Answered step by step

Verified Expert Solution

Question

1 Approved Answer

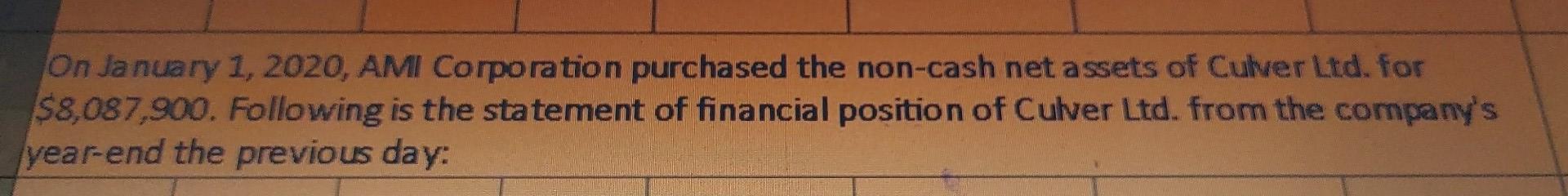

On January 1, 2020, AMI Corporation purchased the non-cash net assets of Culver Ltd. for $8,087,900. Following is the statement of financial position of Culver

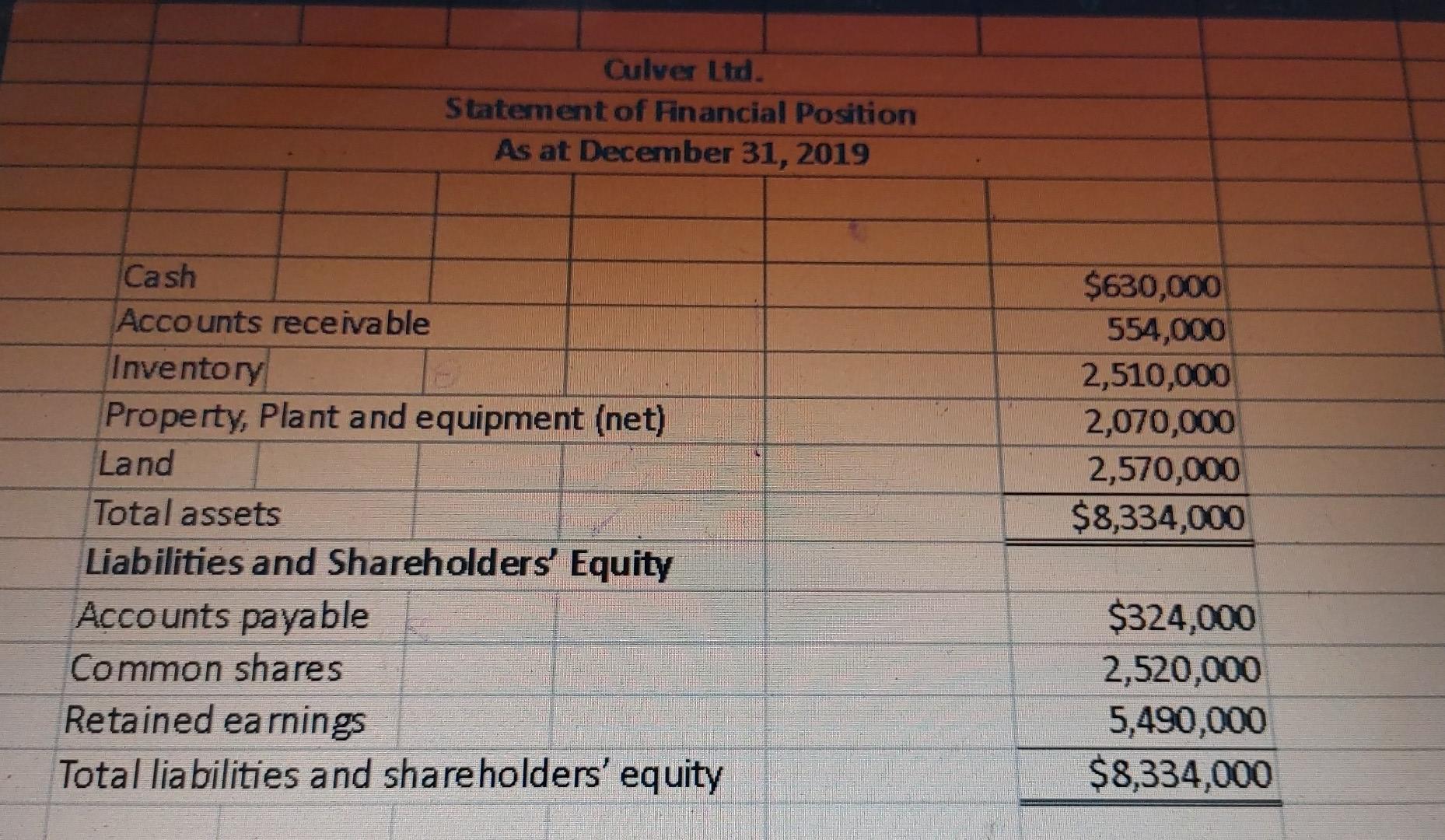

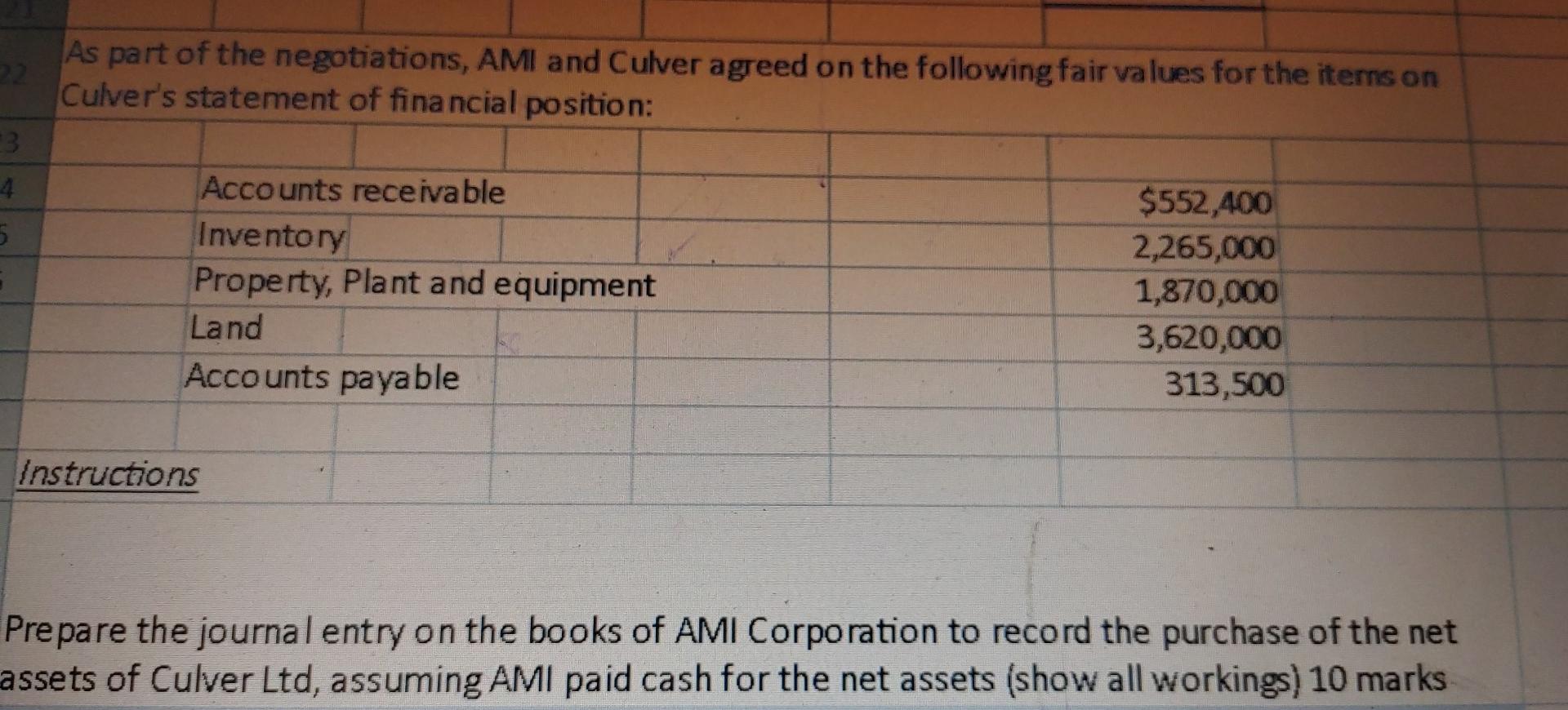

On January 1, 2020, AMI Corporation purchased the non-cash net assets of Culver Ltd. for $8,087,900. Following is the statement of financial position of Culver Ltd. from the company's year-end the previous day: Culver Ltd. Statement of Financial Position As at December 31, 2019 Cash Accounts receivable Inventory Property, Plant and equipment (net) Land Total assets Liabilities and Shareholders' Equity Accounts payable Common shares Retained earnings Total liabilities and shareholders' equity $630,000 554,000 2,510,000 2,070,000 2,570,000 $8,334,000 $324,000 2,520,000 5,490,000 $8,334,000 22 As part of the negotiations, AMI and Culver agreed on the following fair values for the items on Culver's statement of financial position: 3. 4. 5 Accounts receivable Inventory Property, Plant and equipment Land Accounts payable $552,400 2,265,000 1,870,000 3,620,000 313,500 Instructions Prepare the journal entry on the books of AMI Corporation to record the purchase of the net assets of Culver Ltd, assuming AMI paid cash for the net assets (show all workings) 10 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started