Question

On January 1, 2018, Ima sample and Ura Student decided to form the Student-Sample partnership. The information for the partnership is as follows: Tasks In

On January 1, 2018, Ima sample and Ura Student decided to form the Student-Sample partnership. The information for the partnership is as follows:

Tasks In a Word document, compose a basic partnership agreement The agreement should include, but not limited to: a.) The name of the partnership, b.) partnership responsibilities, c.) the procedures for admission , withdrawal and death of partner, d. how profits and losses will be divided (cannot be 50/50), e.) the amount of interest partners earn on contributions, and f.) partners salaries. In a second Word document, using the Insert Tables feature, create a general journal. Then, journalize the entries for the formation of the partnership. One partner must bring in a fixed asset that includes a liability with it and the other should bring only cash. You may decide the amount of each of the partner?s investment. Using the two profit/loss amounts from the table above and an Excel Spreadsheet, create a table showing the distribution of Profit or Loss to the partners. Include under the table, the journal entries to distribute the profit or loss. The distribution must include salaries, interest, and distribution to the partners. Using a Word or Excel document/table, create a partnership liquidation for the partnership. Make sure to show the payment of liabilities, sell of noncash assets, and distribution of the remainder.

Part A:

Student and Sample will be changing their business type from a Partnership to a Corporation. For this company, create an Articles of Incorporation using the Georgia Secretary of State Guidelines in the format of the Georgia Secretary of State template. The document must include:

- The name of the corporation.

- The address of the corporation.

- The number of common and preferred shares the corporation is authorized to issue.

- The par value of each class of stork

- Names and Addresses of the Incorporators (Ima).

- The State of Incorporation.

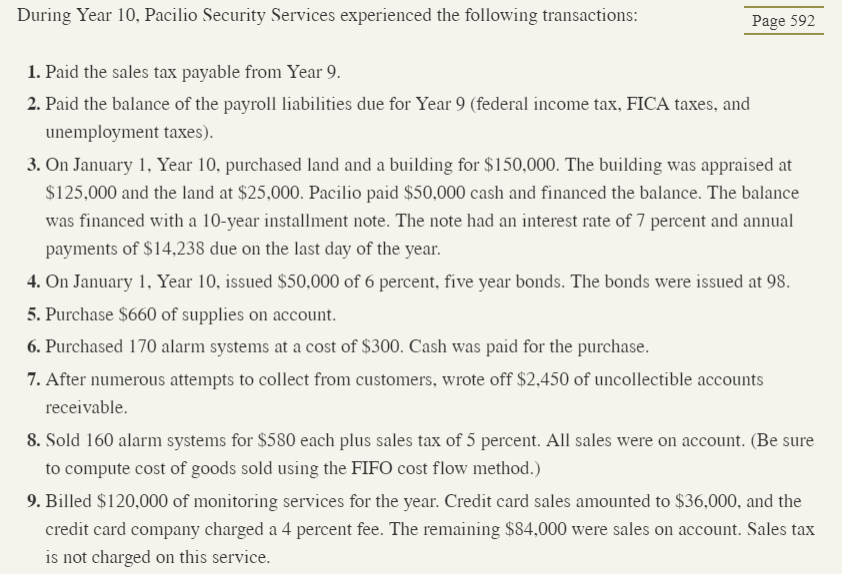

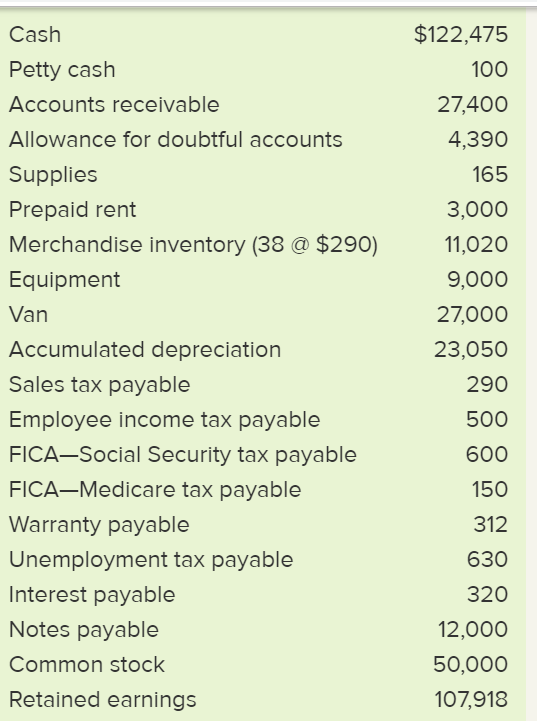

For Part 2 of this project. Complete the following problem. You can use electronic accounting forms, manual accounting forms, or excel to complete the problem. For the statements, prepare a comprehensive income statement and classified balance sheet.

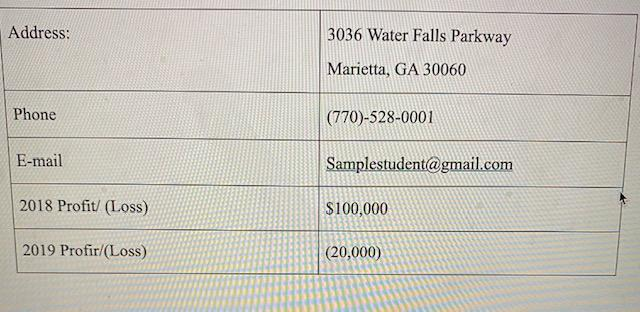

Address: Phone E-mail 2018 Profit/ (Loss) 2019 Profir/(Loss) 3036 Water Falls Parkway Marietta, GA 30060 (770)-528-0001 Samplestudent@gmail.com $100,000 (20,000)

Step by Step Solution

3.58 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

This Partnership Agreement the Agreement is made and entered into on January 1st 2018 the Execution Date by and between the following parties Ima Sample has the following management role Senior Partne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started