Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, Amity Company leases a crane to Baltimore Company. The lease contains the following terms and provisions The lease is noncancelable and

On January 1, 2019, Amity Company leases a crane to Baltimore Company. The lease contains the following terms and provisions

- The lease is noncancelable and has a term of 10 years.

- The lease does not contain a renewal or bargain purchase option.

- The annual rentals are $4,000, payable at the beginning of each year.

- Baltimore agrees to pay all executory costs directly to a third party.

- The cost of the equipment to the lessor is $24,925.00. The fair value of the equipment is $26,400.

- Amity incurs initial direct costs of $1,415.09.

- The interest rate implicit in the lease is 12%

- Amity expects to collect all lease payments from Baltimore.

- Amity estimates that the fair value at the end of the lease term will be $3,190 and that the economic life of the crane is 12 years. This value is not guaranteed by Baltimore.

Required:

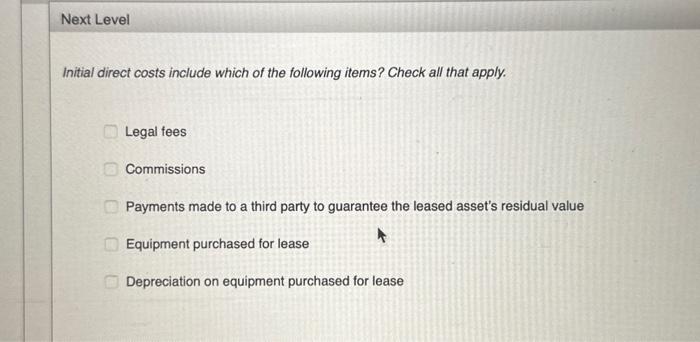

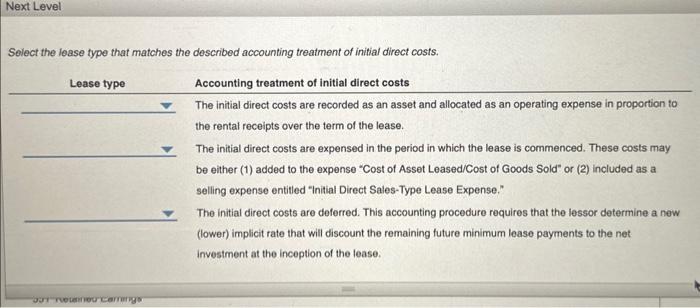

- Next Level What are initial direct costs? Discuss the accounting treatment of these costs. Are they treated in the same manner for (a) an operating lease, (b) a sales-type lease, and (c) a direct financing lease?

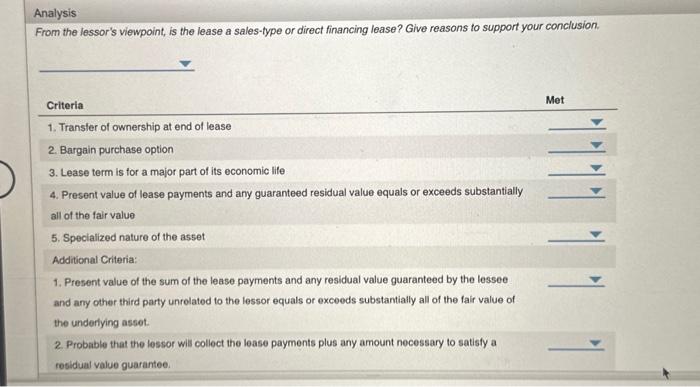

- From the lessor's viewpoint, is the preceding lease a sales-type or direct financing lease? Give reasons to support your conclusion.

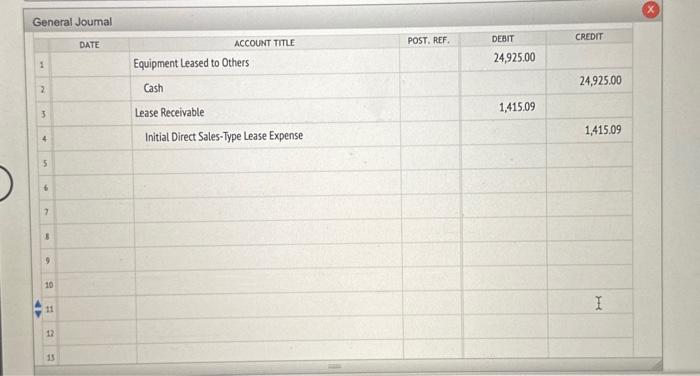

- Prepare the journal entries for Amity for 2019.

1. prepare the 13 journal entries for amity for 2019

dont forget to put the dates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started