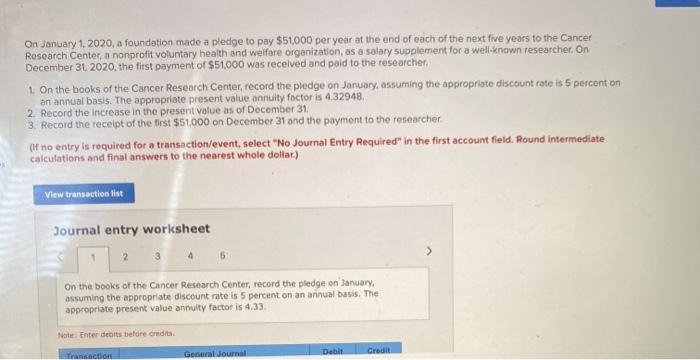

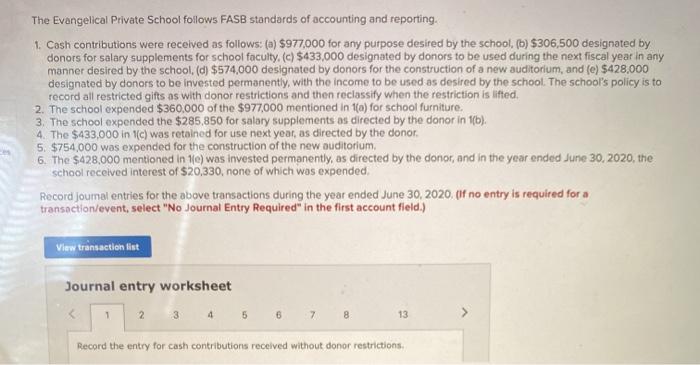

On January 1, 2020, a foundation made a pledge to pay $51,000 per year at the end of each of the next five years to the Cancer Research Center, a nonprofit voluntary health and welfare organization, as a salary supplement for a well-known researcher On December 31, 2020, the first payment of $51000 was received and paid to the researcher 1. On the books of the Cancer Research Center, record the pledge on January, assuming the appropriate discount rate is 5 percent on an annual basis. The appropriate present value annuity foctor is 432948 2. Record the increase in the present value as of December 31, 3. Record the receipt of the first $51,000 on December 31 and the payment to the researcher (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar.) View transaction list Journal entry worksheet On the books of the Cancer Research Center, record the pledge on January assuming the appropriate discount rate is 5 percent on an annual basis. The appropriate present value annuity factor is 4.33 Note: Enter debits before credit Deble Credit Transaction General Journal The Evangelical Private School follows FASB standards of accounting and reporting. 1. Cash contributions were received as follows: (a) $977,000 for any purpose desired by the school. (b) $306,500 designated by donors for salary supplements for school faculty. (c)$433,000 designated by donors to be used during the next fiscal year in any manner desired by the school. (d) $574,000 designated by donors for the construction of a new auditorium, and (e) $428.000 designated by donors to be invested permanently, with the income to be used as desired by the school. The school's policy is to record all restricted gifts as with donor restrictions and then reclassify when the restriction is lifted, 2. The school expended $360,000 of the $977,000 mentioned in 1(a) for school furniture. 3. The school expended the $285,850 for salary supplements as directed by the donor in 1b). 4. The $433,000 in 1(c) was retained for use next year, as directed by the donor 5. $754,000 was expended for the construction of the new auditorium 6. The $428.000 mentioned in 1e) was invested permanently, as directed by the donor, and in the year ended June 30, 2020, the school received interest of $20,330, none of which was expended Recordjoumal entries for the above transactions during the year ended June 30, 2020. Of no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 1 4 5 6 7 8 13 Record the entry for cash contributions received without donor restrictions