Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, the partner's capital balance in Rosen & Decker Ltd are Jerry Rosen, $27,000 and Patricia Decker, $34,000. For the year

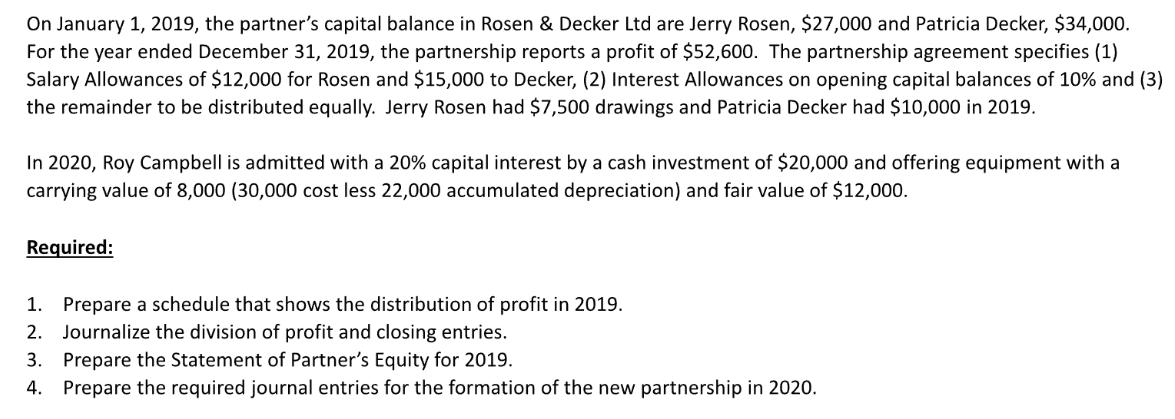

On January 1, 2019, the partner's capital balance in Rosen & Decker Ltd are Jerry Rosen, $27,000 and Patricia Decker, $34,000. For the year ended December 31, 2019, the partnership reports a profit of $52,600. The partnership agreement specifies (1) Salary Allowances of $12,000 for Rosen and $15,000 to Decker, (2) Interest Allowances on opening capital balances of 10% and (3) the remainder to be distributed equally. Jerry Rosen had $7,500 drawings and Patricia Decker had $10,000 in 2019. In 2020, Roy Campbell is admitted with a 20% capital interest by a cash investment of $20,000 and offering equipment with a carrying value of 8,000 (30,000 cost less 22,000 accumulated depreciation) and fair value of $12,000. Required: 1. Prepare a schedule that shows the distribution of profit in 2019. 2. Journalize the division of profit and closing entries. 3. Prepare the Statement of Partner's Equity for 2019. 4. Prepare the required journal entries for the formation of the new partnership in 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Distribution of profit in 2019 Based on the partnership agreement the profit of 52600 will be distri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started