Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, Ms. Tinker Bell began Bell Corporation with an initial cash investment of $25,000. The capital structure of Bell Corporation consists of

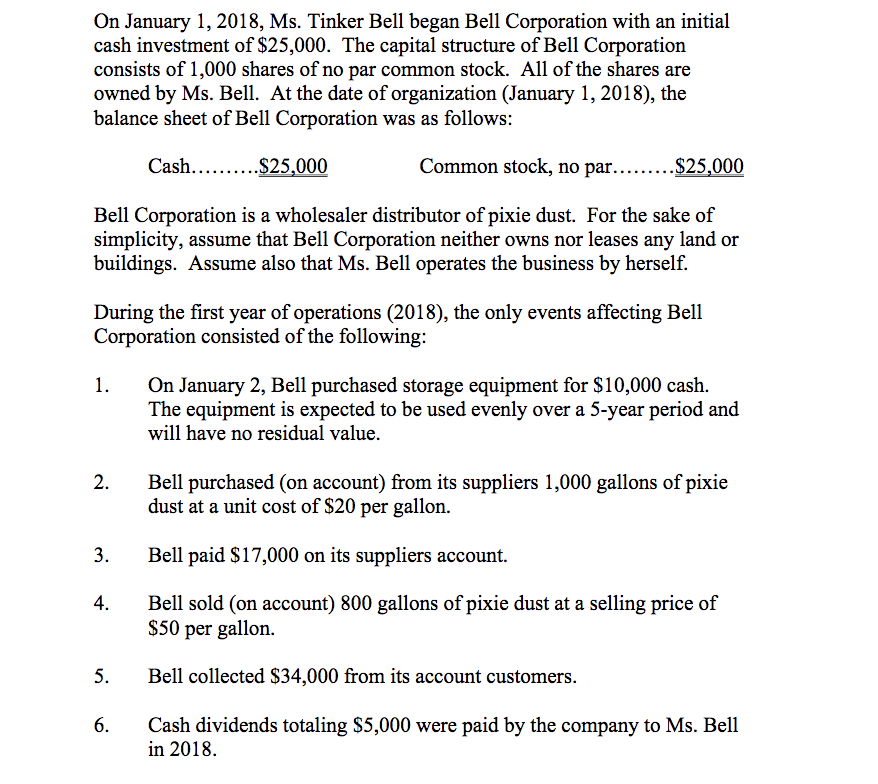

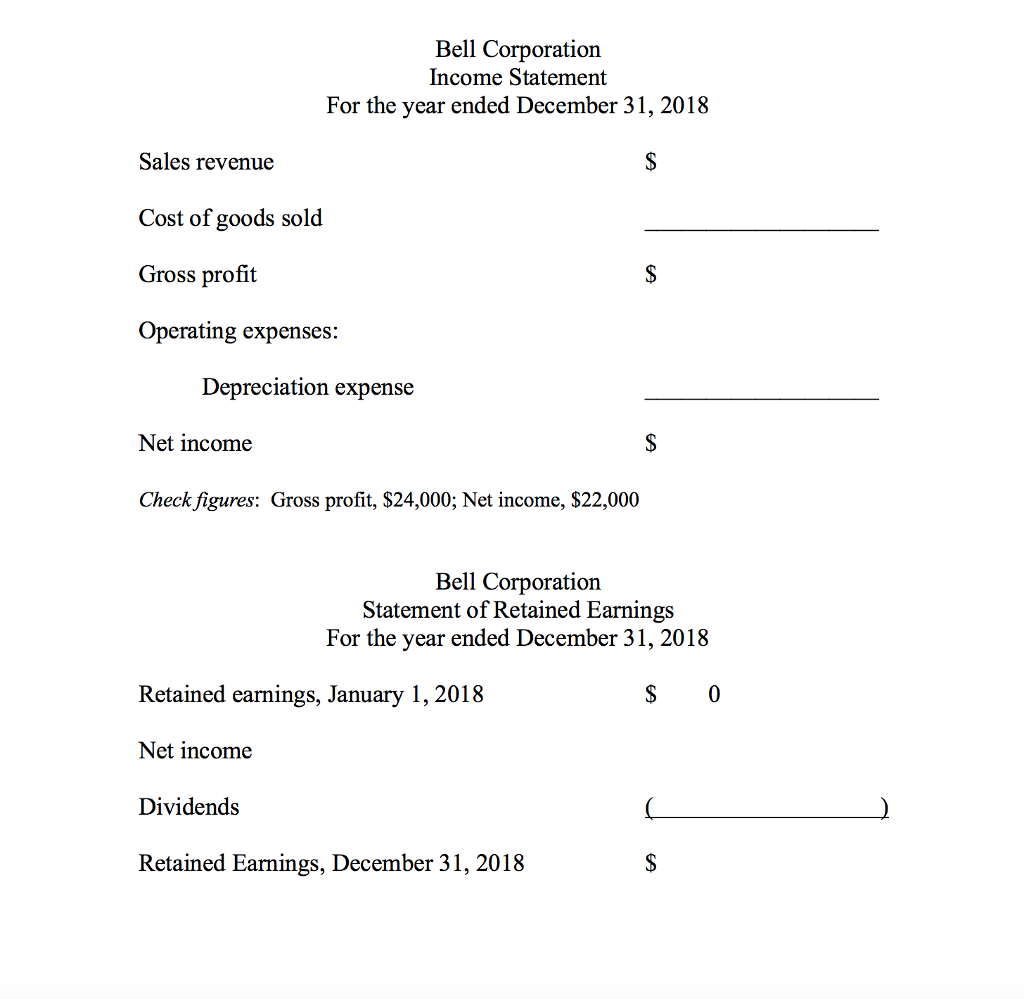

On January 1, 2018, Ms. Tinker Bell began Bell Corporation with an initial cash investment of $25,000. The capital structure of Bell Corporation consists of 1,000 shares of no par common stock. All of the shares are owned by Ms. Bell. At the date of organization (January 1, 2018), the balance sheet of Bell Corporation was as follows: Bell Corporation is a wholesaler distributor of pixie dust. For the sake of simplicity, assume that Bell Corporation neither owns nor leases any land or buildings. Assume also that Ms. Bell operates the business by herself. During the first year of operations (2018), the only events affecting Bell Corporation consisted of the following: 1. On January 2, Bell purchased storage equipment for S10,000 cash. The equipment is expected to be used evenly over a 5-year period and will have no residual value. 2. Bell purchased (on account) from its suppliers 1,000 gallons of pixie dust at a unit cost of S20 per gallon. 3.Bell paid $17,000 on its suppliers account. 4.Bell sold (on account) 800 gallons of pixie dust at a selling price of S50 per gallon. Bell collected $34,000 from its account customers. Cash dividends totaling S5,000 were paid by the company to Ms. Bell 5. 6. in 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started