Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, the general ledger of TNT Fireworks includes the following account balances: Accounts Debit Credit Cash $ 60,300 Accounts Receivable 28,200 Inventory

On January 1, 2018, the general ledger of TNT Fireworks includes the following account balances:

| Accounts | Debit | Credit | ||||

| Cash | $ | 60,300 | ||||

| Accounts Receivable | 28,200 | |||||

| Inventory | 37,900 | |||||

| Notes Receivable (5%, due in 2 years) | 31,200 | |||||

| Land | 171,000 | |||||

| Allowance for Uncollectible Accounts | 3,800 | |||||

| Accounts Payable | 16,400 | |||||

| Common Stock | 236,000 | |||||

| Retained Earning | 72,400 | |||||

|

|

|

|

|

|

| |

| Totals | $ | 328,600 | $ | 328,600 | ||

|

|

|

|

|

|

| |

|

| ||||||

During January 2018, the following transactions occur:

| January 1 | Purchase equipment for $21,100. The company estimates a residual value of $3,100 and a five-year service life. |

| January 4 | Pay cash on accounts payable, $11,100. |

| January 8 | Purchase additional inventory on account, $98,900. |

| January 15 | Receive cash on accounts receivable, $23,600 |

| January 19 | Pay cash for salaries, $31,400. |

| January 28 | Pay cash for January utilities, $18,100. |

| January 30 | Firework sales for January total $236,000. All of these sales are on account. The cost of the units sold is $123,000. |

The following information is available on January 31, 2018.

- Depreciation on the equipment for the month of January is calculated using the straight-line method.

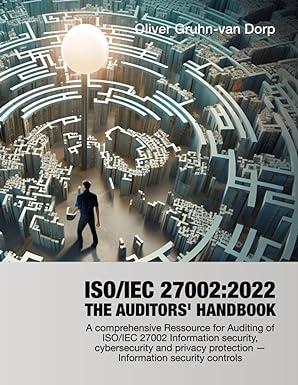

- The company estimates future uncollectible accounts. The company determines $4,600 of accounts receivable on January 31 are past due, and 50% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 3% of these accounts are estimated to be uncollectible. The note receivable of $31,200 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.)

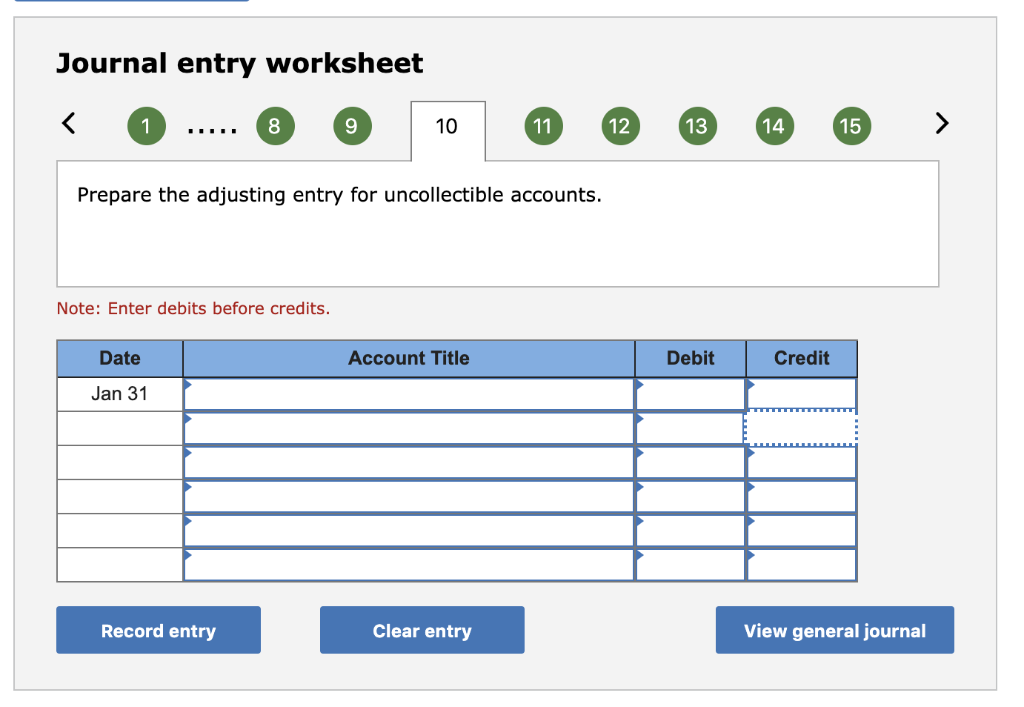

- Accrued interest revenue on notes receivable for January.

- Unpaid salaries at the end of January are $34,200.

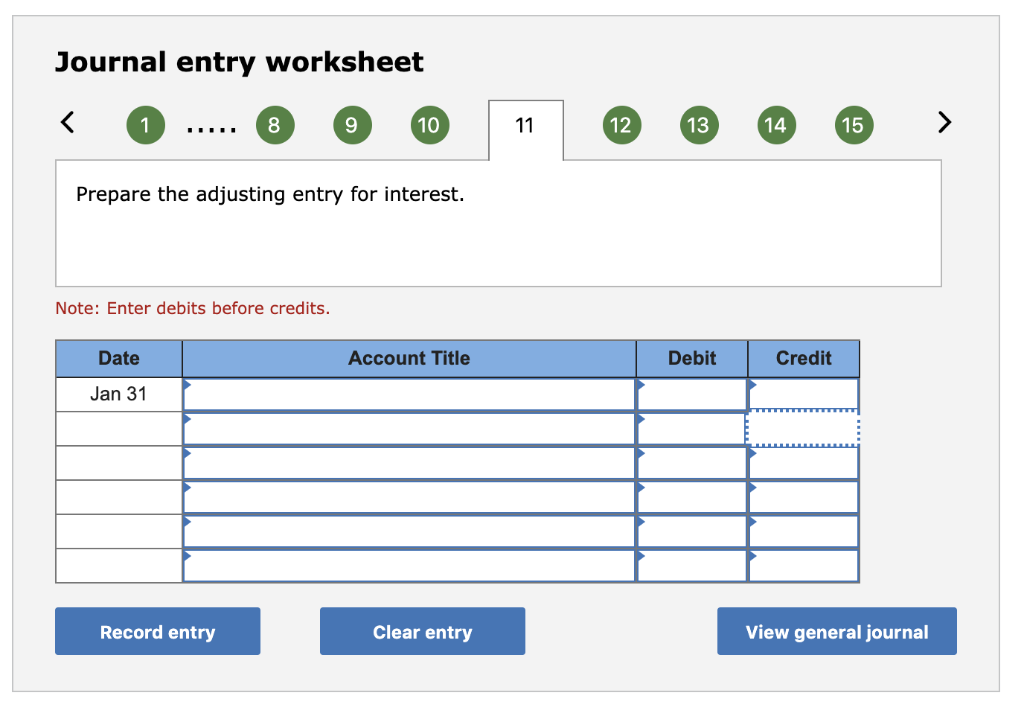

- Accrued income taxes at the end of January are $10,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started