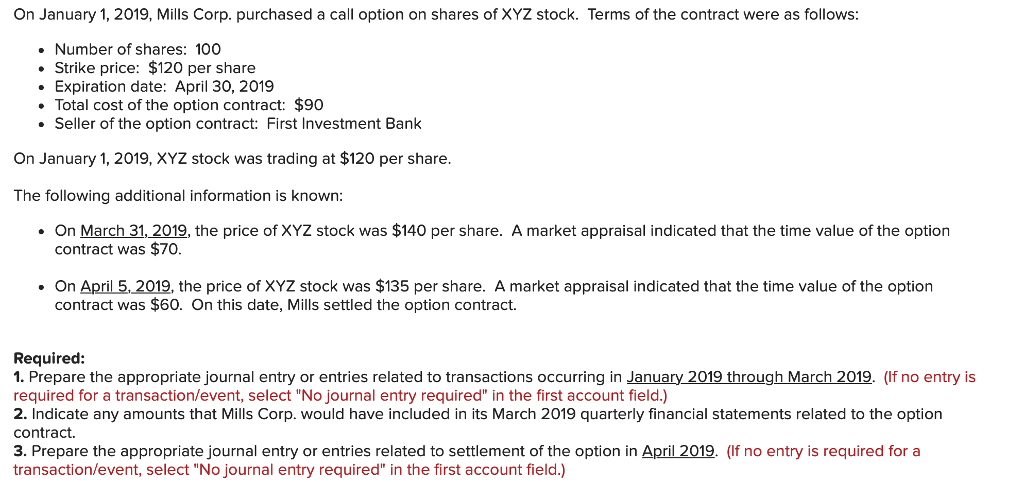

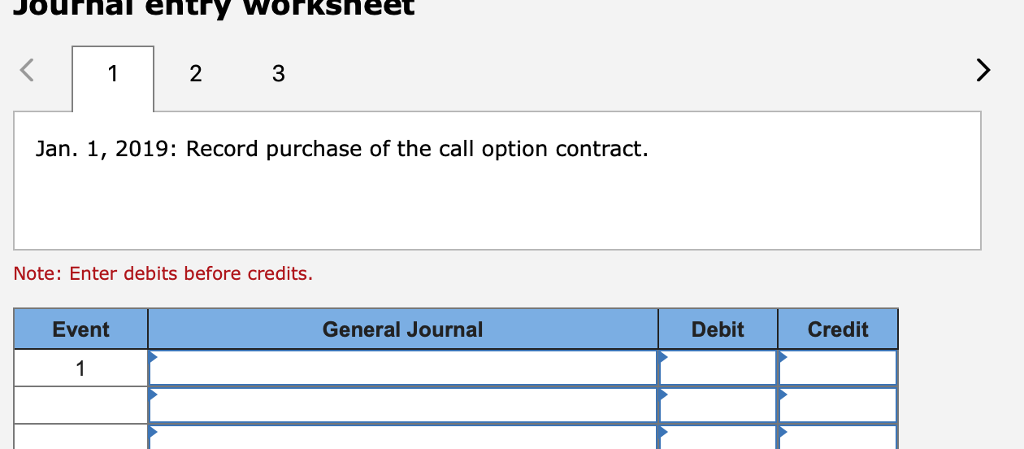

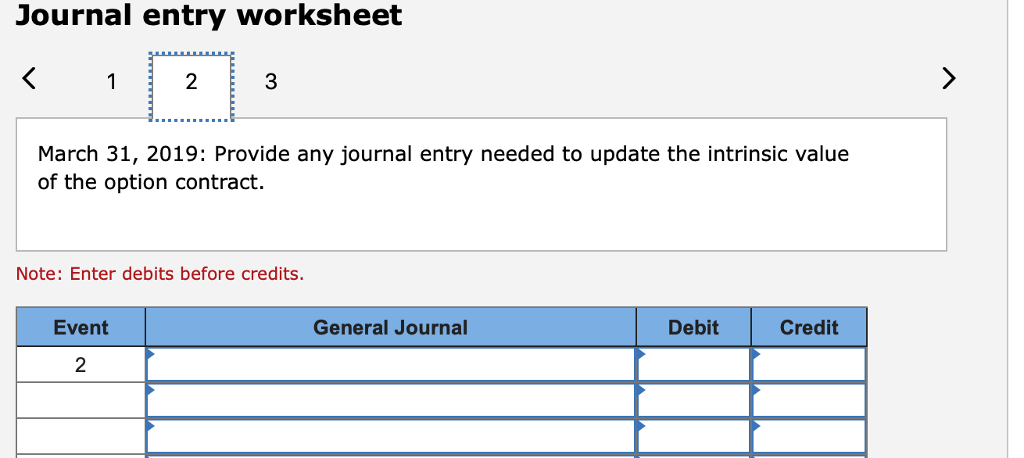

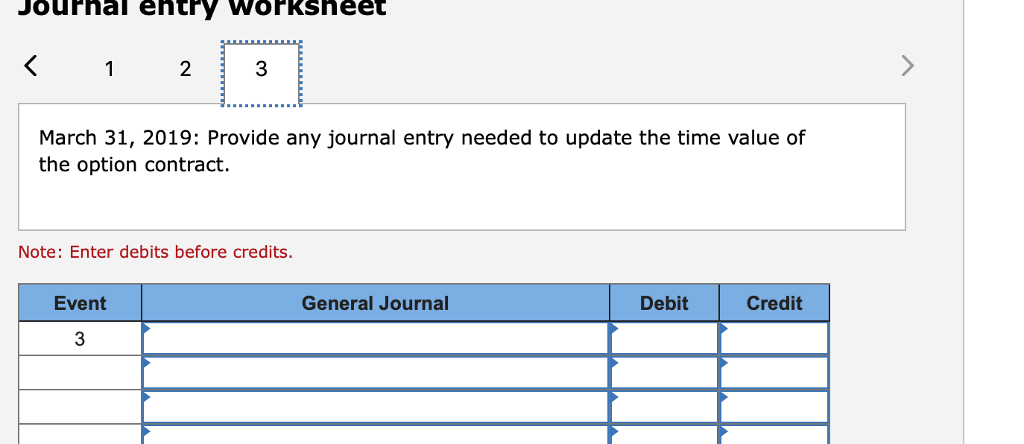

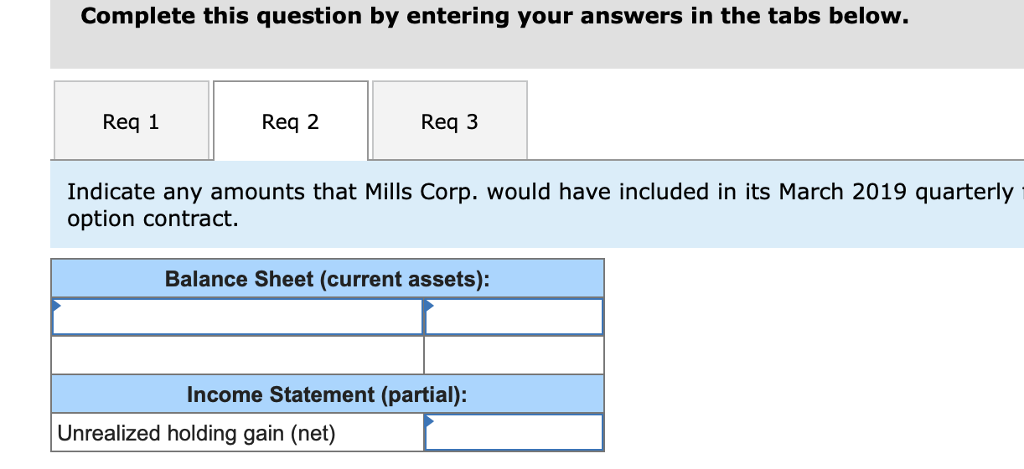

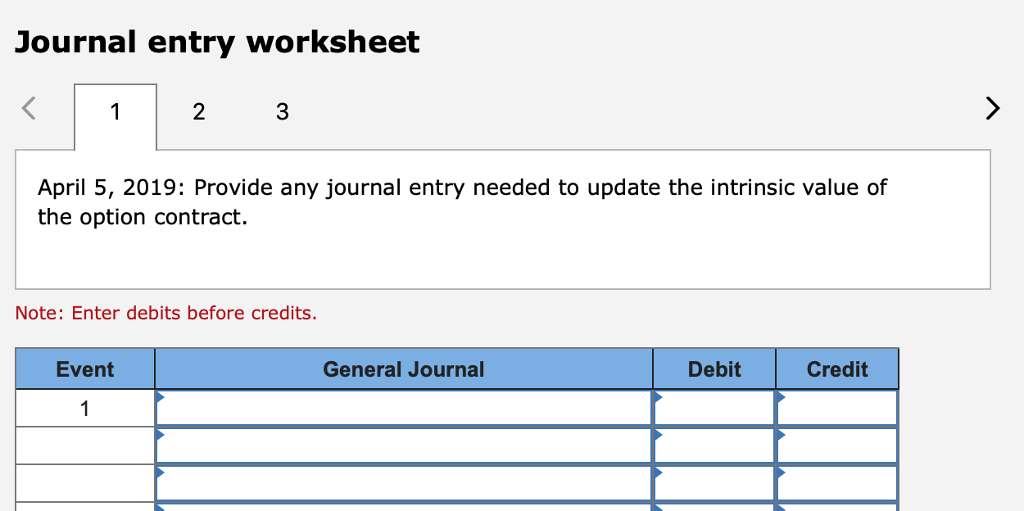

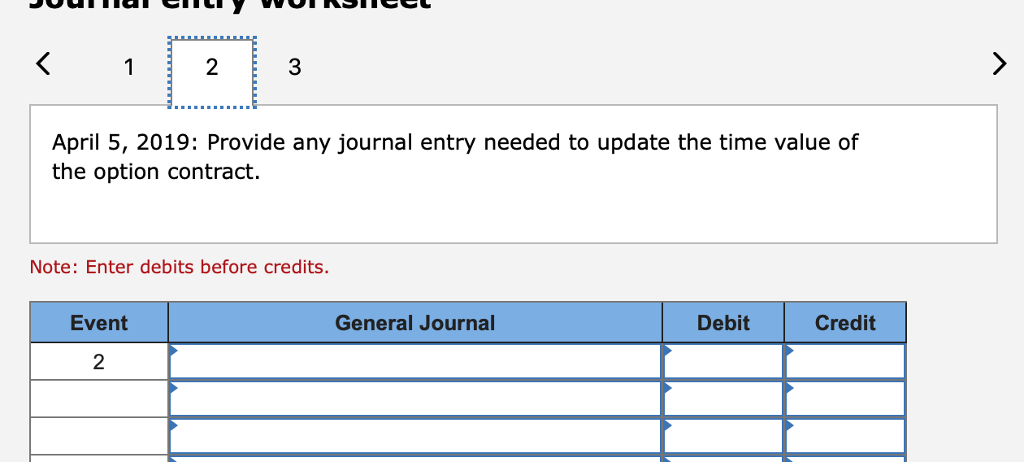

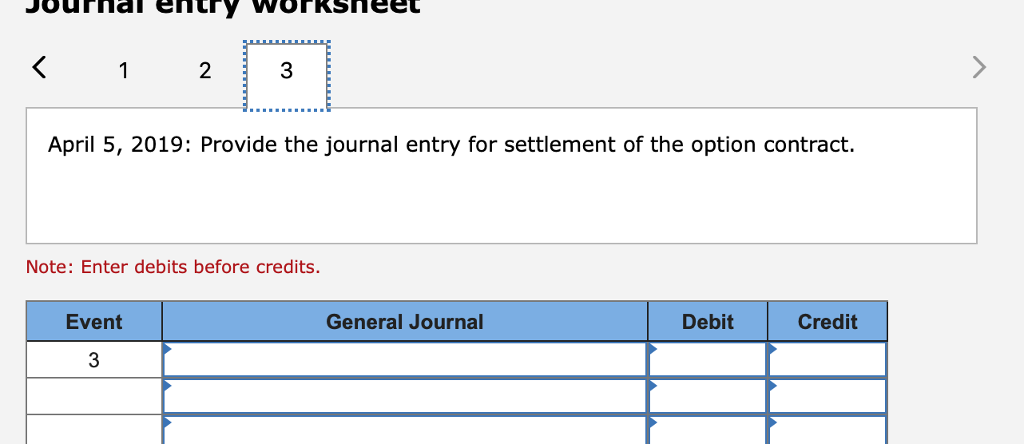

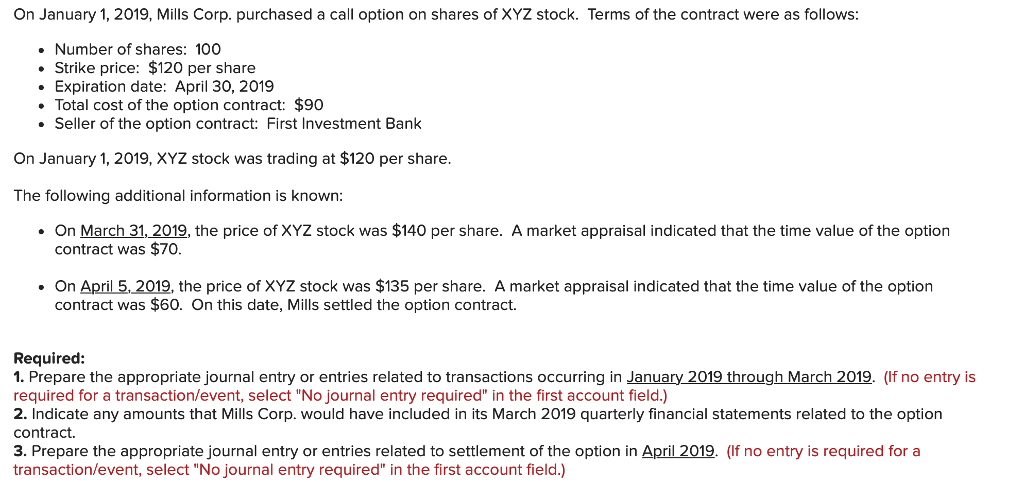

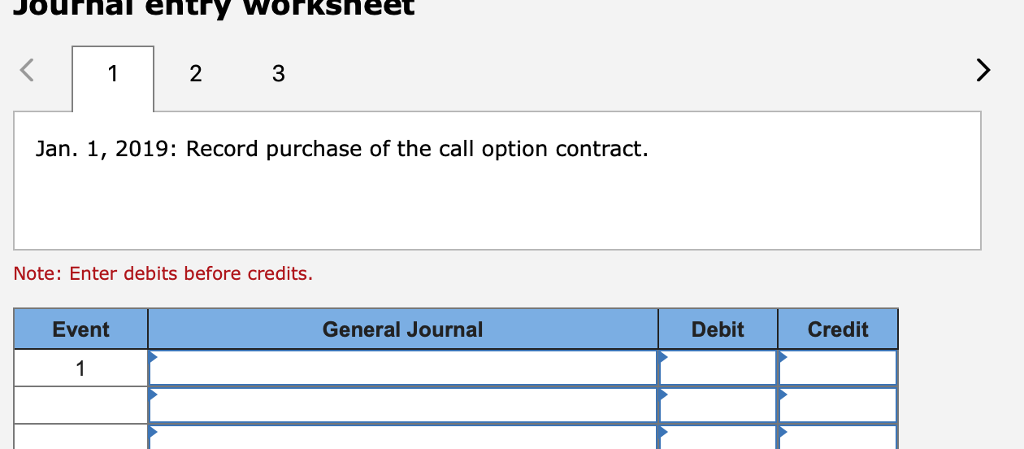

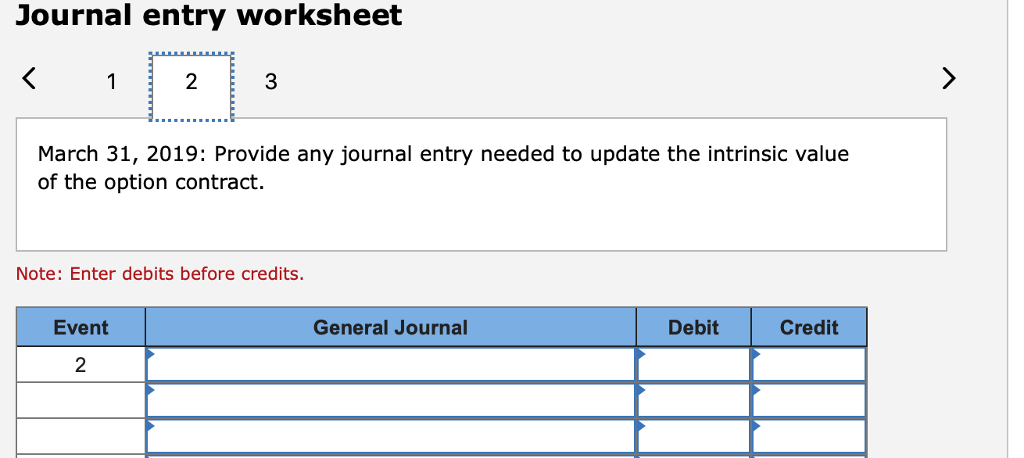

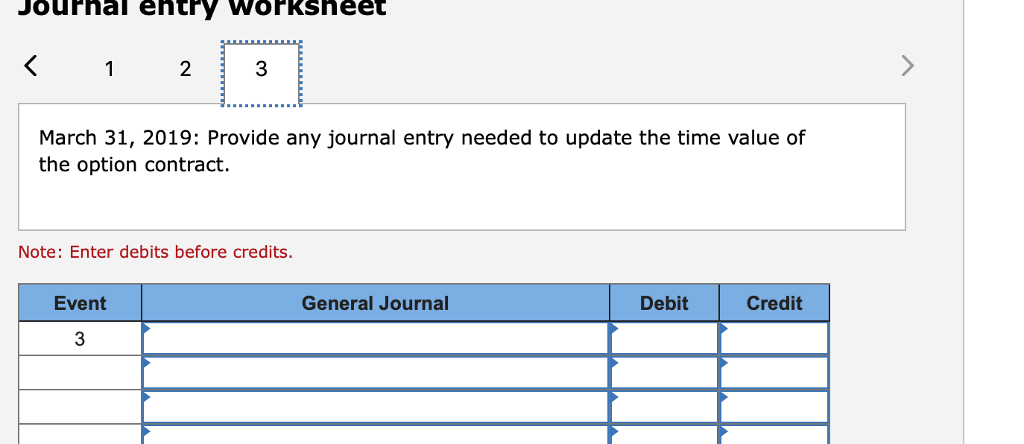

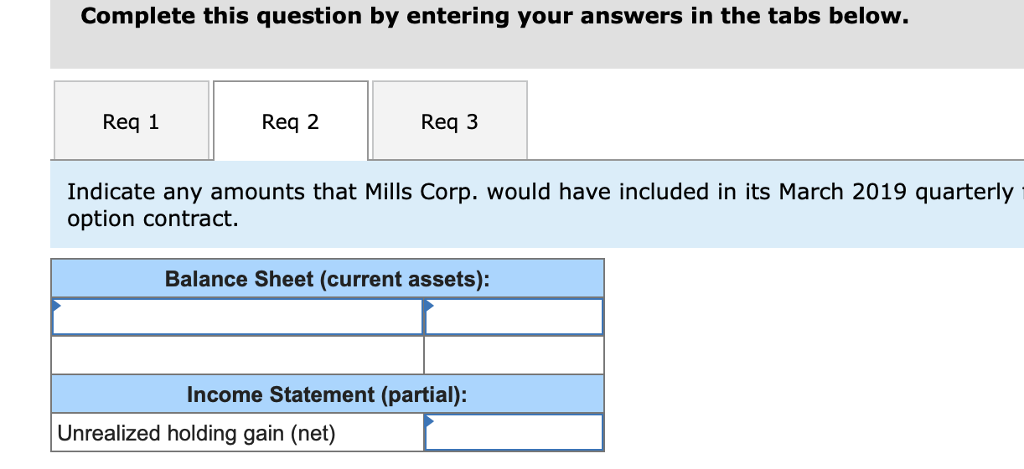

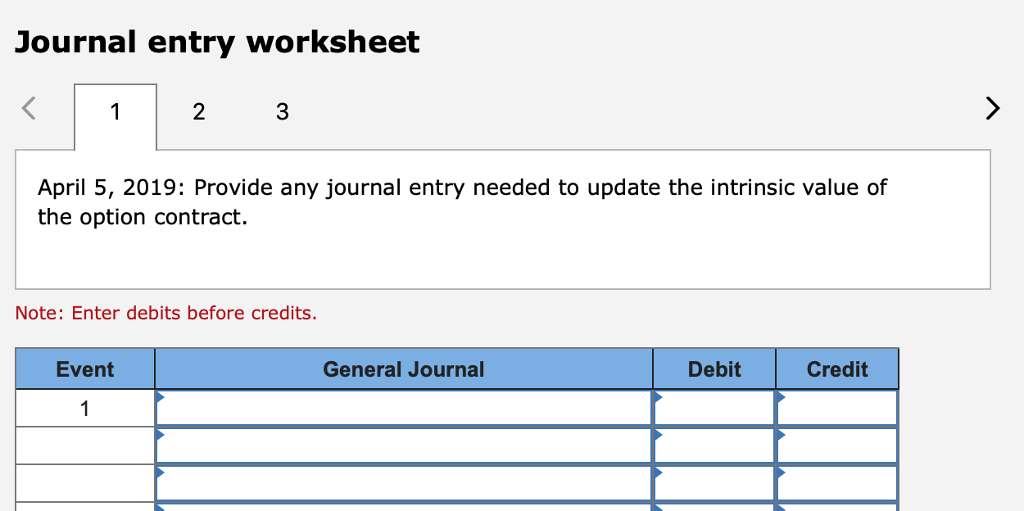

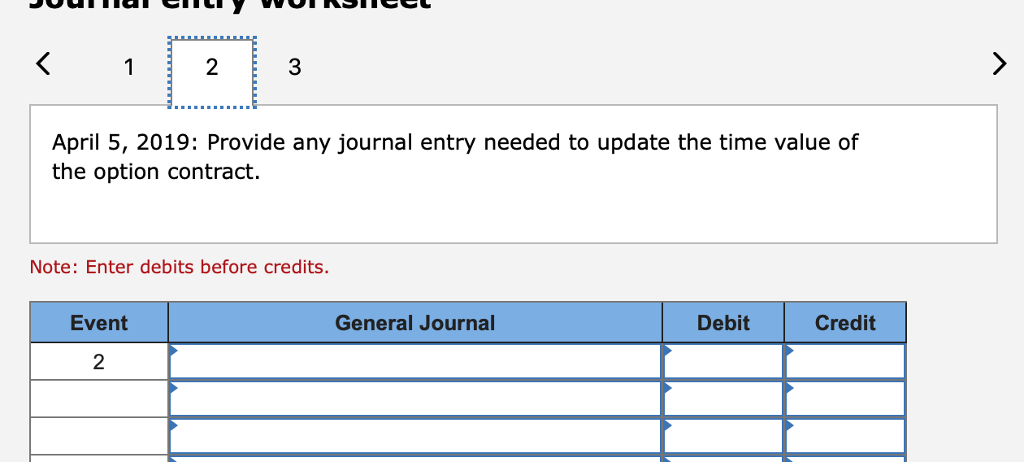

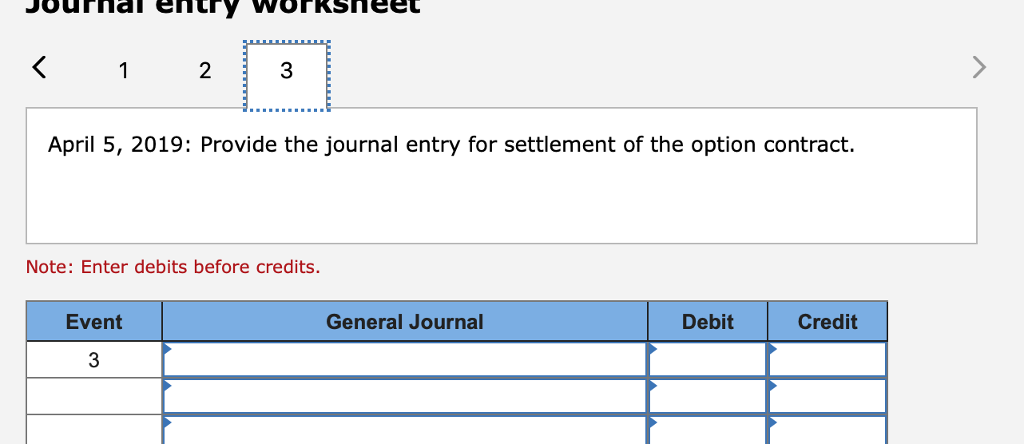

On January 1, 2019, Mills Corp. purchased a call option on shares of XYZ stock. Terms of the contract were as follows: Number of shares: 100 Strike price: $120 per share Expiration date: April 30, 2019 Total cost of the option contract: $90 Seller of the option contract: First Investment Bank On January 1, 2019, XYZ stock was trading at $120 per share. The following additional information is known: On March 31,2019, the price of XYZ stock was $140 per share. A market appraisal indicated that the time value of the option contract was $70. On April 5,2019, the price of XYZ stock was $135 per share. A market appraisal indicated that the time value of the option contract was $60. On this date, Mills settled the option contract. Required: 1. Prepare the appropriate journal entry or entries related to transactions occurring in January 2019 through March 2019 (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Indicate any amounts that Mills Corp. would have included in its March 2019 quarterly financial statements related to the option contract. 3. Prepare the appropriate journal entry or entries related to settlement of the option in April 2019. (If no entry is required fora transaction/event, select "No journal entry required" in the first account field.) Jourhal entry WoFKsheet 2 March 31, 2019: Provide any journal entry needed to update the time value of the option contract Note: Enter debits before credits. Event General Journal Debit Credit 3 Complete this question by entering your answers in the tabs below Req 1 Req 2 Req 3 Indicate any amounts that Mills Corp. would have included in its March 2019 quarterly option contract. Balance Sheet (current assets): Income Statement (partial): Unrealized holding gain (net) Journal entry worksheet 2 3 April 5, 2019: Provide any journal entry needed to update the intrinsic value of the option contract. Note: Enter debits before credits. Event General Journal Debit Credit 2 3 April 5, 2019: Provide any journal entry needed to update the time value of the option contract Note: Enter debits before credits. Event General Journal Debit Credit 2 2 April 5, 2019: Provide the journal entry for settlement of the option contract. Note: Enter debits before credits. Event General Journal Debit Credit