Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, Peel Ltd. purchased 30,000 of Sticky Inc.'s 250,000 outstanding voting shares for $450,000. At December 31, 2018, shares of Sticky

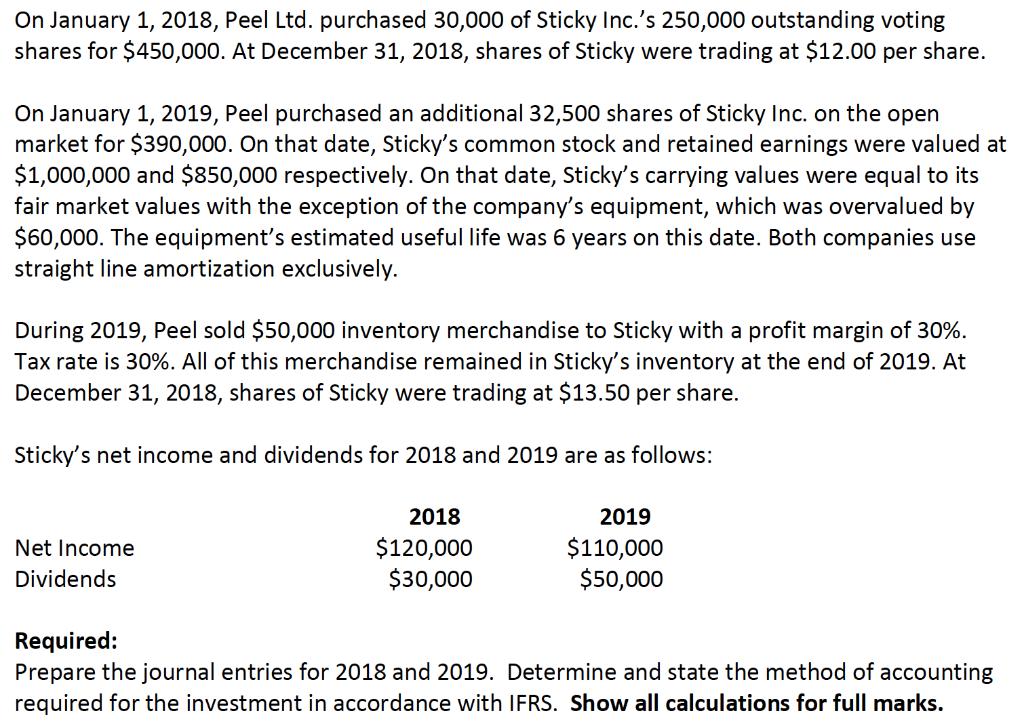

On January 1, 2018, Peel Ltd. purchased 30,000 of Sticky Inc.'s 250,000 outstanding voting shares for $450,000. At December 31, 2018, shares of Sticky were trading at $12.00 per share. On January 1, 2019, Peel purchased an additional 32,500 shares of Sticky Inc. on the open market for $390,000. On that date, Sticky's common stock and retained earnings were valued at $1,000,000 and $850,000 respectively. On that date, Sticky's carrying values were equal to its fair market values with the exception of the company's equipment, which was overvalued by $60,000. The equipment's estimated useful life was 6 years on this date. Both companies use straight line amortization exclusively. During 2019, Peel sold $50,000 inventory merchandise to Sticky with a profit margin of 30%. Tax rate is 30%. All of this merchandise remained in Sticky's inventory at the end of 2019. At December 31, 2018, shares of Sticky were trading at $13.50 per share. Sticky's net income and dividends for 2018 and 2019 are as follows: Net Income Dividends 2018 $120,000 $30,000 2019 $110,000 $50,000 Required: Prepare the journal entries for 2018 and 2019. Determine and state the method of accounting required for the investment in accordance with IFRS. Show all calculations for full marks.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The journal entries for 2018 and 2019 are as follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started