Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the Equity in Q-Video's earnings for both 2018 and 2019; as well as the ending balance in the Investment Account as of December 31,

Compute the Equity in Q-Video's earnings for both 2018 and 2019; as well as the ending balance in the Investment Account as of December 31, 2019. It may be helpful to prepare the journal entries for each year.

Compute the Equity in Q-Video's earnings for both 2018 and 2019; as well as the ending balance in the Investment Account as of December 31, 2019. It may be helpful to prepare the journal entries for each year.

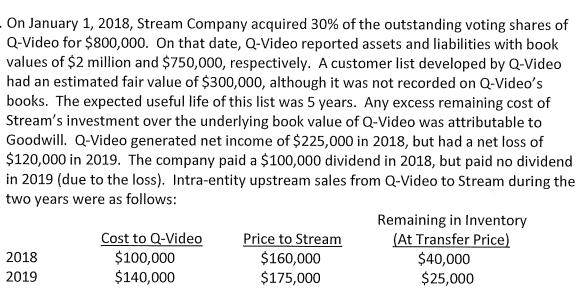

On January 1, 2018, Stream Company acquired 30% of the outstanding voting shares of Q-Video for $800,000. On that date, Q-Video reported assets and liabilities with book values of $2 million and $750,000, respectively. A customer list developed by Q-Video had an estimated fair value of $300,000, although it was not recorded on Q-Video's books. The expected useful life of this list was 5 years. Any excess remaining cost of Stream's investment over the underlying book value of Q-Video was attributable to Goodwill. Q-Video generated net income of $225,000 in 2018, but had a net loss of $120,000 in 2019. The company paid a $100,000 dividend in 2018, but paid no dividend in 2019 (due to the loss). Intra-entity upstream sales from Q-Video to Stream during the two years were as follows: 2018 2019 Cost to Q-Video $100,000 $140,000 Price to Stream $160,000 $175,000 Remaining in Inventory (At Transfer Price) $40,000 $25,000

Step by Step Solution

★★★★★

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Equity in QVideos earnings for 2018 112500 Equity in QVideos earnings for 2019 60000 Ending balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started