Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, the campus bookstore has 1,000 copies of the Accounting textbook in Beginning Inventory, at a cost of $70 each. The bookstore

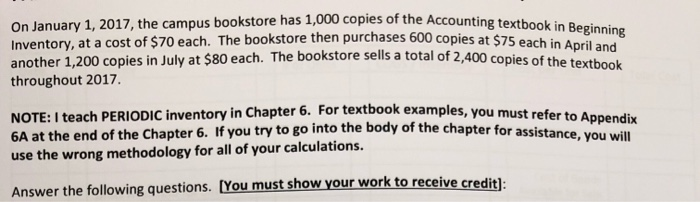

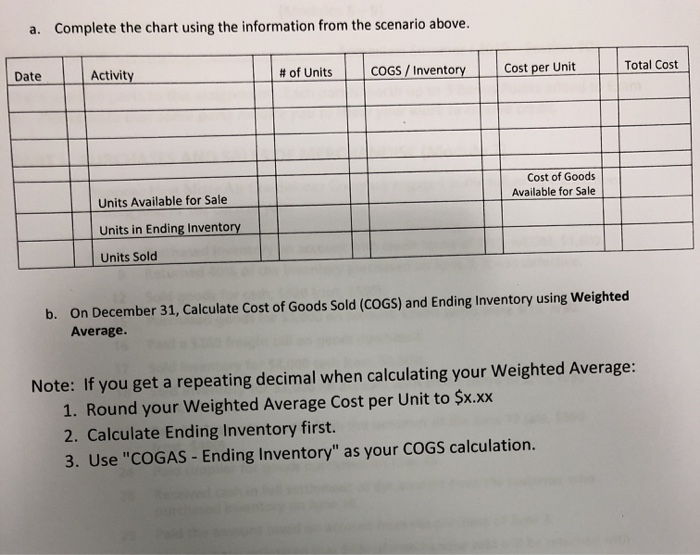

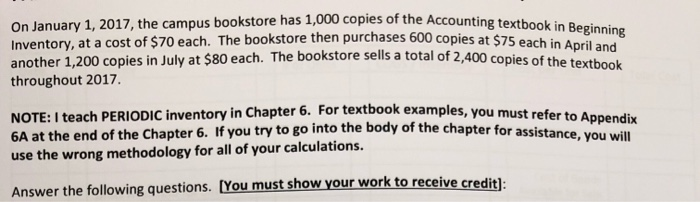

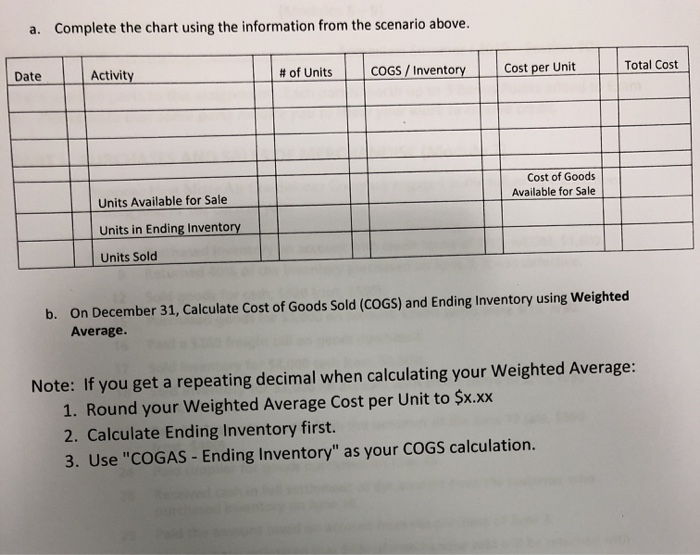

On January 1, 2017, the campus bookstore has 1,000 copies of the Accounting textbook in Beginning Inventory, at a cost of $70 each. The bookstore then purchases 600 copies at $75 each in April and another 1,200 copies in July at $80 each. The bookstore sells a total of 2,400 copies of the textbook throughout 2017. NOTE: I teach PERIODIC inventory in Chapter 6. For textbook examples, you must refer to Appendix 6A at the end of the Chapter 6. If you try to go into the body of the chapter for assistance, you will use the wrong methodology for all of your calculations Answer the following questions. [You must show your work to receive credit]: Complete the chart using the information from the scenario above. a. Date Activity #of Units COGS/Inventory Total Cost Cost per Unit Cost of Goods Available for Sale Units Available for Sale Units in Ending Inventory Units Sold On December 31, Calculate Cost of Goods Sold (COGS) and Ending Inventory using Weighted Average. b. repeating decimal when calculating your Weighted Average: Note: If you get a 1. Round your Weighted Average Cost per Unit to $x.xx 2. Calculate Ending Inventory first. 3. Use "COGAS -Ending Inventory" as your COGS calculation

On January 1, 2017, the campus bookstore has 1,000 copies of the Accounting textbook in Beginning Inventory, at a cost of $70 each. The bookstore then purchases 600 copies at $75 each in April and another 1,200 copies in July at $80 each. The bookstore sells a total of 2,400 copies of the textbook throughout 2017. NOTE: I teach PERIODIC inventory in Chapter 6. For textbook examples, you must refer to Appendix 6A at the end of the Chapter 6. If you try to go into the body of the chapter for assistance, you will use the wrong methodology for all of your calculations Answer the following questions. [You must show your work to receive credit]: Complete the chart using the information from the scenario above. a. Date Activity #of Units COGS/Inventory Total Cost Cost per Unit Cost of Goods Available for Sale Units Available for Sale Units in Ending Inventory Units Sold On December 31, Calculate Cost of Goods Sold (COGS) and Ending Inventory using Weighted Average. b. repeating decimal when calculating your Weighted Average: Note: If you get a 1. Round your Weighted Average Cost per Unit to $x.xx 2. Calculate Ending Inventory first. 3. Use "COGAS -Ending Inventory" as your COGS calculation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started