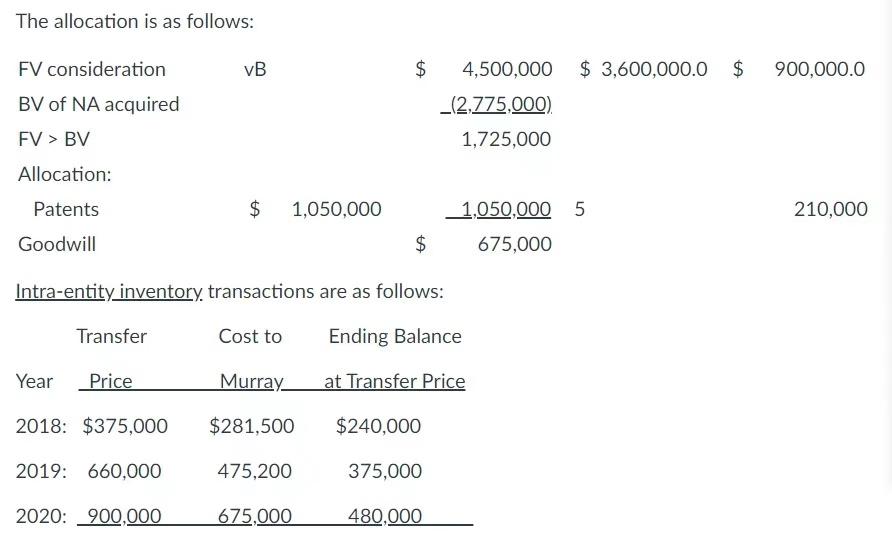

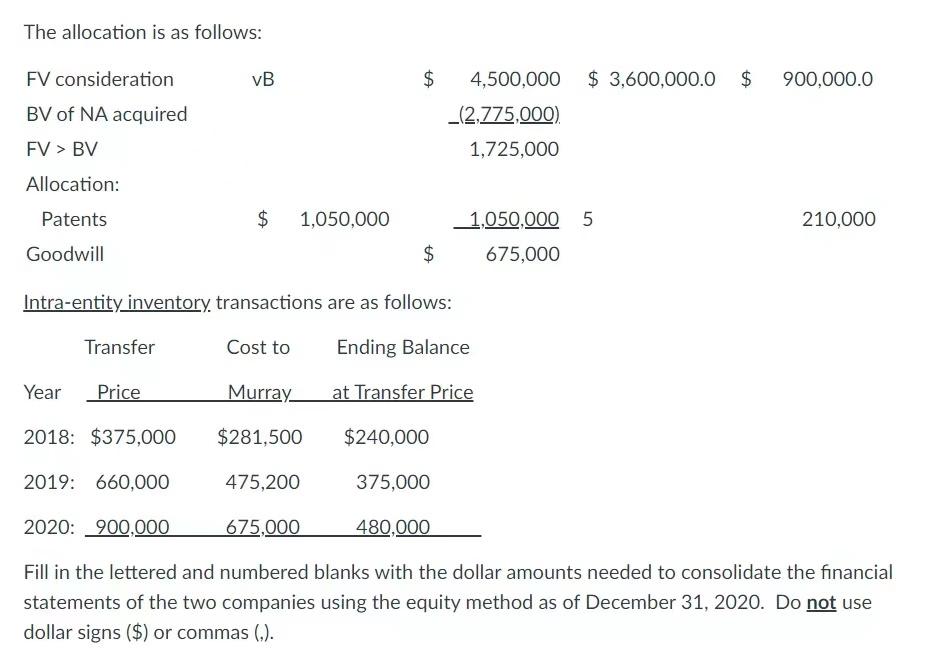

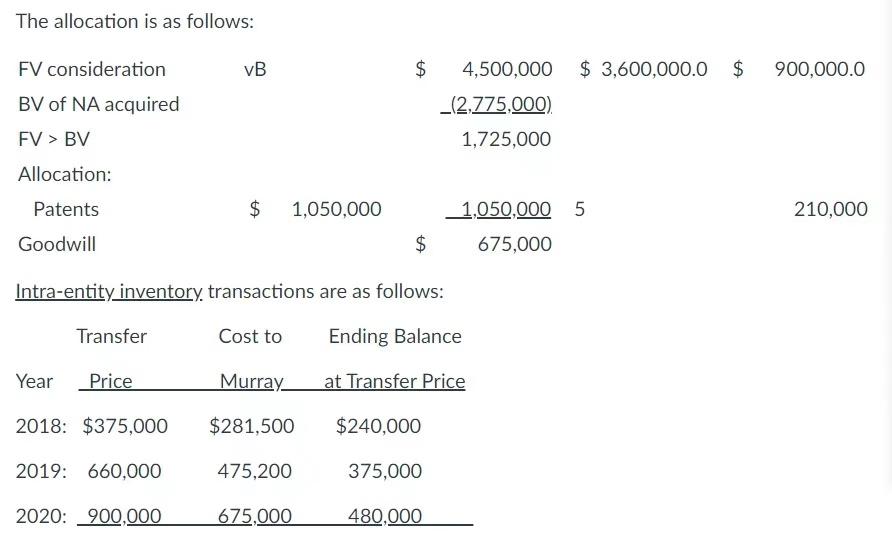

On January 1, 2018 Calloway Corporation acquired 80% of the outstanding voting stock of Murray Co.in exchange for $3,600,000 cash. At acquisition, Murray had a total book value of $2,775,000 and fair value of $4,500,000.With the exception of the patent account. which was undervalued by $1,050,000 the assets and liabilities approximated their acquisition-date fair values. At that time the patent had a remaining life of 5 years. Any remaining excess fair value is attributed to goodwill. Murray regularly sells inventory to Calloway.

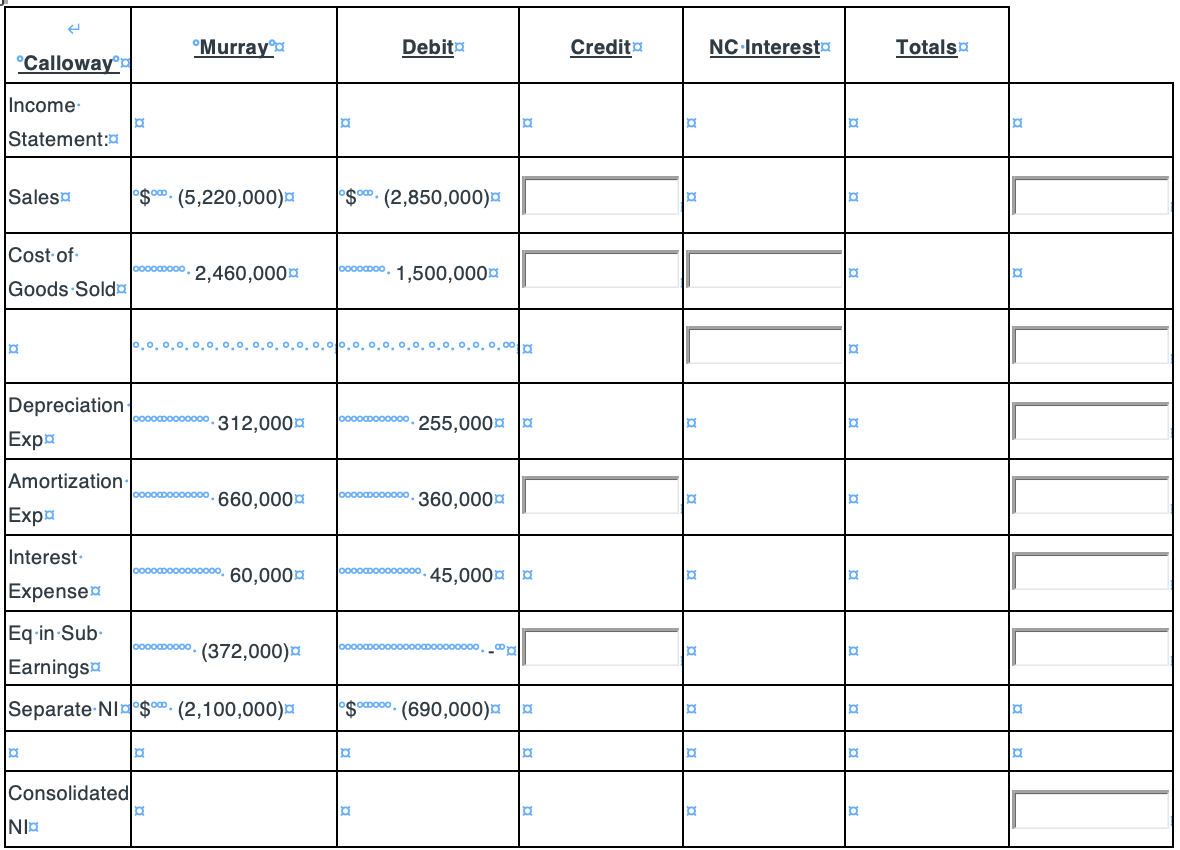

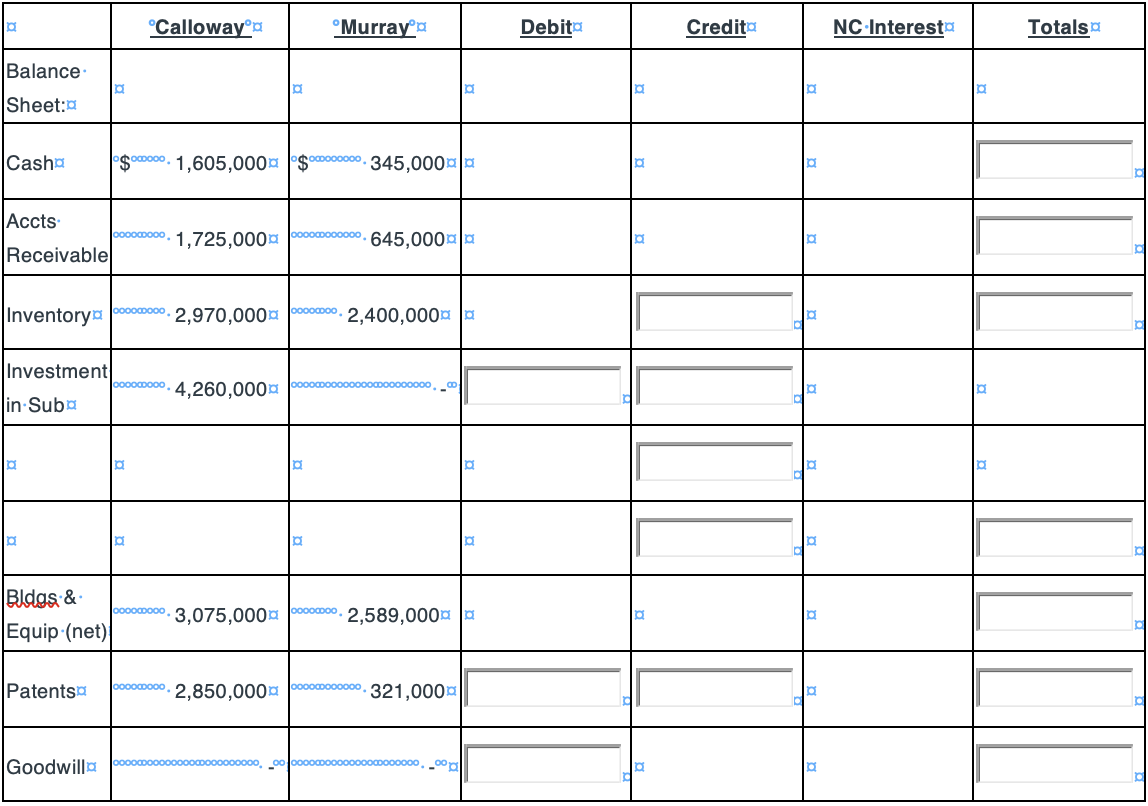

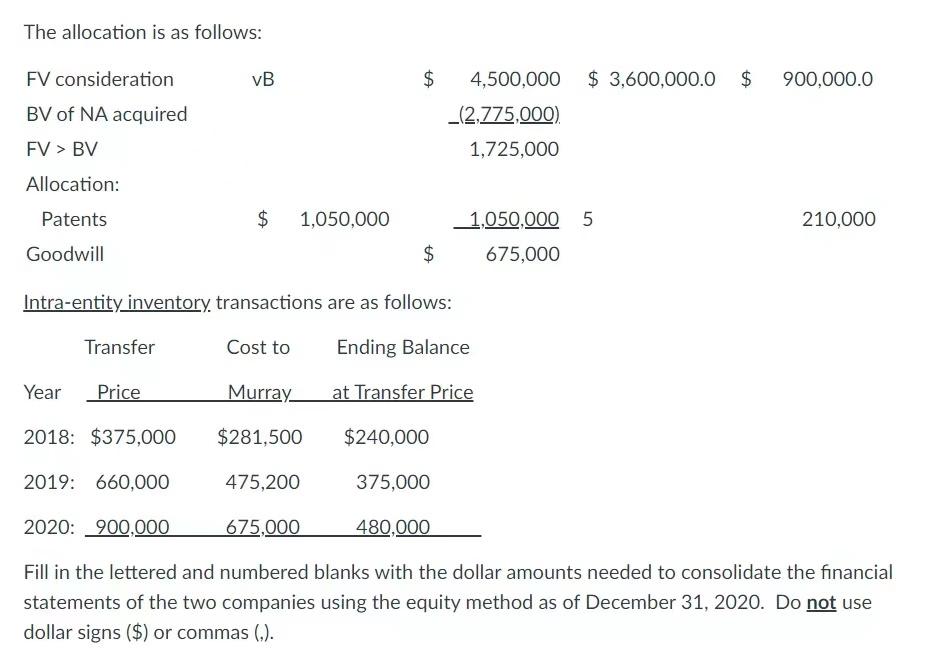

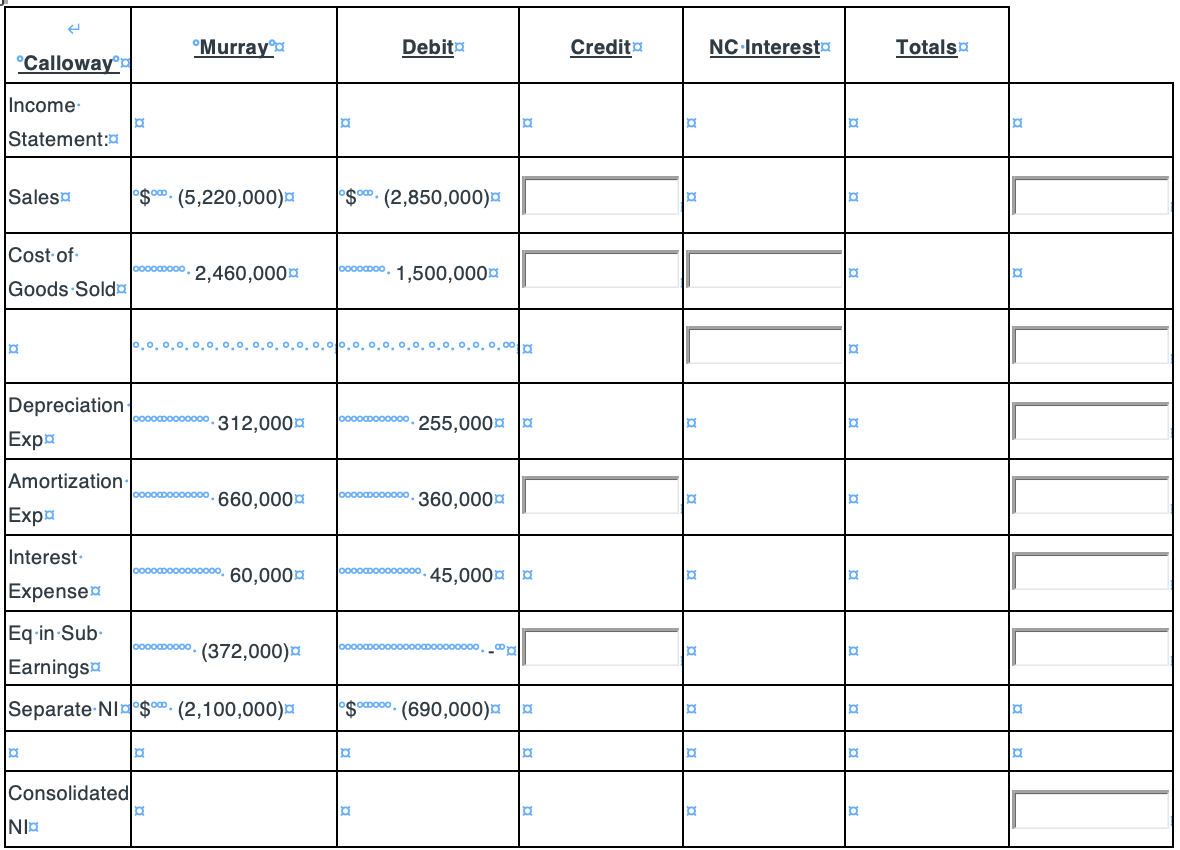

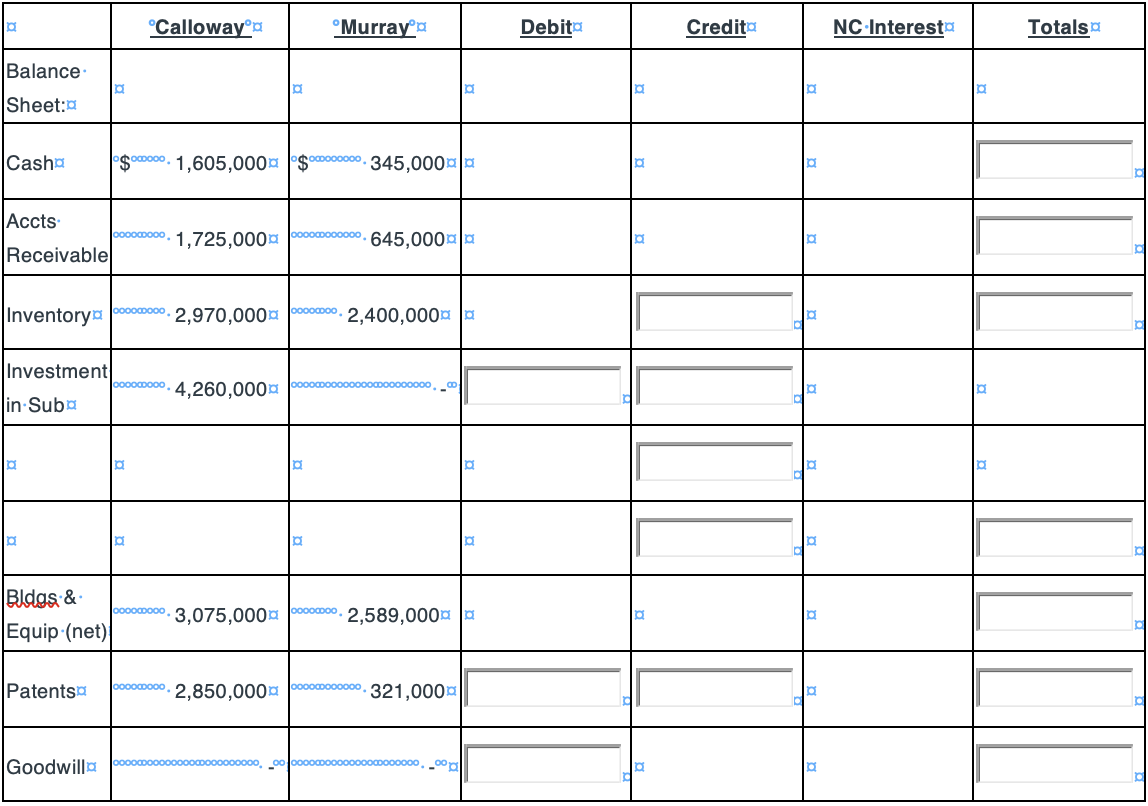

The allocation is as follows: FV consideration VB $ $ 3,600,000.0 $ 900,000.0 BV of NA acquired FV > BV 4,500,000 _(2,775,000) 1,725,000 Allocation: Patents $ 1,050,000 210,000 1,050,000 5 675,000 Goodwill $ Intra-entity inventory transactions are as follows: Transfer Cost to Ending Balance Year Price Murray at Transfer Price 2018: $375,000 $281,500 $240,000 2019: 660,000 475,200 375,000 2020: 900,000 675,000 480,000 The allocation is as follows: FV consideration VB $ $ 3,600,000.0 $ 900,000.0 BV of NA acquired FV > BV Allocation: 4,500,000 _(2,775,000) 1,725,000 $ 1,050,000 210,000 Patents Goodwill 1,050,000 5 675,000 $ Intra-entity inventory transactions are as follows: Transfer Cost to Ending Balance Year Price Murray at Transfer Price 2018: $375,000 $281,500 $240,000 2019: 660,000 475,200 375,000 2020: 900,000 675,000 480,000 Fill in the lettered and numbered blanks with the dollar amounts needed to consolidate the financial statements of the two companies using the equity method as of December 31, 2020. Do not use dollar signs ($) or commas (). Murray Debita Credito NC Intereste Totals Calloway Income . . Statement: Sales $ . (5,220,000) $. (2,850,000) Cost of Goods Solda OOOOOOOO 00000000 2,460,000 1,500,000 Ig 0,0,0,0. 0,0,0,0,0,00 Depreciation Expo ooooo 312,000 255,000 Amortization 660,0000 360,0000 Expo Interest 60,000 45,0000 lo Expenseo Eq.in Sub Earnings 0000000000. (372,000) COOCOOOOO0000.. Separate NI $0. (2,100,000) OOOOO $ (690,000) 110 o Consolidated le INA Callowayp Murray Debito Credito NC Interest Totals Balance Sheet: Casho $000000 1,605,0000 00000000 345,000 Accts OoooooOOO OOOOOOOO000 1,725,000 645,000 Receivable 000000000 Inventory 2,970,000 , 2,400,000 Investment 000000000. 4,260,0000 in Suba O Bldas & Equip (net) OOOOOOO Oooo0000 3,075,000 2,589,0000 Patents 000000000 2,850,0000 00000000. 321,000 Goodwilla 0 The allocation is as follows: FV consideration VB $ $ 3,600,000.0 $ 900,000.0 BV of NA acquired FV > BV 4,500,000 _(2,775,000) 1,725,000 Allocation: Patents $ 1,050,000 210,000 1,050,000 5 675,000 Goodwill $ Intra-entity inventory transactions are as follows: Transfer Cost to Ending Balance Year Price Murray at Transfer Price 2018: $375,000 $281,500 $240,000 2019: 660,000 475,200 375,000 2020: 900,000 675,000 480,000 The allocation is as follows: FV consideration VB $ $ 3,600,000.0 $ 900,000.0 BV of NA acquired FV > BV Allocation: 4,500,000 _(2,775,000) 1,725,000 $ 1,050,000 210,000 Patents Goodwill 1,050,000 5 675,000 $ Intra-entity inventory transactions are as follows: Transfer Cost to Ending Balance Year Price Murray at Transfer Price 2018: $375,000 $281,500 $240,000 2019: 660,000 475,200 375,000 2020: 900,000 675,000 480,000 Fill in the lettered and numbered blanks with the dollar amounts needed to consolidate the financial statements of the two companies using the equity method as of December 31, 2020. Do not use dollar signs ($) or commas (). Murray Debita Credito NC Intereste Totals Calloway Income . . Statement: Sales $ . (5,220,000) $. (2,850,000) Cost of Goods Solda OOOOOOOO 00000000 2,460,000 1,500,000 Ig 0,0,0,0. 0,0,0,0,0,00 Depreciation Expo ooooo 312,000 255,000 Amortization 660,0000 360,0000 Expo Interest 60,000 45,0000 lo Expenseo Eq.in Sub Earnings 0000000000. (372,000) COOCOOOOO0000.. Separate NI $0. (2,100,000) OOOOO $ (690,000) 110 o Consolidated le INA Callowayp Murray Debito Credito NC Interest Totals Balance Sheet: Casho $000000 1,605,0000 00000000 345,000 Accts OoooooOOO OOOOOOOO000 1,725,000 645,000 Receivable 000000000 Inventory 2,970,000 , 2,400,000 Investment 000000000. 4,260,0000 in Suba O Bldas & Equip (net) OOOOOOO Oooo0000 3,075,000 2,589,0000 Patents 000000000 2,850,0000 00000000. 321,000 Goodwilla 0