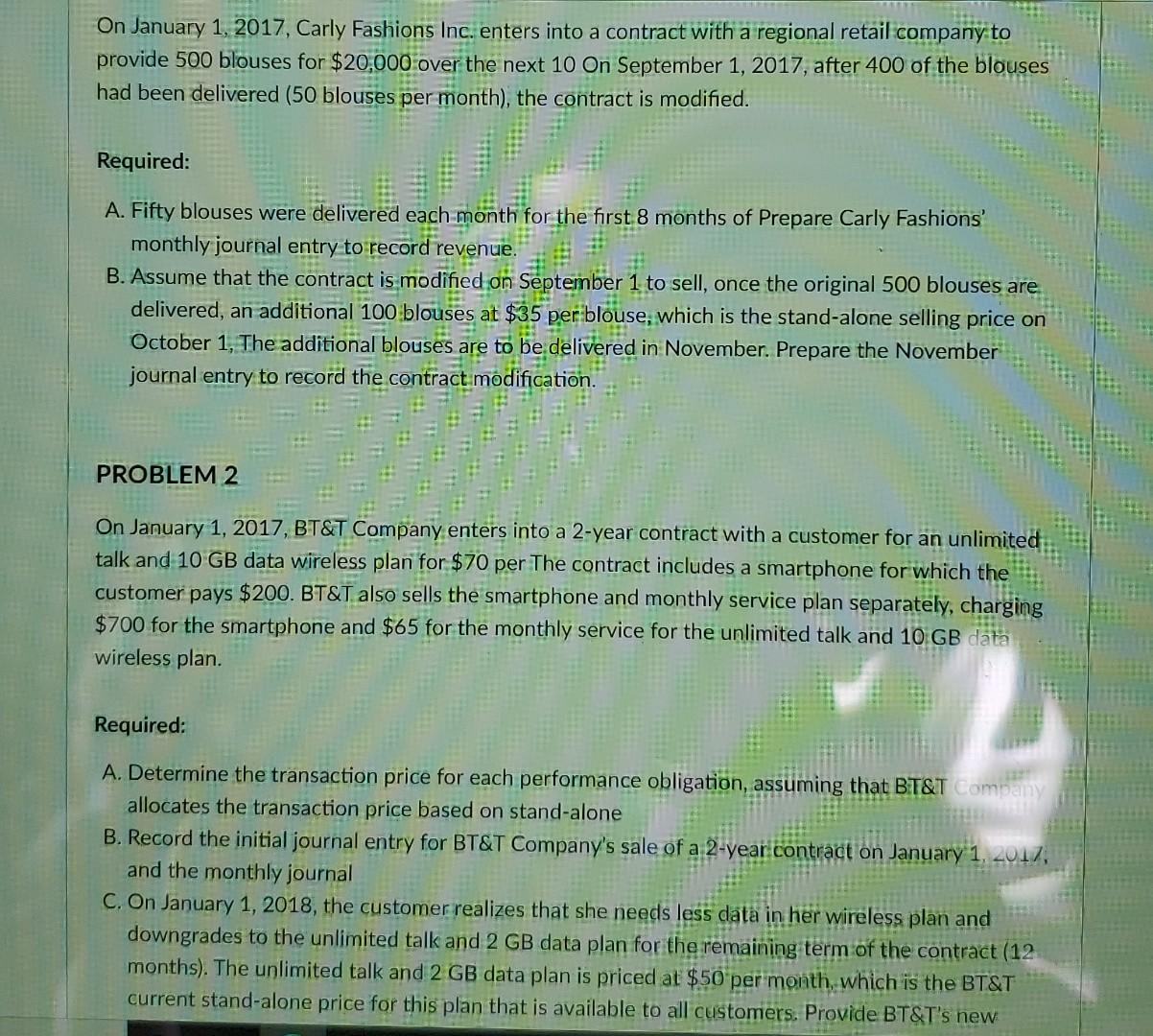

On January 1, 2017, Carly Fashions Inc. enters into a contract with a regional retail company to provide 500 blouses for $20,000 over the next 10 On September 1, 2017, after 400 of the blouses had been delivered (50 blouses per month), the contract is modified. Required: A. Fifty blouses were delivered each month for the first 8 months of Prepare Carly Fashions' monthly journal entry to record revenue. B. Assume that the contract is modified on September 1 to sell, once the original 500 blouses are delivered, an additional 100 blouses at $35 per blouse, which is the stand-alone selling price on October 1, The additional blouses are to be delivered in November. Prepare the November journal entry to record the contract modification. PROBLEM 2 On January 1, 2017, BT&T Company enters into a 2-year contract with a customer for an unlimited talk and 10 GB data wireless plan for $70 per The contract includes a smartphone for which the customer pays $200. BT&T also sells the smartphone and monthly service plan separately, charging $700 for the smartphone and $65 for the monthly service for the unlimited talk and 10 GB data wireless plan. Required: A. Determine the transaction price for each performance obligation, assuming that BT&T Compan allocates the transaction price based on stand-alone B. Record the initial journal entry for BT&T Company's sale of a 2-year contract on January 1, 2017 and the monthly journal C. On January 1, 2018, the customer realizes that she needs less data in her wireless plan and downgrades to the unlimited talk and 2 GB data plan for the remaining term of the contract (12 months). The unlimited talk and 2 GB data plan is priced at $50 per month, which is the BT&T current stand-alone price for this plan that is available to all customers. Provide BT&T's new

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started