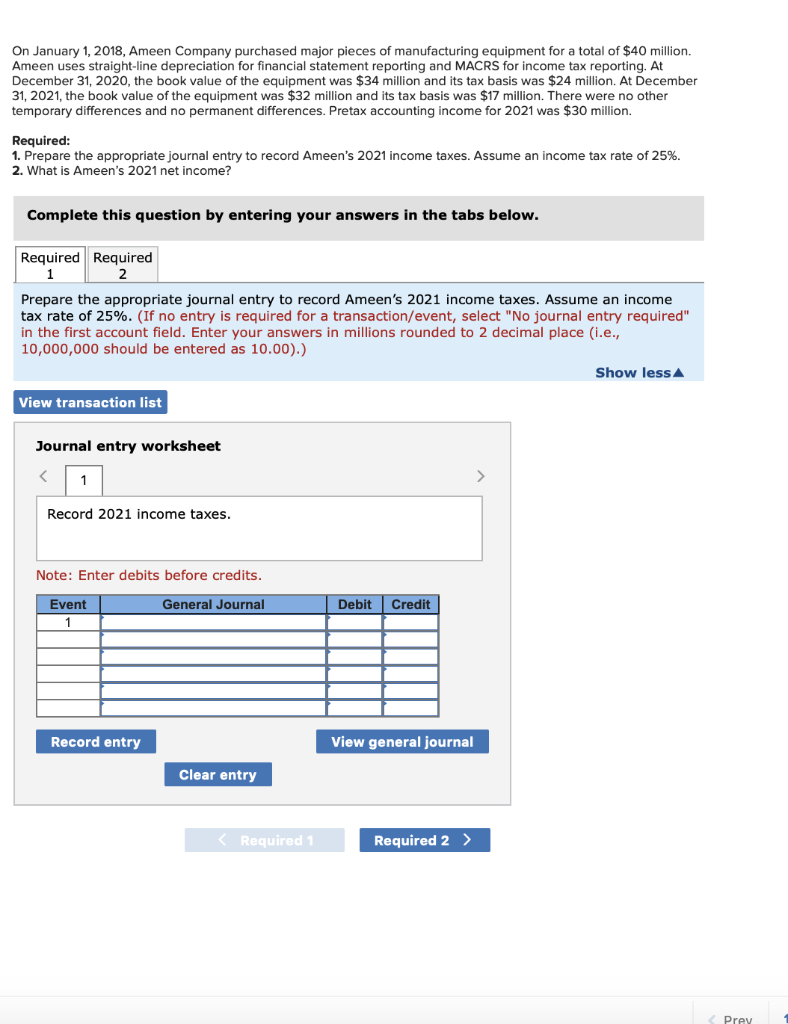

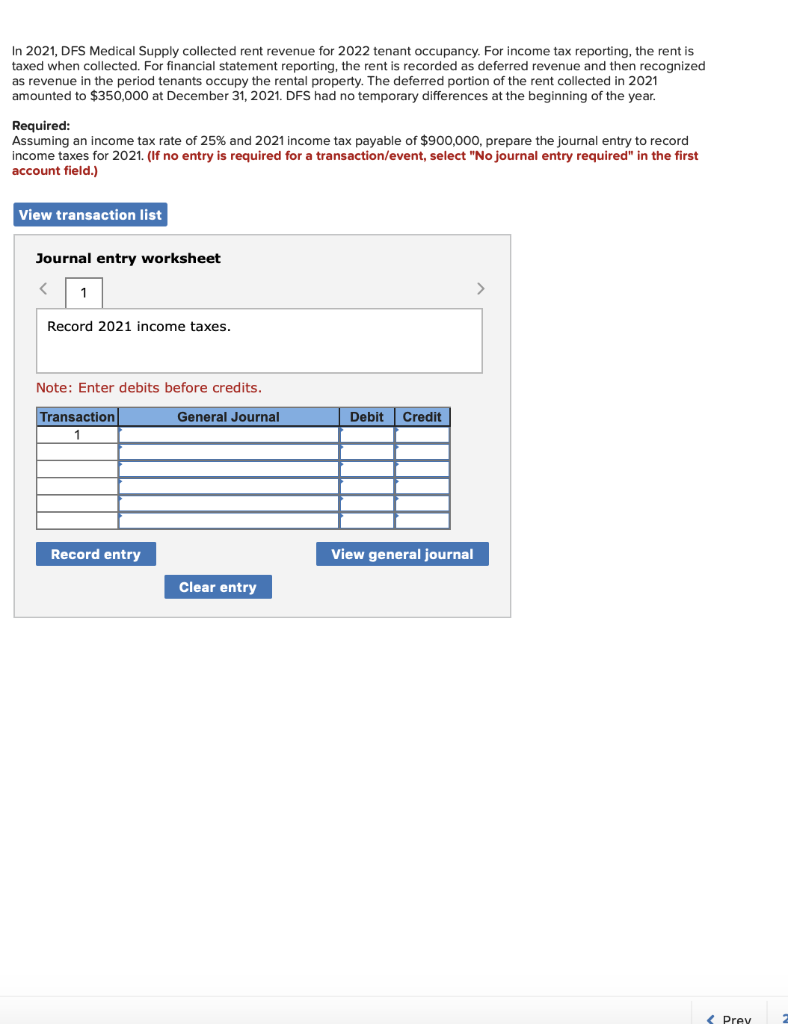

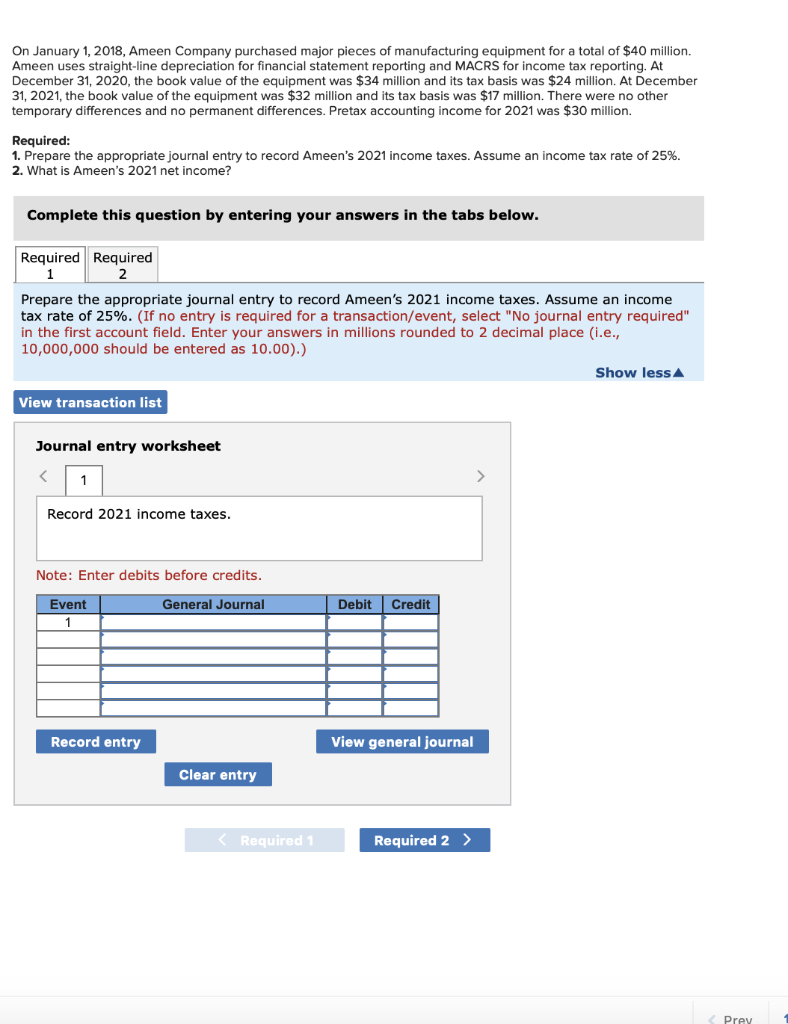

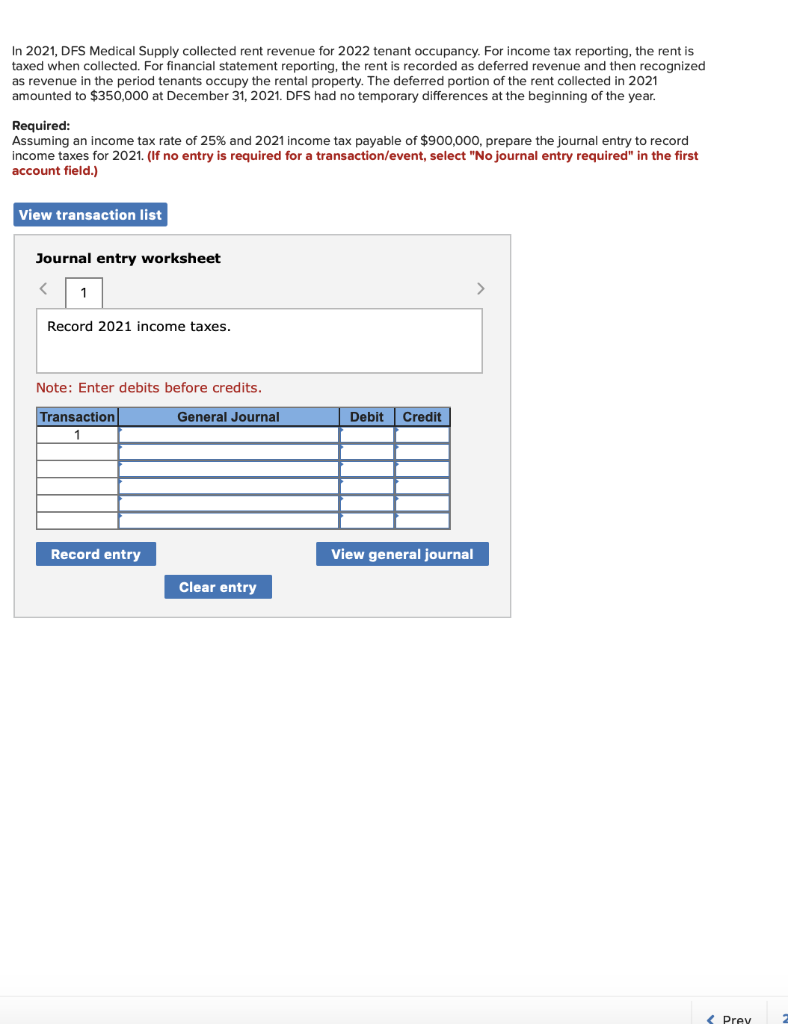

On January 1, 2018, Ameen Company purchased major pieces of manufacturing equipment for a total of $40 million. Ameen uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. At December 31, 2020, the book value of the equipment was $34 million and its tax basis was $24 million. At December 31, 2021, the book value of the equipment was $32 million and its tax basis was $17 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2021 was $30 million. Required: 1. Prepare the appropriate journal entry to record Ameen's 2021 income taxes. Assume an income tax rate of 25%. 2. What is Ameen's 2021 net income? Complete this question by entering your answers in the tabs below. Required Required Prepare the appropriate journal entry to record Ameen's 2021 income taxes. Assume an income tax rate of 25%. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal place (i.e., 10,000,000 should be entered as 10.00).) Show less View transaction list Journal entry worksheet 1 > Record 2021 income taxes. Note: Enter debits before credits. General Journal Debit Event 1 Credit Record entry View general journal Clear entry Required 1 Required 2 > Prey In 2021, DFS Medical Supply collected rent revenue for 2022 tenant occupancy. For income tax reporting, the rent is taxed when collected. For financial statement reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy the rental property. The deferred portion of the rent collected in 2021 amounted to $350,000 at December 31, 2021. DFS had no temporary differences at the beginning of the year. Required: Assuming an income tax rate of 25% and 2021 income tax payable of $900,000, prepare the journal entry to record income taxes for 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record 2021 income taxes. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry View general journal Clear entry Record 2021 income taxes. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry View general journal Clear entry