Question

On January 1, 2019, PR paid $90,000 to purchase 10% (10,000) of the ordinary shares of HR Inc. On December 27, 2019, HR declared

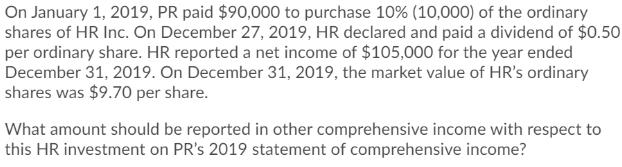

On January 1, 2019, PR paid $90,000 to purchase 10% (10,000) of the ordinary shares of HR Inc. On December 27, 2019, HR declared and paid a dividend of $0.50 per ordinary share. HR reported a net income of $105,000 for the year ended December 31, 2019. On December 31, 2019, the market value of HR's ordinary shares was $9.70 per share. What amount should be reported in other comprehensive income with respect to this HR investment on PR's 2019 statement of comprehensive income?

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine the amount that should be reported in other comprehensive income OCI with respec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting IFRS

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

2nd edition

1118285909, 1118285905, 978-1118285909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App