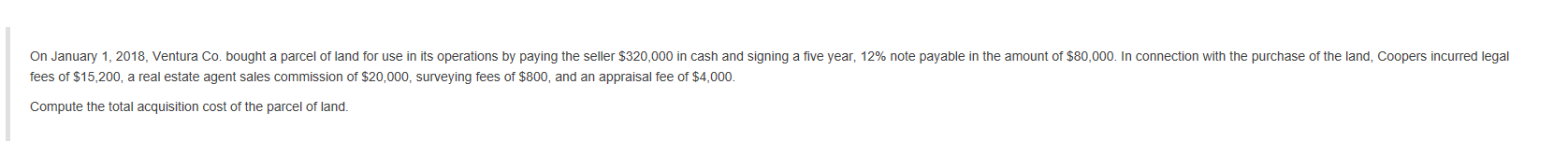

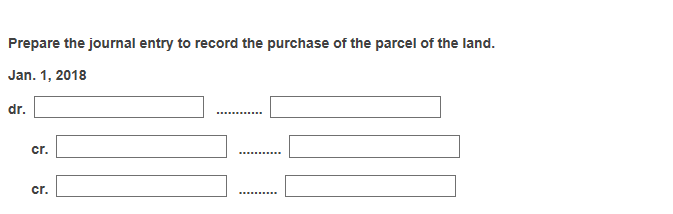

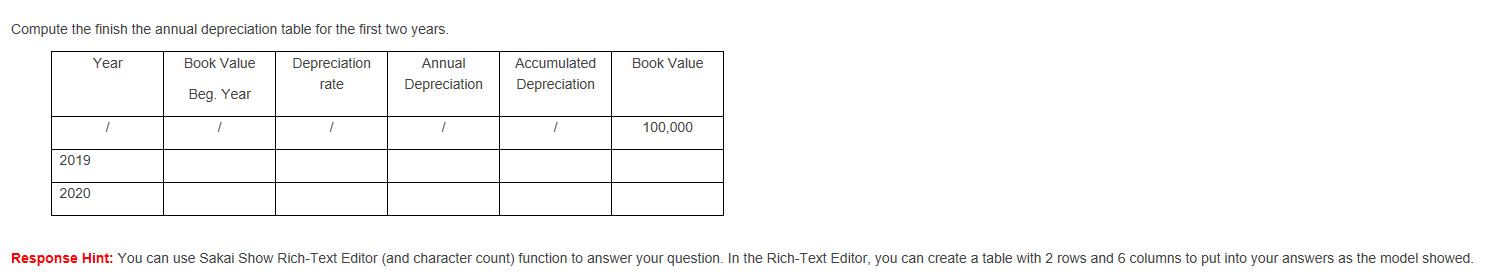

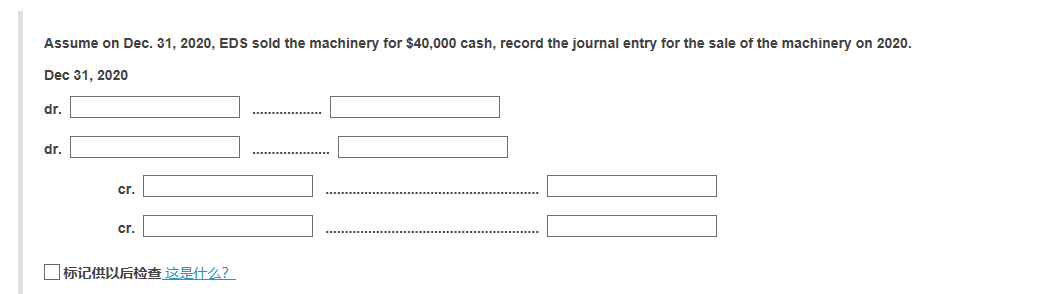

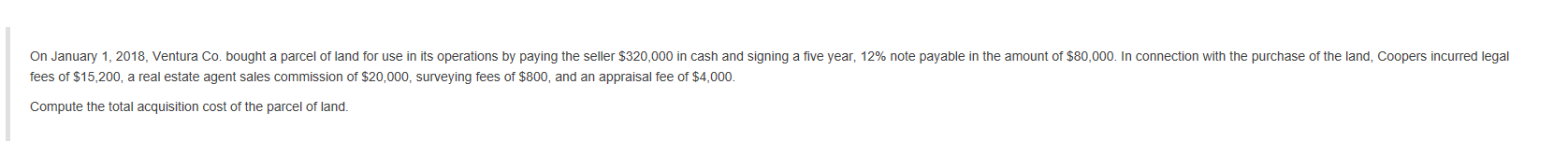

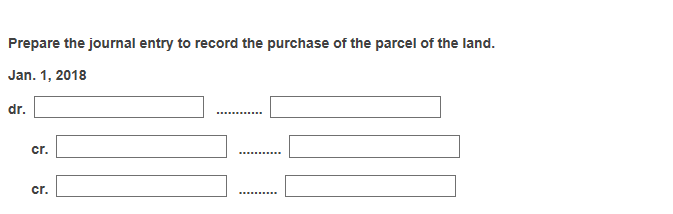

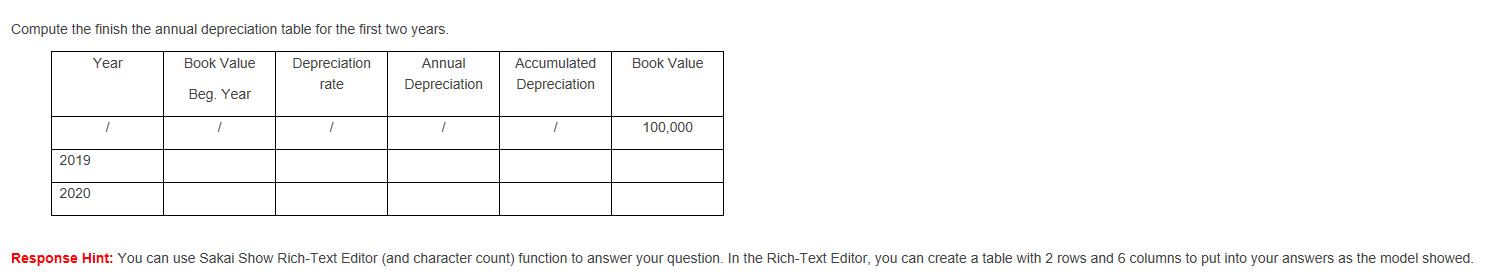

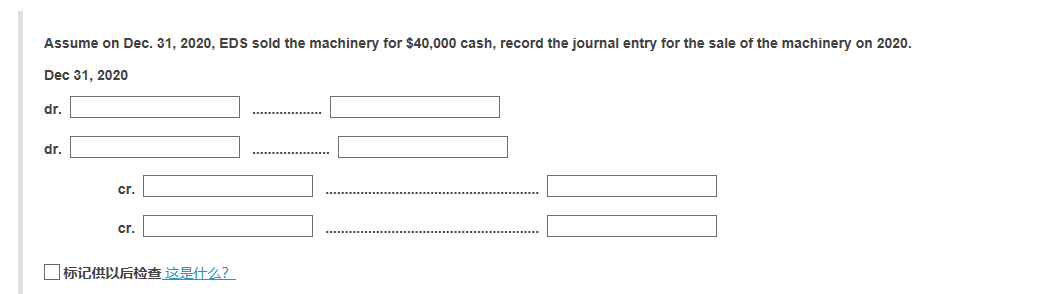

On January 1, 2018, Ventura Co. bought a parcel of land for use in its operations by paying the seller $320,000 in cash and signing a five year, 12% note payable in the amount of $80,000. In connection with the purchase of the land, Coopers incurred legal fees of $15,200, a real estate agent sales commission of $20,000, surveying fees of $800, and an appraisal fee of $4,000. Compute the total acquisition cost of the parcel of land. Prepare the journal entry to record the purchase of the parcel of the land. Jan. 1, 2018 dr. cr. cr. Compute the finish the annual depreciation table for the first two years. Year Book Value Book Value Depreciation rate Annual Depreciation Accumulated Depreciation Beg. Year 100,000 2019 2020 Response Hint: You can use Sakai Show Rich-Text Editor (and character count) function to answer your question. In the Rich-Text Editor, you can create a table with 2 rows and 6 columns to put into your answers as the model showed. Assume on Dec. 31, 2020, EDS sold the machinery for $40,000 cash, record the journal entry for the sale of the machinery on 2020. Dec 31, 2020 dr. dr. cr. cr. | ? On January 1, 2018, Ventura Co. bought a parcel of land for use in its operations by paying the seller $320,000 in cash and signing a five year, 12% note payable in the amount of $80,000. In connection with the purchase of the land, Coopers incurred legal fees of $15,200, a real estate agent sales commission of $20,000, surveying fees of $800, and an appraisal fee of $4,000. Compute the total acquisition cost of the parcel of land. Prepare the journal entry to record the purchase of the parcel of the land. Jan. 1, 2018 dr. cr. cr. Compute the finish the annual depreciation table for the first two years. Year Book Value Book Value Depreciation rate Annual Depreciation Accumulated Depreciation Beg. Year 100,000 2019 2020 Response Hint: You can use Sakai Show Rich-Text Editor (and character count) function to answer your question. In the Rich-Text Editor, you can create a table with 2 rows and 6 columns to put into your answers as the model showed. Assume on Dec. 31, 2020, EDS sold the machinery for $40,000 cash, record the journal entry for the sale of the machinery on 2020. Dec 31, 2020 dr. dr. cr. cr. |