Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2019, the records of Claireborn Company showed the following accounts and balances in its property, plant, and equipment category: Land -

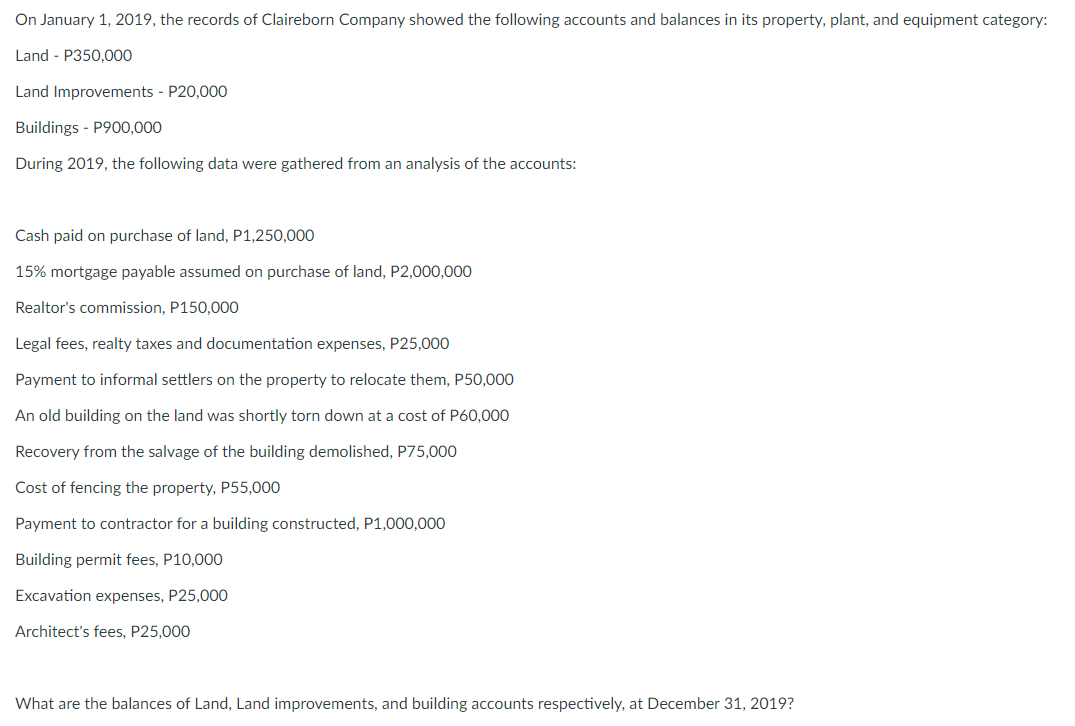

On January 1, 2019, the records of Claireborn Company showed the following accounts and balances in its property, plant, and equipment category: Land - P350,000 Land Improvements - P20,000 Buildings - P900,000 During 2019, the following data were gathered from an analysis of the accounts: Cash paid on purchase of land, P1,250,000 15% mortgage payable assumed on purchase of land, P2,000,000 Realtor's commission, P150,000 Legal fees, realty taxes and documentation expenses, P25,000 Payment to informal settlers on the property to relocate them, P50,000 An old building on the land was shortly torn down at a cost of P60,000 Recovery from the salvage of the building demolished, P75,000 Cost of fencing the property, P55,000 Payment to contractor for a building constructed, P1,000,000 Building permit fees, P10,000 Excavation expenses, P25,000 Architect's fees, P25,000 What are the balances of Land, Land improvements, and building accounts respectively, at December 31, 2019?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the balances of Land Land Improvements and Buildings at December 31 2019 we need to consider the various transactions throughout the year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e885fe53e2_954953.pdf

180 KBs PDF File

663e885fe53e2_954953.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started