Answered step by step

Verified Expert Solution

Question

1 Approved Answer

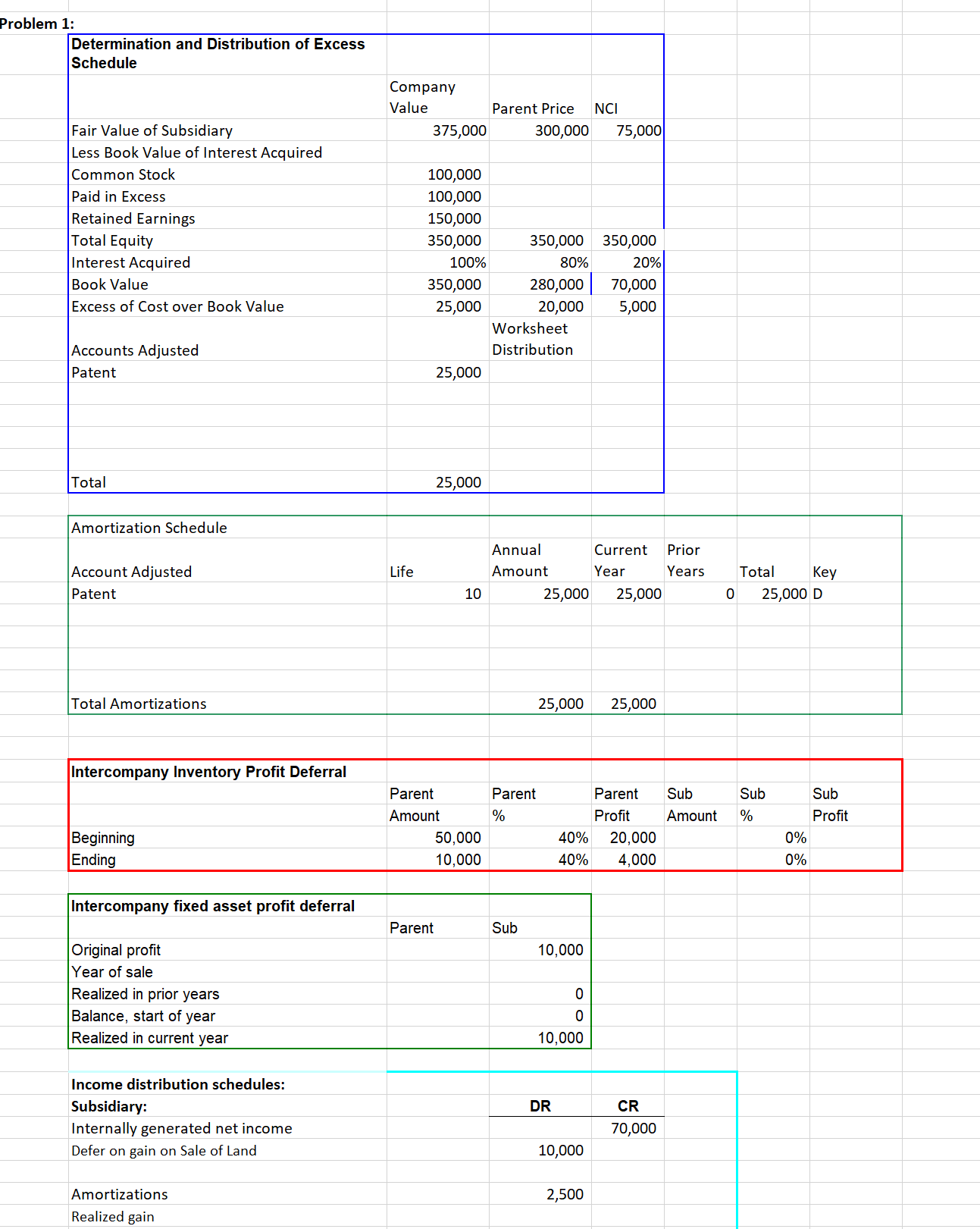

On January 1, 2018, Paul Company purchased 80% of the common stock of Smith Company for $300,000. On this date Smith had total owners' equity

On January 1, 2018, Paul Company purchased 80% of the common stock of Smith Company for $300,000. On this date Smith had total owners' equity of $350,000. Any excess of cost over book value is attributed to a patent, to be amortized over 10 years.

- During 2018, Paul has accounted for its investment in Smith using the simple equity method.

- During 2018, Paul sold merchandise to Smith for $50,000, of which $10,000 is held by Smith on December 31, 2018. Paul's gross profit on sales is 40%.

- During 2018, Smith sold some land to Paul at a gain of $10,000. Paul still holds the land at year end.

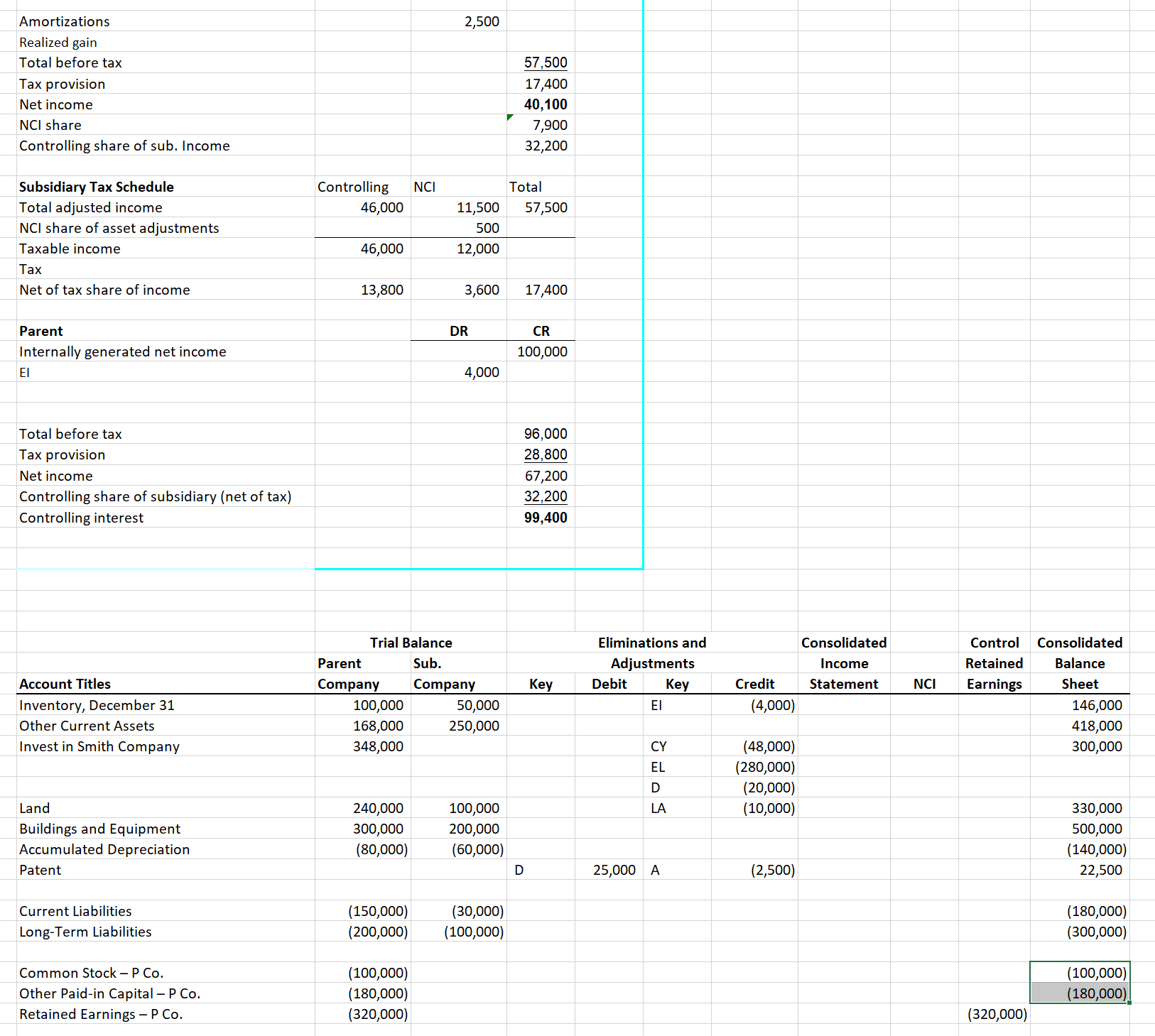

- Paul and Smith qualify as an affiliated group for tax purposes and thus will file a consolidated tax return. Assume a 30% corporate income tax rate.

Required:

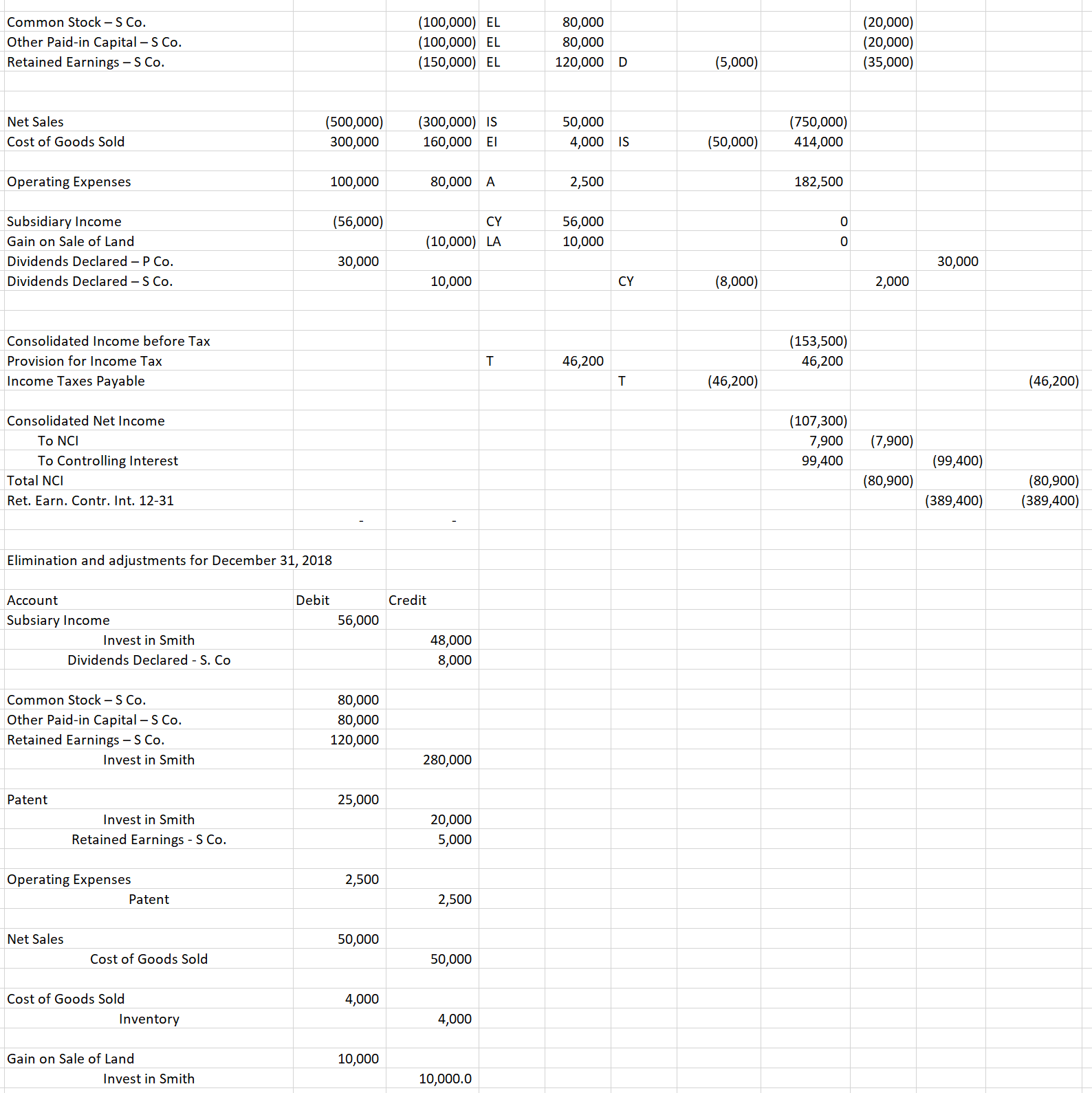

- Complete the Determination and Distribution of Excess schedule, income distribution schedules (with tax schedule), and any other necessary schedules.

- Prepare the elimination entries in journal form.

- Complete the worksheet for consolidated financial statements for the year ended December 31, 2018.

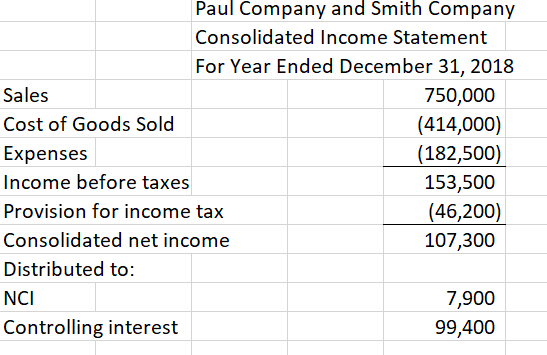

- Prepare the formal financial statements (Income Statement and Balance Sheet) at December 31, 2018.

Problem 1: Determination and Distribution of Excess Schedule Company Value Parent Price NCI Fair Value of Subsidiary Less Book Value of Interest Acquired Common Stock Paid in Excess 375,000 300,000 75,000 100,000 100,000 Retained Earnings 150,000 Total Equity 350,000 350,000 350,000 Interest Acquired 100% 80% 20% Book Value 350,000 280,000 70,000 Excess of Cost over Book Value 25,000 20,000 5,000 Worksheet Accounts Adjusted Distribution Patent 25,000 Total Amortization Schedule Account Adjusted Patent Total Amortizations Intercompany Inventory Profit Deferral Beginning Ending Intercompany fixed asset profit deferral 25,000 Life Annual Amount Current Prior Year Years Total 10 25,000 25,000 0 25,000 25,000 Key 25,000 D Parent Amount Parent % 50,000 Parent Sub Profit 40% 20,000 Sub Amount % Sub Profit 0% 10,000 40% 4,000 0% Original profit Parent Sub 10,000 Year of sale Realized in prior years Balance, start of year Realized in current year 0 0 10,000 Income distribution schedules: Subsidiary: DR CR Internally generated net income 70,000 Defer on gain on Sale of Land 10,000 Amortizations Realized gain 2,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Determination and Distribution of Excess Schedule Cost of 80 investment in Smith 300000 300000 Book value of Smiths net assets at acquisition 80 of 35...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started