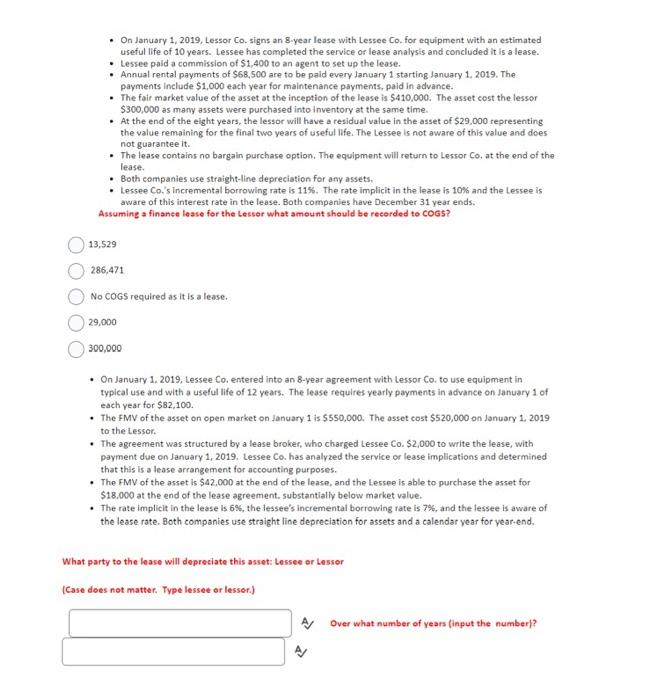

- On January 1, 2019, Lessor Co. signs an 8-year lease with Lessee Co. for equipment with an estimated useful life of 10 years. Lessee has completed the service or lease analysis and concluded it is a lease. - Lessee pald a commission of $1,400 to an agent to set up the lease. - Annual rental payments of $68,500 are to be paid every lanuary 1 starting lanuary 1, 2019, The payments include $1,000 each year for maintenance payments, paid in advance. - The fair market value of the asset at the inception of the lease is $410,000. The asset cost the lessor $300,000 as mary assets were purchased into inventory at the same time. - At the end of the eight years, the lessor will have a residual value in the asset of $29,000 representing the value remaining for the final two years of useful ilfe. The Lessee is not aware of this value and does not guarantee it. - The lease contains no bargalin purchase option. The equipment will return to Lessor Co, at the end of the lease. - Both companies use straight-line depreciation for any assets. - Lessee Co.'s incremental borrowing rate is 115 . The rate implicit in the lease is 10% and the Lessee is avare of this interest rate in the lease. Both companies have December 31 year ends. Assuming a finance lease for the Lesser what ameunt should be recerded to cogs? 13,529 286,471 No COGS required as it is a lease. 29,000 300,000 - On January 1, 2019, Lessee Co, entered into an 8-year agreement with Lessor Co, to use equipment in typical use and with a useful life of 12 years. The lease requires yearly payments in advance on January 1 of each year for $82,100. - The FMV of the asset on open market on Jandary 1 is $550,000. The asset cost $520,000 on danuary 1, 2019 to the Lessor. - The agreement was structured by a lease broker, who charged Lessee Co. $2,000 to write the lease, with payment due on January 1, 2019. Lessee Co. has analyzed the service or lease implications and determined that this is a lease arrangement for accounting purposes. - The FMV of the asset is $42,000 at the end of the lease, and the Lessee is able to purchase the asset for $18,000 at the end of the lease agreement. substantially below market value. - The rate implicit in the lease is 6%, the lessee's incremental borrowing rate is 7%, and the lessee is aware of the lease rate. Both companies use straight line depreciation for assets and a calendar year for year-end. at party to the lease will depreciate this asset: Lessee or Lesser se does not matter. Type lessee or lesser.) Ay Over what number of years (input the number)