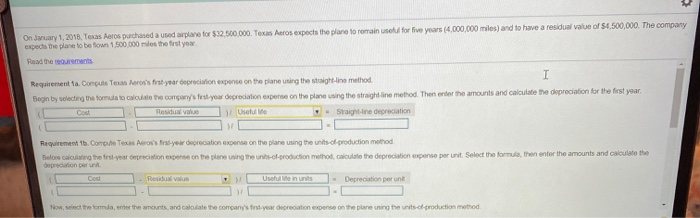

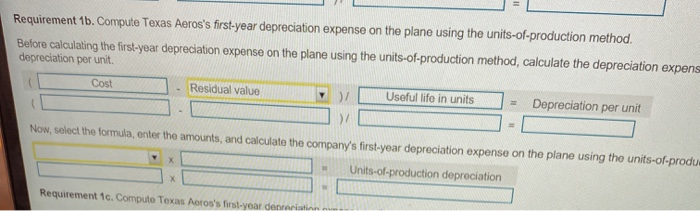

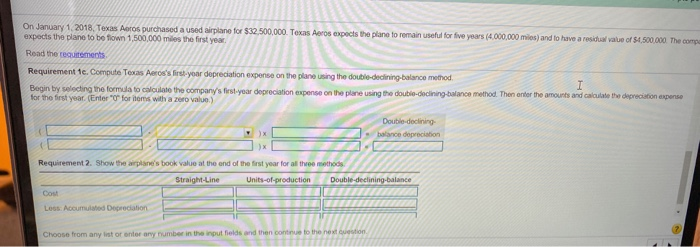

On January 1, 2018. Texas Aeros purchased a used arplan for $32.500.000. Texas Aeros expects the plane to remain useful for five years (4,000,000 miles) and to have a residual value of $4.500,000. The company expecs the place to be town 1.500.000 others you Read the requirements Requirement la compute T Begin by selecting the formulat h eron's first year depreciation expense on the plane using the tight-line method e the company's first year depreciation expense on the plane using the straight line method. Then enter the amounts and calculate the depreciation for the first year Useite - Straight line depreciation Requirement to. Come Texas Aeros's Erst year deprecation on the plane using the units of production method Belor calculating the test year precision expens on the plane using the production method calculate the depreciation expense per unit Select the formulation enter the amounts and calculate the con porn Cos - Toda Usefute in units - Depreciation perunt Now, the formdate the amounts and calculate the company's test year depreciation expense on the plane using the units of production method Requirement 1b. Compute Texas Aeros's first-year depreciation expense on the plane using the units-of-production method. Before calculating the first-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expens depreciation per unit. Cost Residual value Useful life in units = Depreciation per unit Now, select the formula, enter the amounts, and calculate the company's first-year depreciation expense on the plane using the units-of-produ Units-of-production depreciation Requirement tc. Compute Texas Aeros's forsvaren On January 1, 2018. Texas Aeros purchased and plane for $32,500,000. Texas Acros expects the plane to remain useful for five years (4.000.000 miles) and to have a residual value of 0.500.000 The.com expects the plane to be fown 1.500.000 miles the first year Read the requests he coepers Requirement te. Compute Texas Aeros's first-year depreciation expense on the plane using the double-declining-balance method Begin by w ing the formato the company's first year depreciation expert on the parengthe n ing balance method. Then enter the amounts and cac for the first year Enterolooms with zero value) Double-declining 2 . ce depreciation Requirement 2. Show the wron's book value at the end of the first year for all the methods Straight-Line Units-of production Double-declining balance Loss Accumulated Decreciation Choose from any sorr y number in the out folds and then continue to the