Question

On January 1, 2017, Sarasota Co. leased a building to Ivanhoe Inc. The relevant information related to the lease is as follows. 1. The lease

On January 1, 2017, Sarasota Co. leased a building to Ivanhoe Inc. The relevant information related to the lease is as follows.

1. The lease arrangement is for 10 years.

2. The leased building cost $4,430,000 and was purchased for cash on January 1, 2017.

3. The building is depreciated on a straight-line basis. Its estimated economic life is 50 years with no salvage value.

4. Lease payments are $289,700 per year and are made at the end of the year.

5. Property tax expense of $82,400 and insurance expense of $10,400 on the building were incurred by Sarasota in the first year.

Payment on these two items was made at the end of the year. 6. Both the lessor and the lessee are on a calendar-year basis.

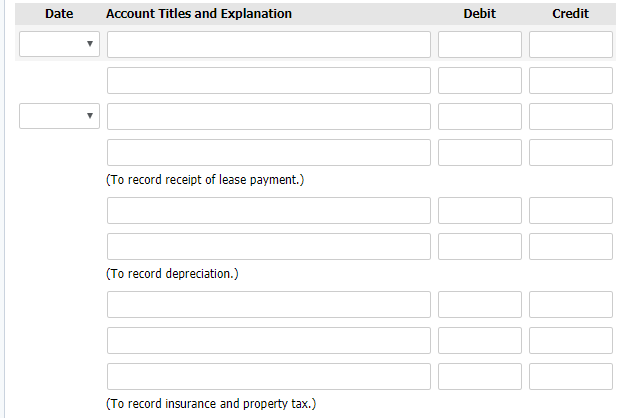

(a) Prepare the journal entries that Sarasota Co. should make in 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

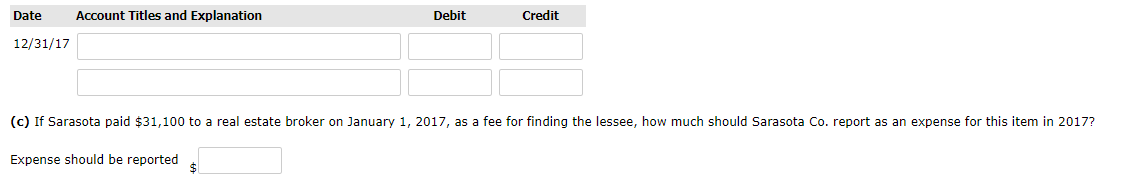

(b) Prepare the journal entries that Ivanhoe Inc. should make in 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started