Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, Ambrosia Corp. purchased 7% 5-year bonds with face value of $600,000. The bonds were dated January 1, 2018, and would

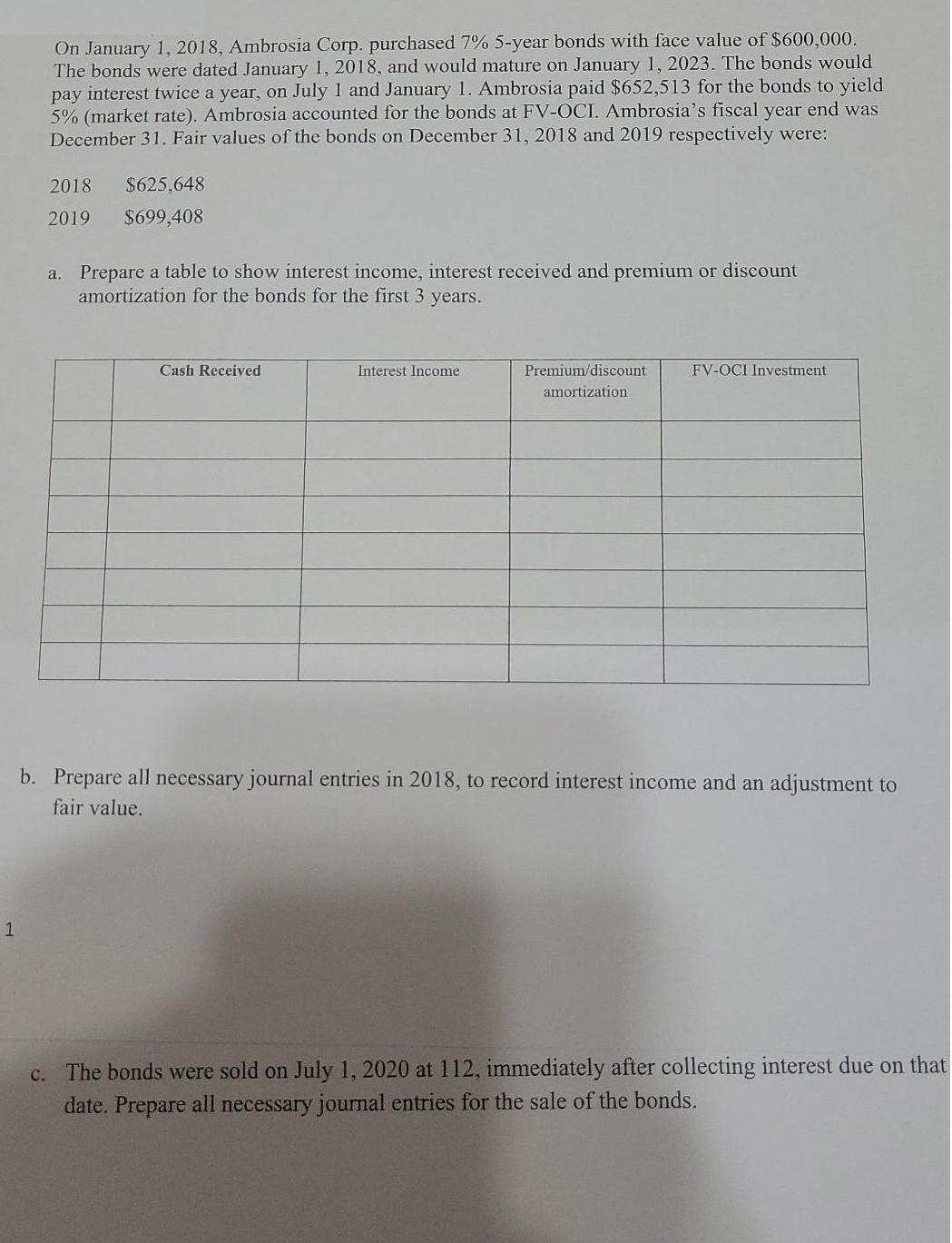

On January 1, 2018, Ambrosia Corp. purchased 7% 5-year bonds with face value of $600,000. The bonds were dated January 1, 2018, and would mature on January 1, 2023. The bonds would pay interest twice a year, on July 1 and January 1. Ambrosia paid $652,513 for the bonds to yield 5% (market rate). Ambrosia accounted for the bonds at FV-OCI. Ambrosia's fiscal year end was December 31. Fair values of the bonds on December 31, 2018 and 2019 respectively were: 2018 $625,648 2019 $699,408 Prepare a table to show interest income, interest received and premium or discount amortization for the bonds for the first 3 years. a. Cash Received Interest Income Premium/discount FV-OCI Investment amortization b. Prepare all necessary journal entries in 2018, to record interest income and an adjustment to fair value. 1 c. The bonds were sold on July 1, 2020 at 112, immediately after collecting interest due on that date. Prepare all necessary journal entries for the sale of the bonds.

Step by Step Solution

★★★★★

3.62 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer The answe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started