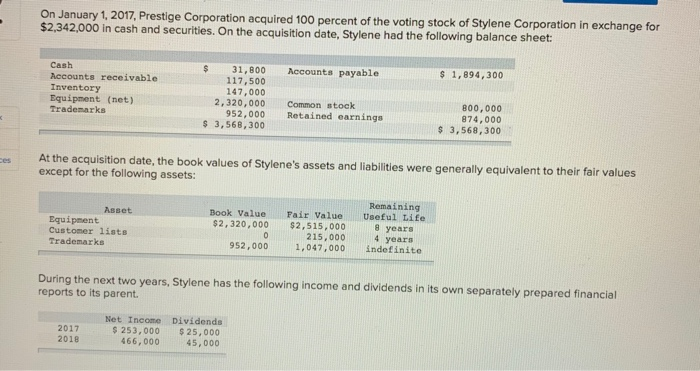

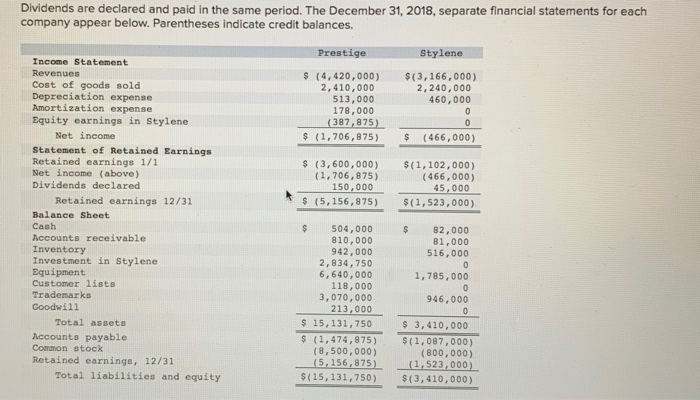

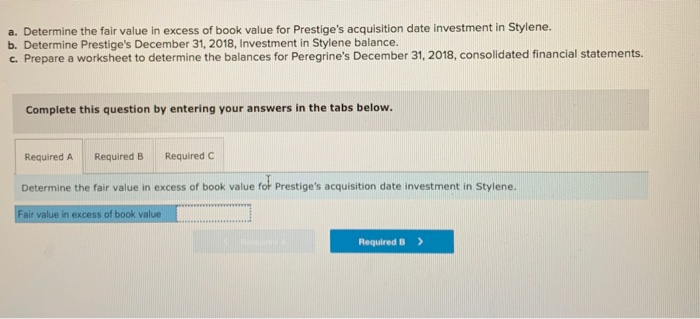

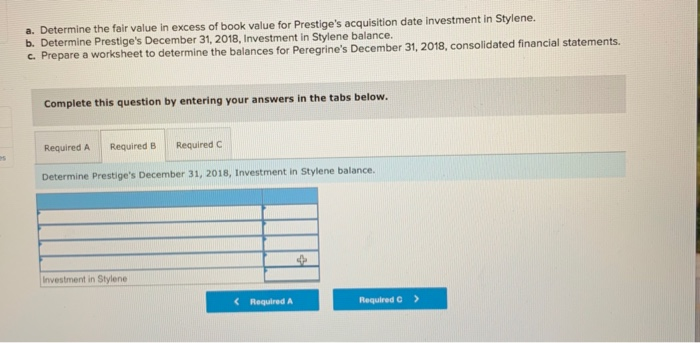

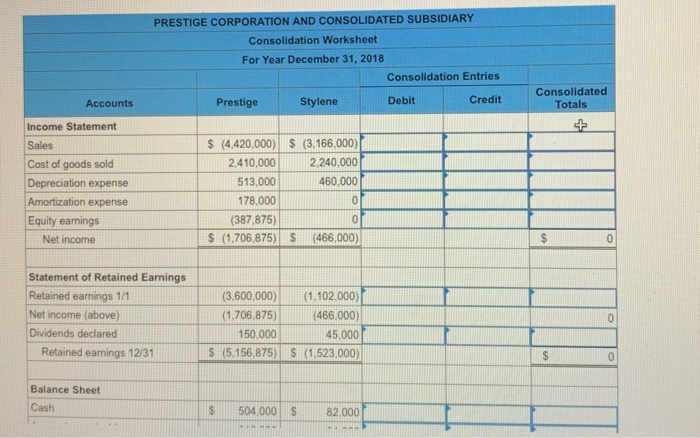

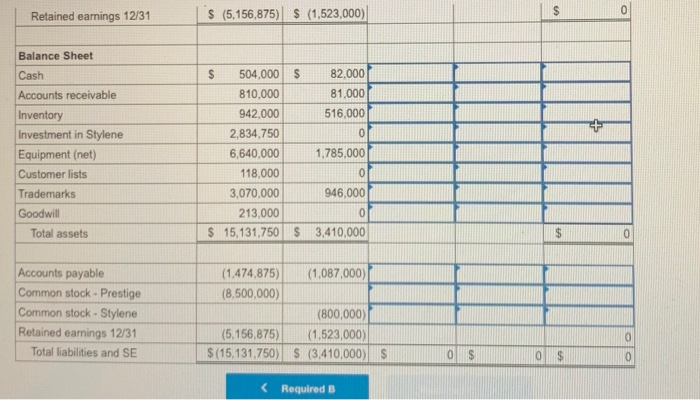

On January 1, 2017, Prestige Corporation acquired 100 percent of the voting stock of Stylene Corporation in exchange for $2,342,000 in cash and securities. On the acquisition date, Stylene had the following balance sheet: Accounts payable $ 1,894,300 Cash Accounts receivable Inventory Equipment (net) Trademarks $ 31,800 117,500 147,000 2,320,000 952,000 $ 3,568,300 Common stock Retained earnings 800,000 874,000 $ 3,568,300 At the acquisition date, the book values of Stylene's assets and liabilities were generally equivalent to their fair values except for the following assets: Asset Equipment Customer lists Trademarks Book Value $2,320,000 0 952,000 Fair Value $2,515,000 215,000 1,047,000 Remaining Useful Life 8 years 4 years indefinite During the next two years, Stylene has the following income and dividends in its own separately prepared financial reports to its parent. 2017 2018 Net Income Dividends $ 253,000 $ 25,000 466,000 45,000 Dividends are declared and paid in the same period. The December 31, 2018, separate financial statements for each company appear below. Parentheses indicate credit balances. Prestige Stylene $ (4,420,000) 2,410,000 513,000 178,000 (387,875) $ (1,706,875) $(3,166,000) 2,240,000 460,000 0 $ (466,000) $ (3,600,000) (1,706,875) 150,000 $ (5,156,875) $(1,102,000) (466,000) 45,000 $(1,523,000) Income Statement Revenues Cost of goods sold Depreciation expense Amortization expense Equity earnings in Stylene Net income Statement of Retained Earnings Retained earnings 1/1 Net income (above) Dividends declared Retained earnings 12/31 Balance Sheet Cash Accounts receivable Inventory Investment in Stylene Equipment Customer lists Trademarks Goodwill Total assets Accounts payable Common stock Retained earnings, 12/31 Total liabilities and equity $ 504,000 810,000 942,000 2,834,750 6,640,000 118,000 3,070,000 213,000 $ 15,131,750 $ (1,474,875) (8,500,000) (5, 156,875) $(15,131,750) $ 82,000 81,000 516,000 0 1,785,000 0 946,000 0 $ 3,410,000 $(1,087,000) (800,000) (1,523,000) $ (3,410,000) a. Determine the fair value in excess of book value for Prestige's acquisition date investment in Stylene. b. Determine Prestige's December 31, 2018, Investment in Stylene balance. c. Prepare a worksheet to determine the balances for Peregrine's December 31, 2018, consolidated financial statements. Complete this question by entering your answers in the tabs below. Required A Required B Required Determine the fair value in excess of book value rof Prestige's acquisition date investment in Stylene. Fair value in excess of book value Required B > a. Determine the fair value in excess of book value for Prestige's acquisition date investment in Stylene. b. Determine Prestige's December 31, 2018, Investment in Stylene balance. c. Prepare a worksheet to determine the balances for Peregrine's December 31, 2018, consolidated financial statements. Complete this question by entering your answers in the tabs below. Required A Required B Required C Determine Prestige's December 31, 2018, Investment in Stylene balance. Investment in Stylene