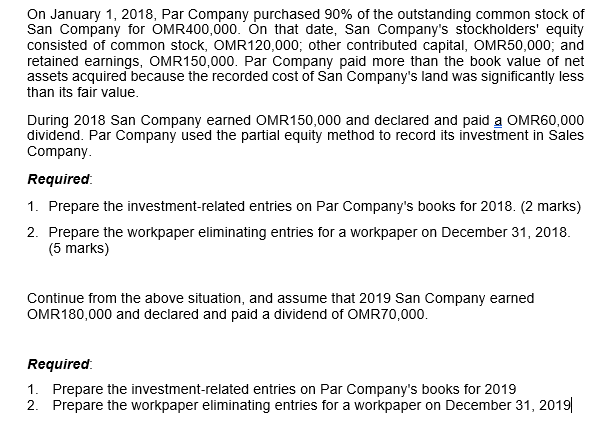

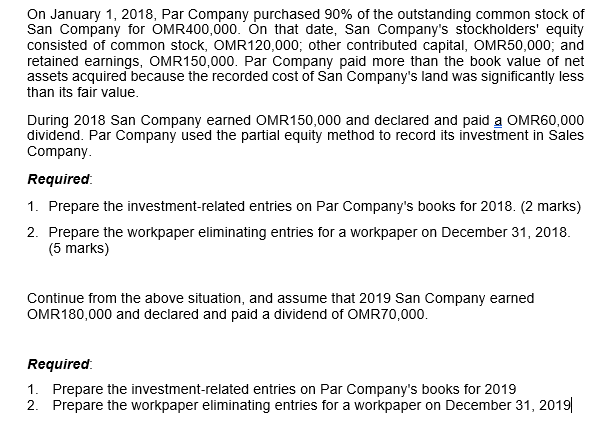

On January 1, 2018, Par Company purchased 90% of the outstanding common stock of San Company for OMR400,000. On that date, San Company's stockholders' equity consisted of common stock, OMR120,000; other contributed capital, OMR50,000, and retained earnings, OMR150,000. Par Company paid more than the book value of net assets acquired because the recorded cost of San Company's land was significantly less than its fair value. During 2018 San Company earned OMR150,000 and declared and paid a OMR60,000 dividend. Par Company used the partial equity method to record its investment in Sales Company Required: 1. Prepare the investment-related entries on Par Company's books for 2018. (2 marks) 2. Prepare the workpaper eliminating entries for a workpaper on December 31, 2018. (5 marks) Continue from the above situation, and assume that 2019 San Company earned OMR180,000 and declared and paid a dividend of OMR70,000. Required: 1. Prepare the investment-related entries on Par Company's books for 2019 2. Prepare the workpaper eliminating entries for a workpaper on December 31, 2019 On January 1, 2018, Par Company purchased 90% of the outstanding common stock of San Company for OMR400,000. On that date, San Company's stockholders' equity consisted of common stock, OMR120,000; other contributed capital, OMR50,000, and retained earnings, OMR150,000. Par Company paid more than the book value of net assets acquired because the recorded cost of San Company's land was significantly less than its fair value. During 2018 San Company earned OMR150,000 and declared and paid a OMR60,000 dividend. Par Company used the partial equity method to record its investment in Sales Company Required: 1. Prepare the investment-related entries on Par Company's books for 2018. (2 marks) 2. Prepare the workpaper eliminating entries for a workpaper on December 31, 2018. (5 marks) Continue from the above situation, and assume that 2019 San Company earned OMR180,000 and declared and paid a dividend of OMR70,000. Required: 1. Prepare the investment-related entries on Par Company's books for 2019 2. Prepare the workpaper eliminating entries for a workpaper on December 31, 2019