Answered step by step

Verified Expert Solution

Question

1 Approved Answer

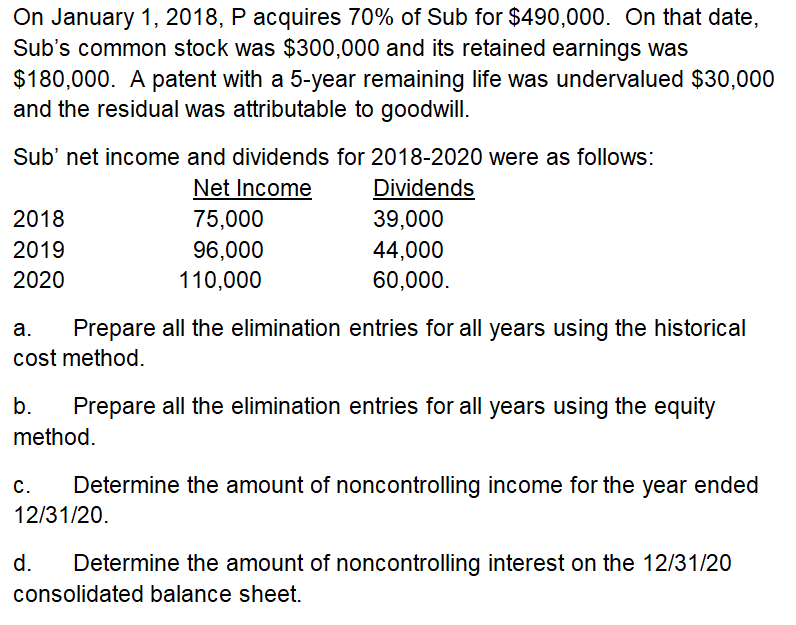

On January 1, 2018, P acquires 70% of Sub for $490,000. On that date, Sub's common stock was $300,000 and its retained earnings was $180,000.

On January 1, 2018, P acquires 70% of Sub for $490,000. On that date, Sub's common stock was $300,000 and its retained earnings was $180,000. A patent with a 5-year remaining life was undervalued $30,000 and the residual was attributable to goodwill Sub' net income and dividends for 2018-2020 were as follows: 2018 2019 2020 Net Income Dividends 75,000 96,000 39,000 44,000 60,000 110,000 a. Prepare all the elimination entries for all years using the historical cost method. b. Prepare all the elimination entries for all years using the equity c. Determine the amount of noncontrolling income for the year ended 12/31/20 d. Determine the amount of noncontrolling interest on the 12/31/20 consolidated balance sheet. On January 1, 2018, P acquires 70% of Sub for $490,000. On that date, Sub's common stock was $300,000 and its retained earnings was $180,000. A patent with a 5-year remaining life was undervalued $30,000 and the residual was attributable to goodwill Sub' net income and dividends for 2018-2020 were as follows: 2018 2019 2020 Net Income Dividends 75,000 96,000 39,000 44,000 60,000 110,000 a. Prepare all the elimination entries for all years using the historical cost method. b. Prepare all the elimination entries for all years using the equity c. Determine the amount of noncontrolling income for the year ended 12/31/20 d. Determine the amount of noncontrolling interest on the 12/31/20 consolidated balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started