Question

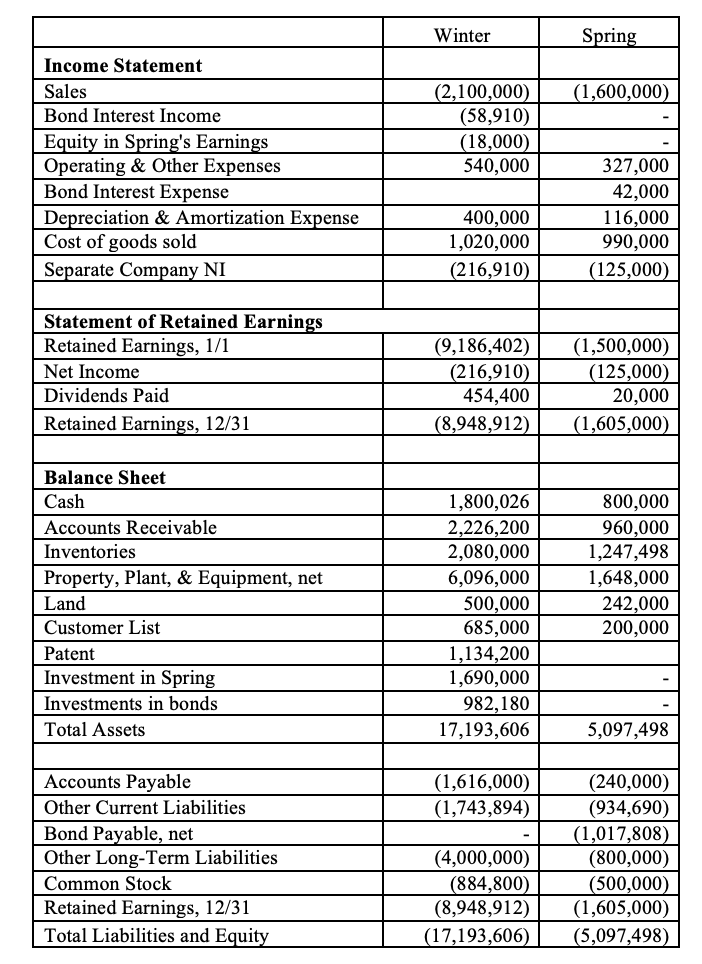

On January 1, 2017 Winter Co. acquired 60% of the stock of Spring, Inc. for $1,560,000. On this date, the fair market value of the

On January 1, 2017 Winter Co. acquired 60% of the stock of Spring, Inc. for $1,560,000. On this date, the fair market value of the Spring shares not purchased by the parent was $1,040,000, and the balances of Springs stockholders equity accounts totaled $1,500,000

On January 1, 2017, Springs recorded book values were equal to fair values for all items except for: 1) a previously unrecorded patent that had a fair value of $450,000 and a 12-year remaining useful life and 2) a customer list that was undervalued by $600,000 and had a 10-year remaining useful life. The parent uses the full equity method to account for its investment in the Spring subsidiary.

On January 1, 2019, Spring acquired $100,000 (face value) of Winters 8% bonds on the open market. At this date, the related liability on Winters books was $106,930, reflecting a 6% effective yield. Spring paid $93,660 for these bonds based on an effective interest rate of 10%

On January 1, 2018, Winter Co. sold land with a book value of $75,000 to Spring for $110,000. Spring continues to hold this land.

Spring routinely sells merchandise to Winter, and all inventory carried over from one year is sold in the next year. During 2019, the intra-entity sales were $600,000 (cost to Spring was $450,000) with $150,000 of merchandise remaining in Winters inventory at year-end. In 2018, the intra-entity sales totaled $625,000 (cost to Spring was $500,000). At December 31, 2018 $200,000 of inventory remained in Winters inventory.

Use the provided pre-closing trial balances and additional information that follows and prepare a December 31, 2019 consolidation spreadsheet (on Excel), in good form. The worksheet should include balances for the controlling and non-controlling interests in consolidated net income and the owners equity attributable to non-controlling interests. A separate worksheet in the same workbook should include the consolidation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started