Question

On January 1, 2018 Philly Corporation paid $40,500 for a 90% interest in Skelly Corporation. On that date Skelly capital stock was $25,000 and its

On January 1, 2018 Philly Corporation paid $40,500 for a 90% interest in Skelly Corporation. On that date Skelly capital stock was $25,000 and its Retained Earnings was $7,500. Any excess will be assigned to goodwill.

Further information:

1. During 2018, Philly's sales to Skelly were $12,000, Skelly managed to sell 50% of this merchandise. (The other half was sold in 2019.)

2. During 2019, Philly's sales to Skelly were $15,000 of which Skelly managed to sell 40% of this merchandise. At year-end 2019, Skelly owed Philly $3,750 for the inventory purchased during 2019. Philly sells merchandise to Skelly at 120% of Philly's cost.

3. On January 1, 2019, Philly sold equipment with a book value of $5,000 and a remaining useful life of four years and no salvage value to Skelly for $7,000. Straight-line depreciation is used.

4. Skelly's income for 2018 was $10,000 and Skelly's dividends received by Philly was $4,500

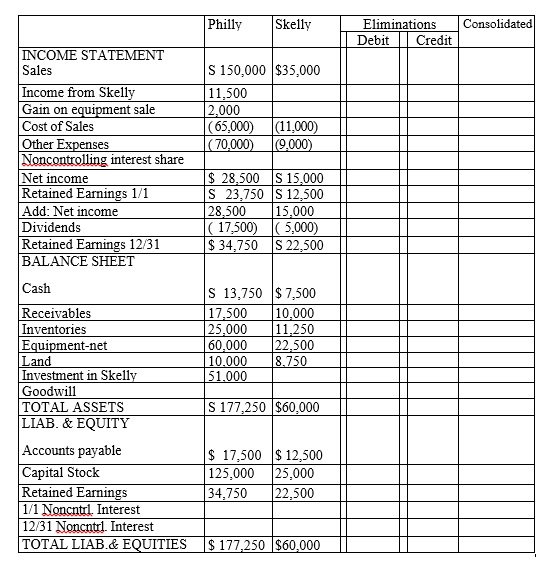

5. Separate company financial statements for Philly Corporation and Subsidiary at December 31, 2019 are summarized in the first two columns of the consolidation working papers.

Required:

Complete the working papers to consolidate the financial statements of Philly Corporation and subsidiary for the year ended December 31, 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started