Question

On January 1, 2019, Metco Inc. reported 255,000 shares of $7 par value common stock as being issued and outstanding. On March 24, 2019, Metco

On January 1, 2019, Metco Inc. reported 255,000 shares of $7 par value common stock as being issued and outstanding. On March 24, 2019, Metco Inc. purchased for its treasury 2,700 shares of its common stock at a price of $35.00 per share. On August 19, 2019, 680 of these treasury shares were sold for $48.00 per share. Metco's directors declared cash dividends of $0.40 per share during the second quarter and again during the fourth quarter, payable on June 30, 2019, and December 31, 2019, respectively. A 4% stock dividend was issued at the end of the year. There were no other transactions affecting common stock during the year.

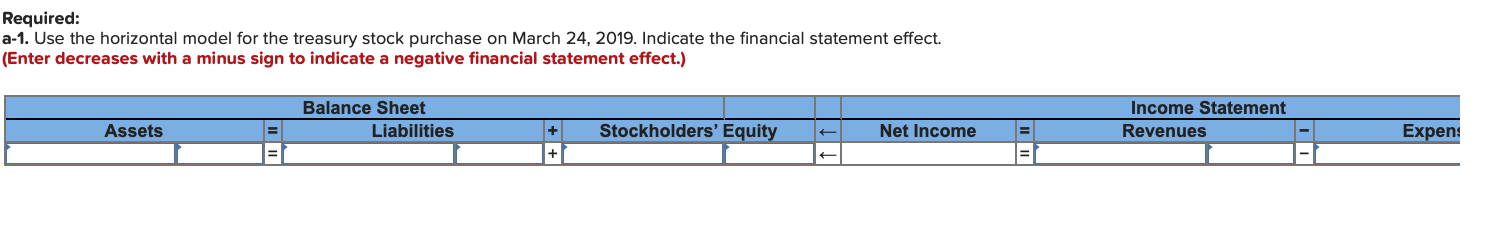

Required: a-1. Use the horizontal model for the treasury stock purchase on March 24, 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started