Answered step by step

Verified Expert Solution

Question

1 Approved Answer

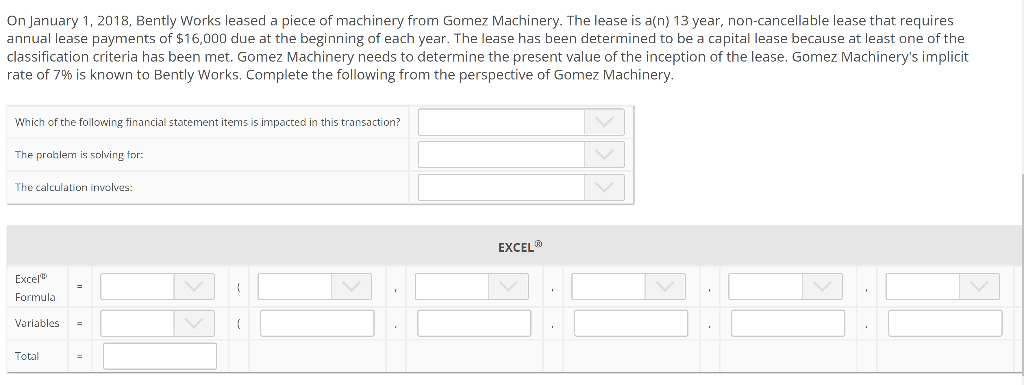

On January 1, 2018, Bently Works leased a piece of machinery from Gomez Machinery. The lease is a(n) 13 year, non-cancellable lease that requires

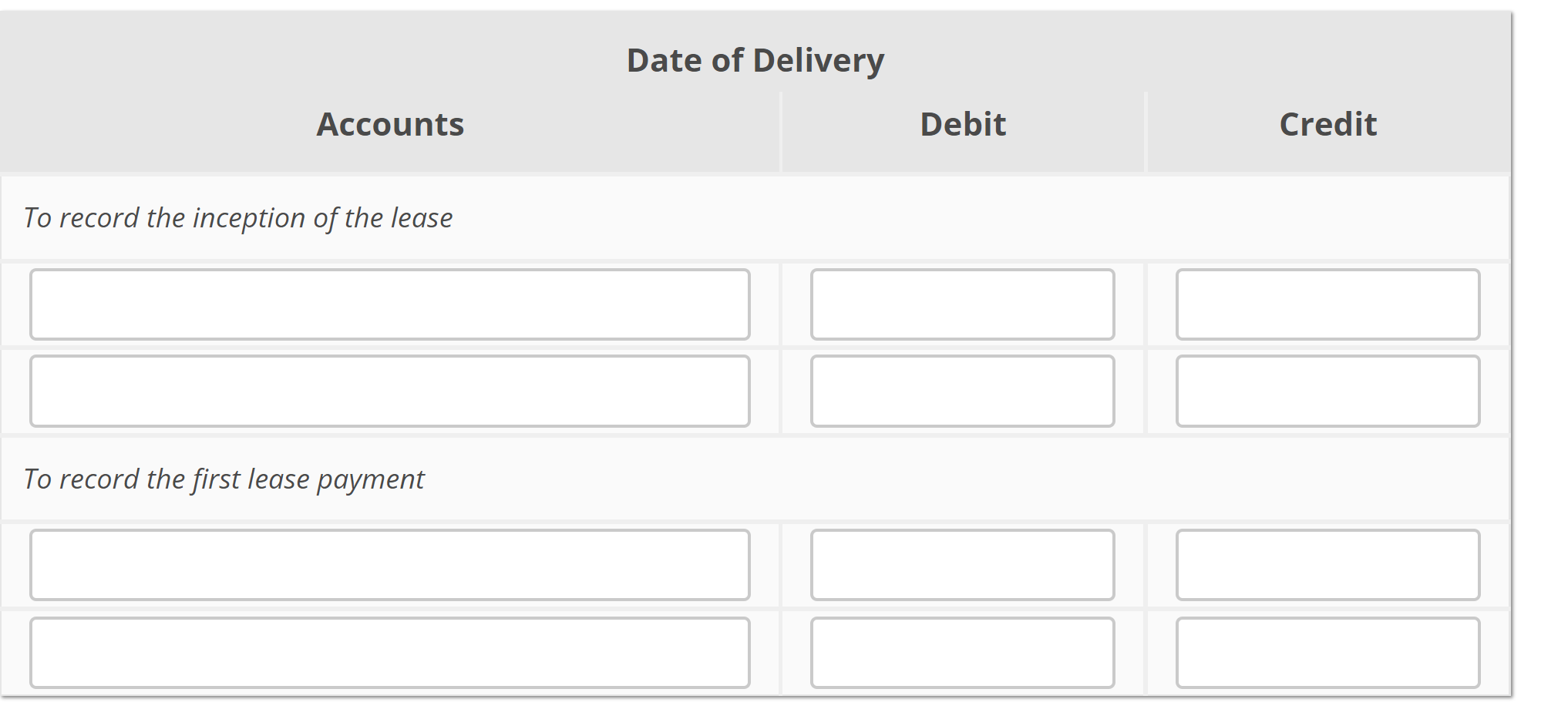

On January 1, 2018, Bently Works leased a piece of machinery from Gomez Machinery. The lease is a(n) 13 year, non-cancellable lease that requires annual lease payments of $16,000 due at the beginning of each year. The lease has been determined to be a capital lease because at least one of the classification criteria has been met. Gomez Machinery needs to determine the present value of the inception of the lease. Gomez Machinery's implicit rate of 7% is known to Bently Works. Complete the following from the perspective of Gomez Machinery. Which of the following financial statement items is impacted in this transaction? The problem is solving for: The calculation involves: EXCEL Excel = Formula Varlables Total Date of Delivery Accounts Debit Credit To record the inception of the lease To record the first lease payment

Step by Step Solution

★★★★★

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To be classified as Capital lease any one of the four conditions must be met 1 A transfer of ownership of the asset at the end of the term 2 An option ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started