Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, Cheyenne Corporation issued $1,640,000 face value, 5%, 10- year bonds at $1,409,627. This price resulted in an effective-interest rate of 7%

On January 1, 2017, Cheyenne Corporation issued $1,640,000 face value, 5%, 10- year bonds at $1,409,627. This price resulted in an effective-interest rate of 7% on the bonds. Cheyenne uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest January 1.

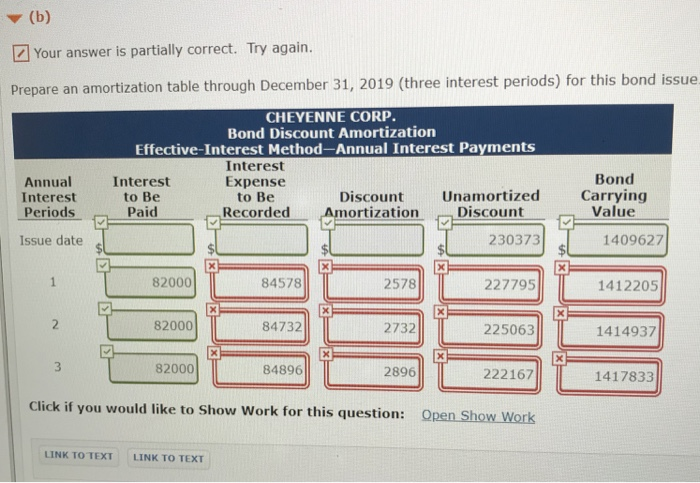

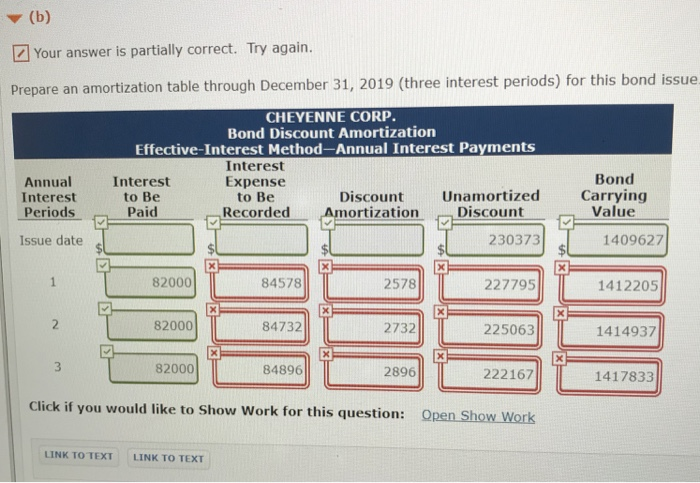

Your answer is partially correct. Try again. Prepare an amortization table through December 31, 2019 (three interest periods) for this bond issue CHEYENNE CORP Bond Discount Amortization Effective-Interest Method-Annual Interest Payments Interest Expense Bond Annual Interest Periods nerrePaid Recorded Amortization Interest to Be Unamortized Discount Carrying Value Discount Issue date 230373 1409627 82000 84578 2578 227795 1412205 82000 84732 2732 225063 1414937 3 82000 84896 2896 222167 1417833 Click if you would like to Show Work for this question: Ope LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started