Answered step by step

Verified Expert Solution

Question

1 Approved Answer

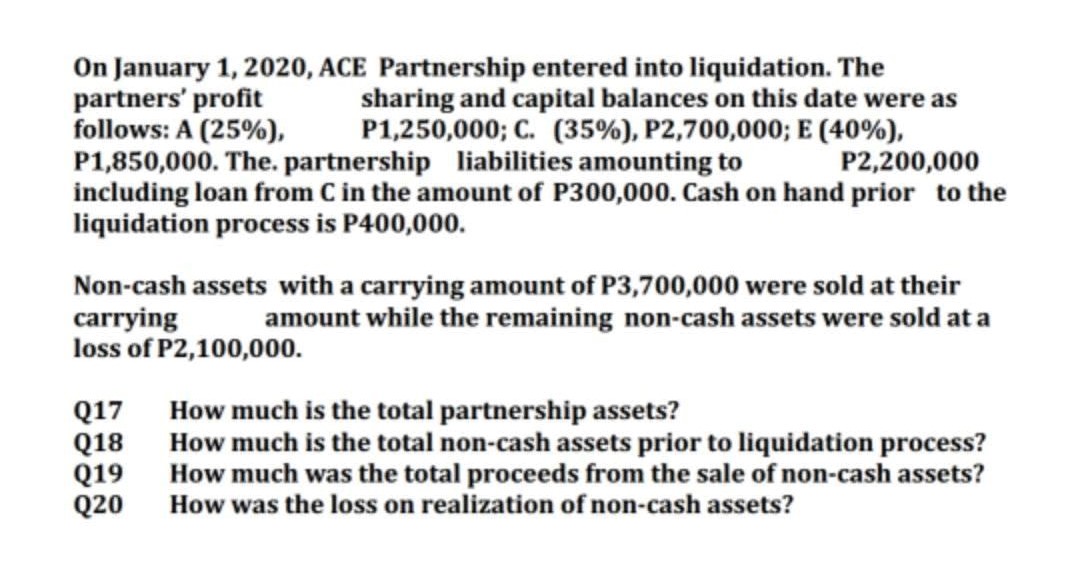

On January 1, 2020, ACE Partnership entered into liquidation. The partners' profit sharing and capital balances on this date were as P1,250,000; C. (35%),

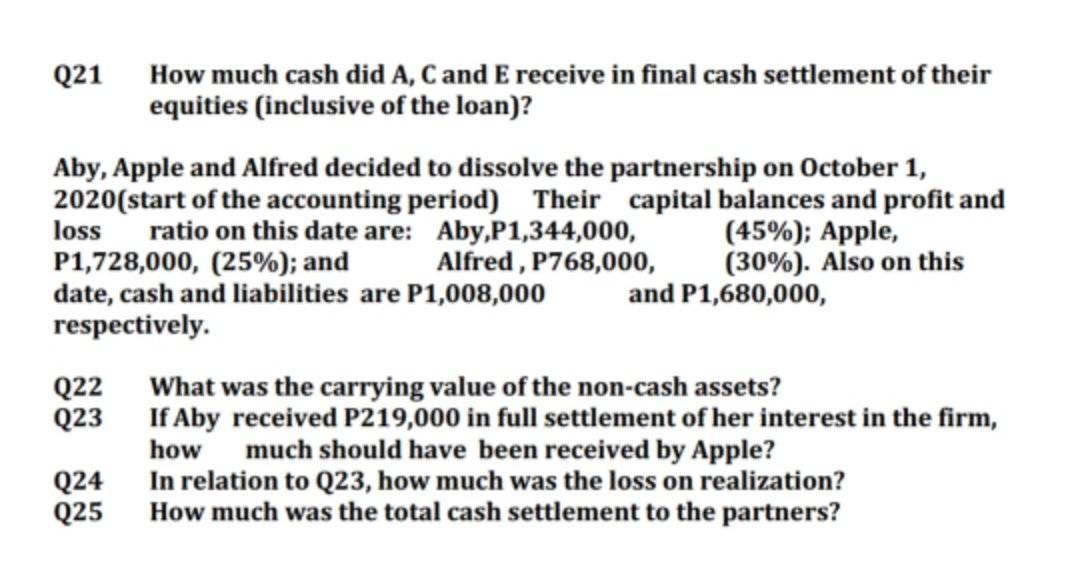

On January 1, 2020, ACE Partnership entered into liquidation. The partners' profit sharing and capital balances on this date were as P1,250,000; C. (35%), P2,700,000; E (40%), follows: A (25%), P1,850,000. The. partnership liabilities amounting to P2,200,000 including loan from C in the amount of P300,000. Cash on hand prior to the liquidation process is P400,000. Non-cash assets with a carrying amount of P3,700,000 were sold at their carrying amount while the remaining non-cash assets were sold at a loss of P2,100,000. Q17 How much is the total partnership assets? Q18 Q19 Q20 How much is the total non-cash assets prior to liquidation process? How much was the total proceeds from the sale of non-cash assets? How was the loss on realization of non-cash assets? Q21 How much cash did A, C and E receive in final cash settlement of their equities (inclusive of the loan)? Aby, Apple and Alfred decided to dissolve the partnership on October 1, 2020(start of the accounting period) Their capital balances and profit and loss ratio on this date are: Aby,P1,344,000, P1,728,000, (25%); and Alfred, P768,000, (45%); Apple, (30%). Also on this and P1,680,000, date, cash and liabilities are P1,008,000 respectively. Q22 Q23 Q24 Q25 What was the carrying value of the non-cash assets? If Aby received P219,000 in full settlement of her interest in the firm, how much should have been received by Apple? In relation to Q23, how much was the loss on realization? How much was the total cash settlement to the partners?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q17 To calculate the total partnership assets we need to add the cash on hand to the total noncash a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started