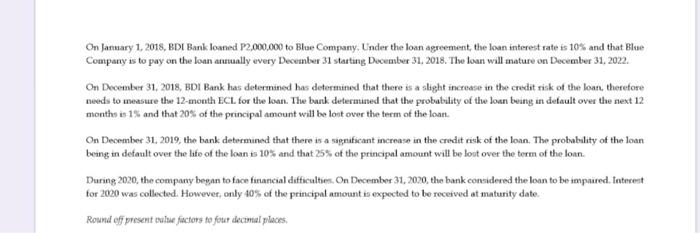

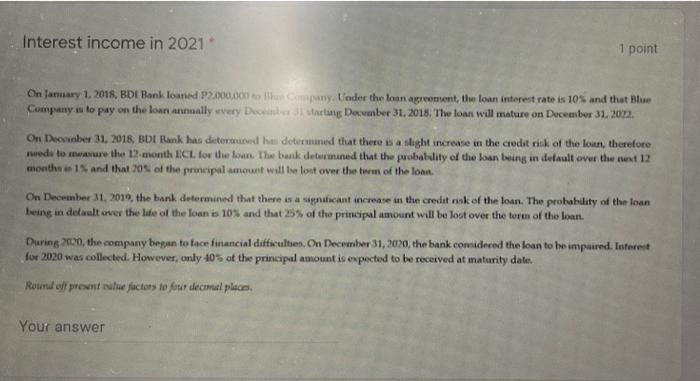

On January 1, 2018, BDI Bank loaned P2,000,000 to Blue Company. Under the loan agreement the loan interest rate is 10% and that Blue Company is to pay on the loan aturally every December 31 starting December 31, 2018. The loan will mature on December 31, 2022. On December 31, 2018, BDI Bank has determined has determined that there is a slight increase in the credit risk of the loan, therefore needs to measure the 12-month ECL. for the loan. The bank determined that the probability of the loan being in default over the next 12 months is 15 and that 20% of the principal amount will be lost over the term of the loan. On December 31, 2019, the bank determined that there is a significant increase in the credit risk of the loan. The probability of the loan being in default over the life of the loan is 10% and that 25% of the principal amount will be lost over the term of the loan. During 2020, the company began to face financial difficulties. On December 31, 2020, the bank considered the loan to be impaired. Interest for 2020 was collected. However, only 40% of the principal amount is expected to be received at maturity date Round off present totale factors to four decemal places Interest income in 2021 1 point On Jamary 1, 2018, BDI Bank loaned P2.000.000 to company. Under the loan agreement, the loan interest rate is 10% and that Blue Company is to pay on the loan annually every December starting December 31, 2018. The loan will mature on December 31, 2022. On December 31, 2018, BDI Bank has determined hedeturmined that there is a slight increase in the credit risk of the loan, therefore reeds to wear the 12-month UCL. for the loan. The bank determined that the probability of the loan being in default over the next 12 months 15 and that 70% of the principal amount will be lost over the term of the loan. On December 31, 2019, the bank determined that there is a significant increase in the credit ook of the loan. The probability of the loan being in detaalt over the life of the loan is 10% and that 25% of the principal amount will be lost over the term of the loan. During 2020, the company began to face financial difficulties. On December 31, 2020, the bank considered the loan to be impaired. Interest for 2020 was collected. However, only 40% of the principal amount is expected to be received at maturity date. Round off prevent value factors to four decoul places Your answer On January 1, 2018, BDI Bank loaned P2,000,000 to Blue Company. Under the loan agreement the loan interest rate is 10% and that Blue Company is to pay on the loan aturally every December 31 starting December 31, 2018. The loan will mature on December 31, 2022. On December 31, 2018, BDI Bank has determined has determined that there is a slight increase in the credit risk of the loan, therefore needs to measure the 12-month ECL. for the loan. The bank determined that the probability of the loan being in default over the next 12 months is 15 and that 20% of the principal amount will be lost over the term of the loan. On December 31, 2019, the bank determined that there is a significant increase in the credit risk of the loan. The probability of the loan being in default over the life of the loan is 10% and that 25% of the principal amount will be lost over the term of the loan. During 2020, the company began to face financial difficulties. On December 31, 2020, the bank considered the loan to be impaired. Interest for 2020 was collected. However, only 40% of the principal amount is expected to be received at maturity date Round off present totale factors to four decemal places Interest income in 2021 1 point On Jamary 1, 2018, BDI Bank loaned P2.000.000 to company. Under the loan agreement, the loan interest rate is 10% and that Blue Company is to pay on the loan annually every December starting December 31, 2018. The loan will mature on December 31, 2022. On December 31, 2018, BDI Bank has determined hedeturmined that there is a slight increase in the credit risk of the loan, therefore reeds to wear the 12-month UCL. for the loan. The bank determined that the probability of the loan being in default over the next 12 months 15 and that 70% of the principal amount will be lost over the term of the loan. On December 31, 2019, the bank determined that there is a significant increase in the credit ook of the loan. The probability of the loan being in detaalt over the life of the loan is 10% and that 25% of the principal amount will be lost over the term of the loan. During 2020, the company began to face financial difficulties. On December 31, 2020, the bank considered the loan to be impaired. Interest for 2020 was collected. However, only 40% of the principal amount is expected to be received at maturity date. Round off prevent value factors to four decoul places Your