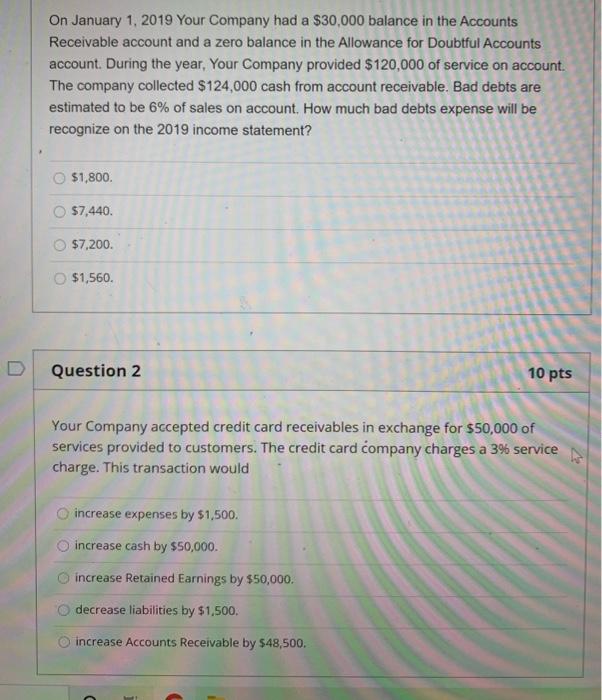

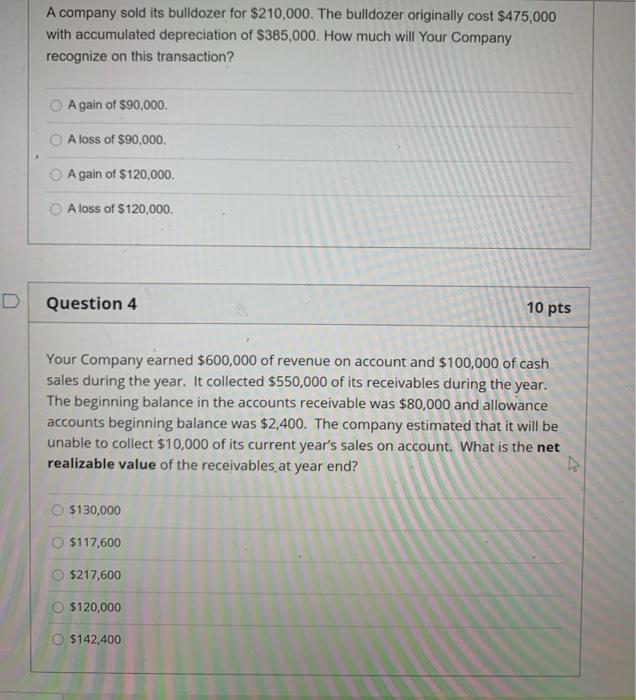

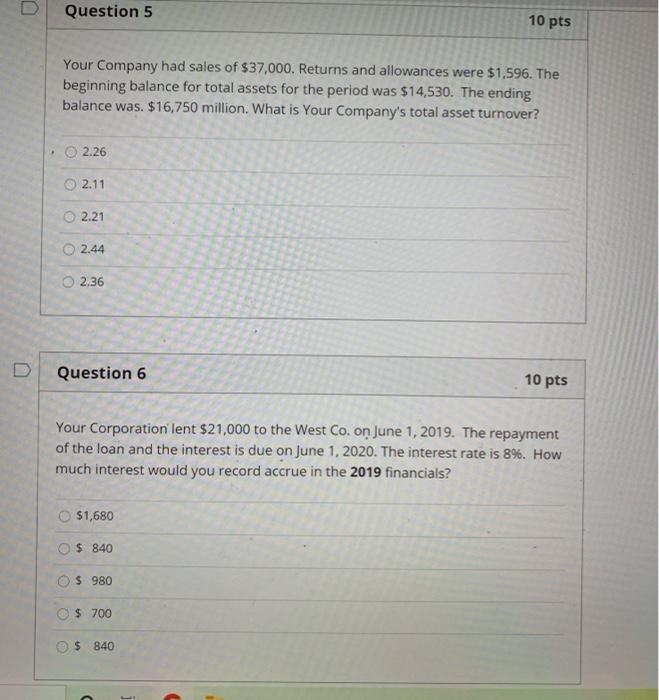

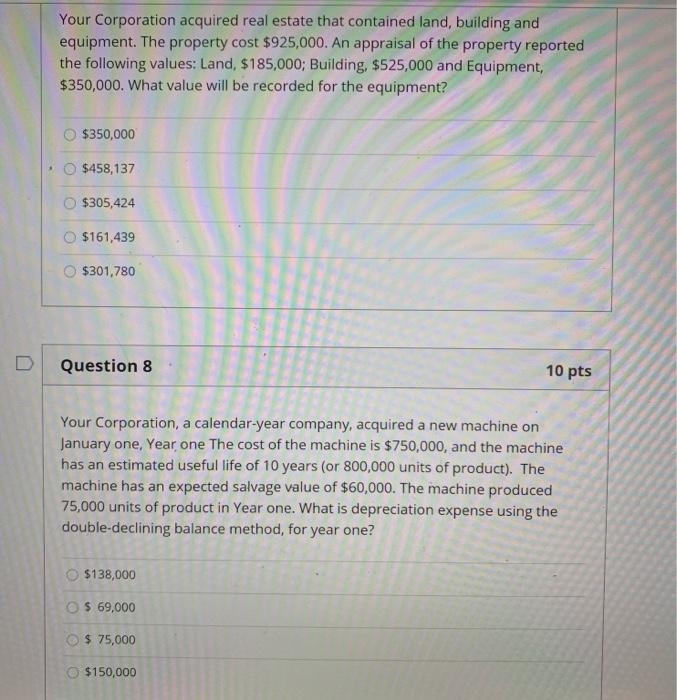

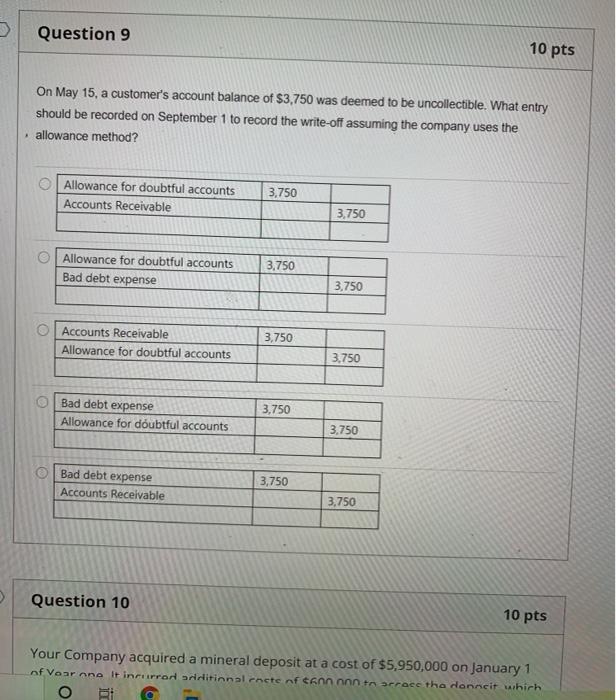

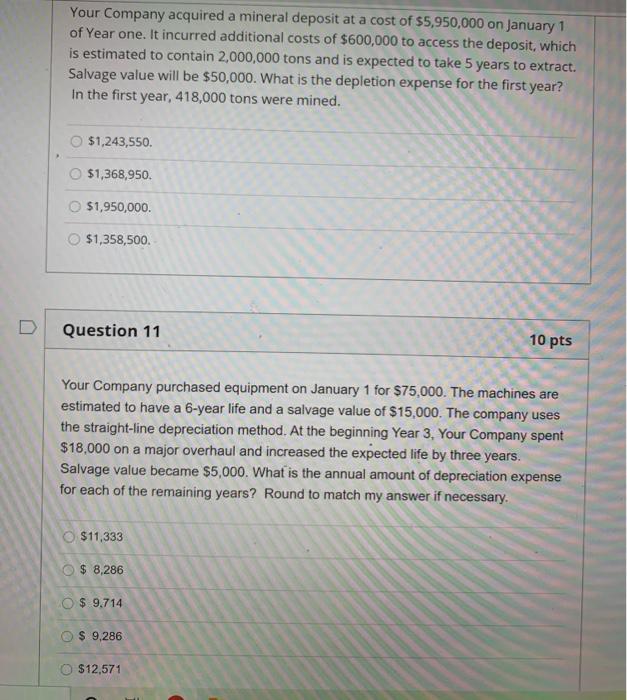

On January 1, 2019 Your Company had a $30,000 balance in the Accounts Receivable account and a zero balance in the Allowance for Doubtful Accounts account. During the year, Your Company provided $120,000 of service on account. The company collected $124,000 cash from account receivable. Bad debts are estimated to be 6% of sales on account. How much bad debts expense will be recognize on the 2019 income statement? $1,800 $7,440 $7,200. $1,560. Question 2 10 pts Your Company accepted credit card receivables in exchange for $50,000 of services provided to customers. The credit card company charges a 3% service charge. This transaction would increase expenses by $1,500. increase cash by $50,000. increase Retained Earnings by $50,000. decrease liabilities by $1,500. increase Accounts Receivable by $48,500. A company sold its bulldozer for $210,000. The bulldozer originally cost $475,000 with accumulated depreciation of $385,000. How much will Your Company recognize on this transaction? A gain of $90,000 A loss of $90,000 A gain of $120,000 A loss of $120,000 D Question 4 10 pts Your Company earned $600,000 of revenue on account and $100,000 of cash sales during the year. It collected $550,000 of its receivables during the year. The beginning balance in the accounts receivable was $80,000 and allowance accounts beginning balance was $2,400. The company estimated that it will be unable to collect $10,000 of its current year's sales on account. What is the net realizable value of the receivables at year end? $130,000 $117,600 $217,600 $120,000 $142,400 D Question 5 10 pts Your Company had sales of $37,000. Returns and allowances were $1,596. The beginning balance for total assets for the period was $14,530. The ending balance was. $16,750 million. What is Your Company's total asset turnover? 2.26 2.11 2.21 o 2.44 2.36 Question 6 10 pts Your Corporation lent $21,000 to the West Co. on June 1, 2019. The repayment of the loan and the interest is due on June 1, 2020. The interest rate is 8%. How much interest would you record accrue in the 2019 financials? $1,680 $ 840 $ 980 $ 700 $ 840 j C Your Corporation acquired real estate that contained land, building and equipment. The property cost $925,000. An appraisal of the property reported the following values: Land, $185,000; Building, $525,000 and Equipment, $350,000. What value will be recorded for the equipment? $350,000 $458,137 $305,424 o $161,439 $301.780 Question 8 10 pts Your Corporation, a calendar-year company, acquired a new machine on January one, Year one The cost of the machine is $750,000, and the machine has an estimated useful life of 10 years (or 800,000 units of product). The machine has an expected salvage value of $60,000. The machine produced 75,000 units of product in Year one. What is depreciation expense using the double-declining balance method, for year one? $138,000 $ 69,000 $ 75,000 $150,000 Question 9 10 pts On May 15, a customer's account balance of $3,750 was deemed to be uncollectible. What entry should be recorded on September 1 to record the write-off assuming the company uses the allowance method? Allowance for doubtful accounts Accounts Receivable 3,750 3,750 Allowance for doubtful accounts Bad debt expense 3.750 3,750 O Accounts Receivable Allowance for doubtful accounts 3,750 3,750 Bad debt expense Allowance for doubtful accounts 3,750 3.750 Bad debt expense Accounts Receivable 3,750 3,750 Question 10 10 pts Your Company acquired a mineral deposit at a cost of $5,950,000 on January 1 of Voar na itinurror ariditinnal cocte of tonnnnn tarrace tha donncit which Your Company acquired a mineral deposit at a cost of $5,950,000 on January 1 of Year one. It incurred additional costs of $600,000 to access the deposit, which is estimated to contain 2,000,000 tons and is expected to take 5 years to extract. Salvage value will be $50,000. What is the depletion expense for the first year? In the first year, 418,000 tons were mined. $1,243,550. $1,368,950 O $1,950,000. $1,358,500. Question 11 10 pts Your Company purchased equipment on January 1 for $75,000. The machines are estimated to have a 6-year life and a salvage value of $15,000. The company uses the straight-line depreciation method. At the beginning Year 3, Your Company spent $18,000 on a major overhaul and increased the expected life by three years. Salvage value became $5,000. What is the annual amount of depreciation expense for each of the remaining years? Round to match my answer if necessary. O $11,333 O $ 8,286 O $ 9.714 $ 9,286 $12,571