Answered step by step

Verified Expert Solution

Question

1 Approved Answer

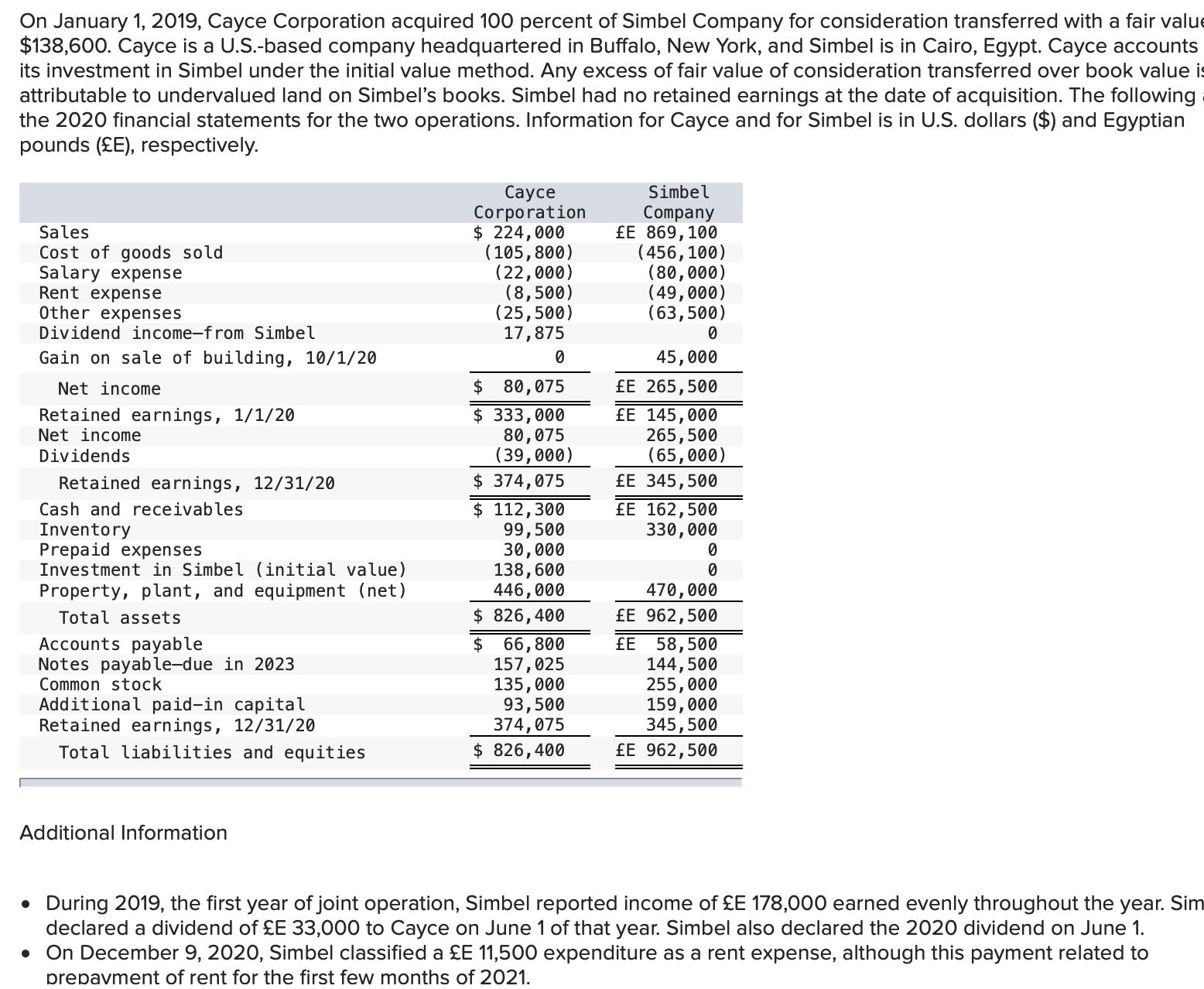

On January 1, 2019, Cayce Corporation acquired 100 percent of Simbel Company for consideration transferred with a fair valu $138,600. Cayce is a U.S.-based

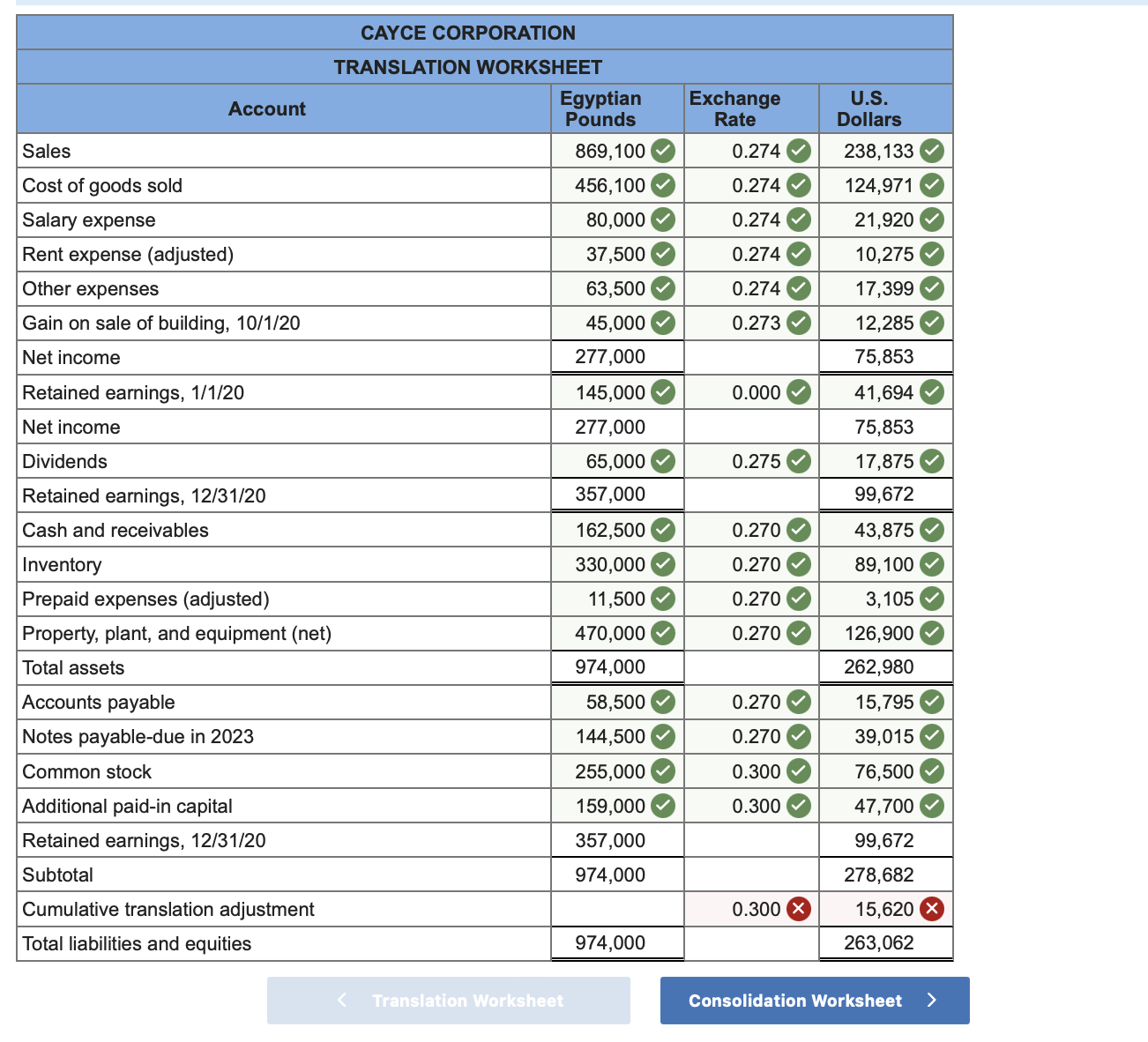

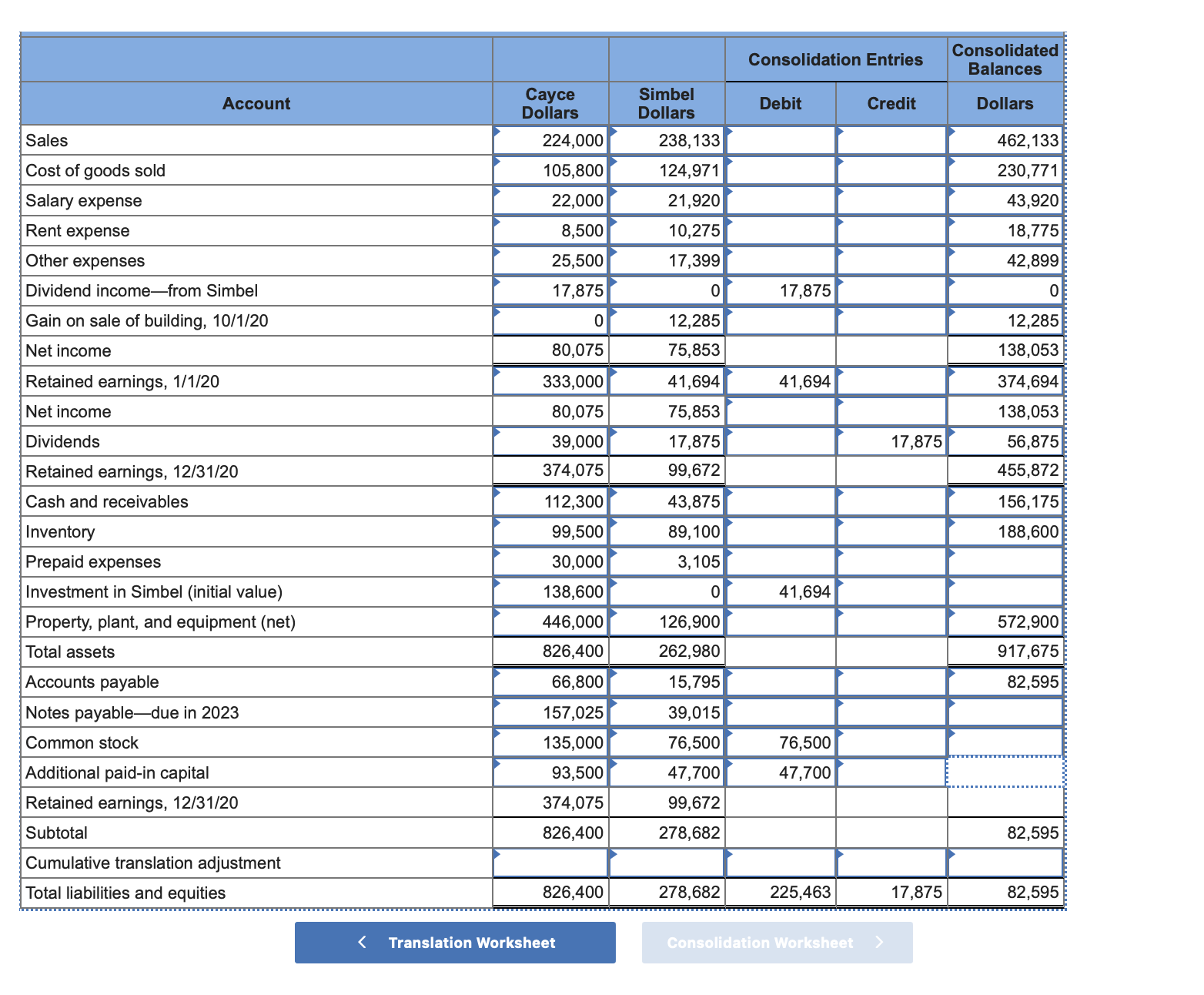

On January 1, 2019, Cayce Corporation acquired 100 percent of Simbel Company for consideration transferred with a fair valu $138,600. Cayce is a U.S.-based company headquartered in Buffalo, New York, and Simbel is in Cairo, Egypt. Cayce accounts its investment in Simbel under the initial value method. Any excess of fair value of consideration transferred over book value is attributable to undervalued land on Simbel's books. Simbel had no retained earnings at the date of acquisition. The following the 2020 financial statements for the two operations. Information for Cayce and for Simbel is in U.S. dollars ($) and Egyptian pounds (E), respectively. Sales Cost of goods sold Salary expense Rent expense Other expenses Dividend income-from Simbel Cayce Corporation $ 224,000 (105,800) (22,000) Simbel Company E 869,100 (456,100) (80,000) (49,000) (63,500) (8,500) (25,500) 17,875 0 0 45,000 $ 80,075 E 265,500 Gain on sale of building, 10/1/20 Net income Retained earnings, 1/1/20 Net income Dividends Retained earnings, 12/31/20 Cash and receivables Inventory Prepaid expenses Investment in Simbel (initial value) Property, plant, and equipment (net) Total assets Accounts payable Notes payable-due in 2023 Common stock Additional paid-in capital Retained earnings, 12/31/20 Total liabilities and equities $ 374,075 $ 112,300 $ 333,000 80,075 (39,000) E 145,000 265,500 (65,000) E 345,500 E 162,500 330,000 0 0 470,000 E 962,500 99,500 30,000 138,600 446,000 $ 826,400 $ 66,800 157,025 135,000 93,500 374,075 E 58,500 144,500 255,000 159,000 345,500 $ 826,400 E 962,500 Additional Information During 2019, the first year of joint operation, Simbel reported income of E 178,000 earned evenly throughout the year. Sim declared a dividend of E 33,000 to Cayce on June 1 of that year. Simbel also declared the 2020 dividend on June 1. On December 9, 2020, Simbel classified a E 11,500 expenditure as a rent expense, although this payment related to prepavment of rent for the first few months of 2021. CAYCE CORPORATION TRANSLATION WORKSHEET Egyptian Exchange U.S. Account Pounds Rate Dollars Sales 869,100 0.274 238,133 Cost of goods sold 456,100 0.274 124,971 Salary expense 80,000 0.274 21,920 Rent expense (adjusted) 37,500 0.274 10,275 Other expenses 63,500 0.274 17,399 Gain on sale of building, 10/1/20 45,000 0.273 12,285 Net income 277,000 75,853 Retained earnings, 1/1/20 145,000 0.000 41,694 Net income 277,000 75,853 Dividends 65,000 0.275 17,875 Retained earnings, 12/31/20 357,000 99,672 Cash and receivables 162,500 0.270 43,875 Inventory 330,000 0.270 89,100 Prepaid expenses (adjusted) 11,500 0.270 3,105 Property, plant, and equipment (net) 470,000 0.270 126,900 Total assets 974,000 262,980 Accounts payable 58,500 0.270 15,795 | Notes payable-due in 2023 144,500 0.270 39,015 Common stock 255,000 0.300 76,500 Additional paid-in capital 159,000 0.300 47,700 Retained earnings, 12/31/20 Subtotal Cumulative translation adjustment Total liabilities and equities 357,000 99,672 974,000 278,682 0.300 X 15,620 974,000 263,062 > Translation Worksheet Consolidation Worksheet > Consolidation Entries Consolidated Balances Cayce Simbel Account Debit Credit Dollars Dollars Dollars Sales 224,000 238,133 462,133 Cost of goods sold 105,800 124,971 230,771 Salary expense 22,000 21,920 43,920 Rent expense 8,500 10,275 18,775 Other expenses 25,500 17,399 42,899 Dividend income-from Simbel 17,875 0 17,875 0 Gain on sale of building, 10/1/20 0 12,285 12,285 Net income 80,075 75,853 138,053 Retained earnings, 1/1/20 333,000 41,694 41,694 374,694 Net income 80,075 75,853 138,053 Dividends 39,000 17,875 17,875 56,875 Retained earnings, 12/31/20 374,075 99,672 455,872 Cash and receivables Inventory 112,300 43,875 156,175 99,500 89,100 188,600 Prepaid expenses 30,000 3,105 Investment in Simbel (initial value) 138,600 0 41,694 Property, plant, and equipment (net) 446,000 126,900 572,900 Total assets 826,400 262,980 917,675 Accounts payable 66,800 15,795 82,595 Notes payable-due in 2023 157,025 39,015 Common stock 135,000 76,500 76,500 Additional paid-in capital 93,500 47,700 47,700 Retained earnings, 12/31/20 Subtotal 374,075 99,672 826,400 278,682 82,595 Cumulative translation adjustment Total liabilities and equities 826,400 278,682 225,463 < Translation Worksheet Consolidation Worksheet > 17,875 82,595

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started