Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020 Apple purchased 10% of the outstanding common stock of Target Co. for $200,000. The total fair value of Target Co.

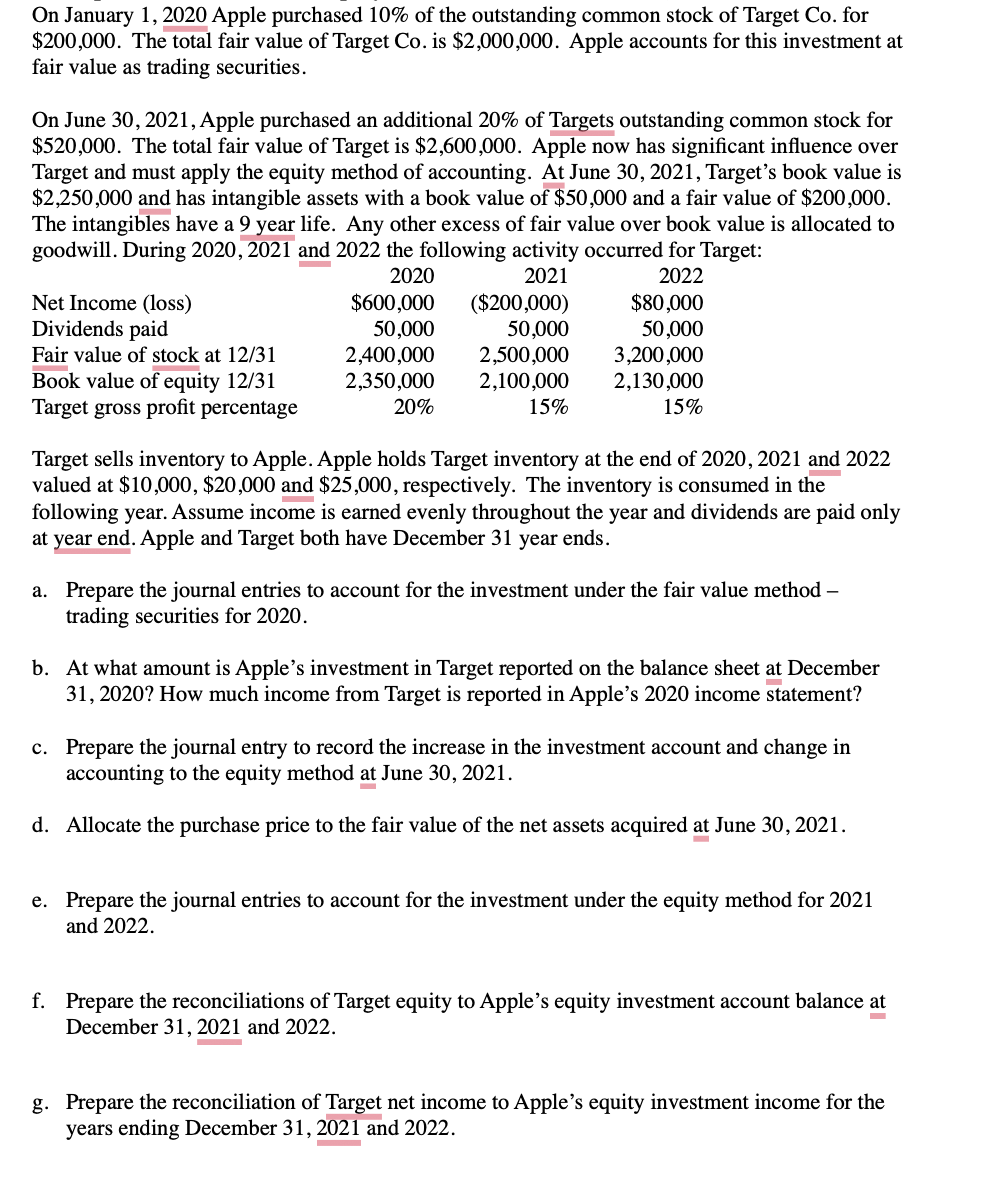

On January 1, 2020 Apple purchased 10% of the outstanding common stock of Target Co. for $200,000. The total fair value of Target Co. is $2,000,000. Apple accounts for this investment at fair value as trading securities. On June 30, 2021, Apple purchased an additional 20% of Targets outstanding common stock for $520,000. The total fair value of Target is $2,600,000. Apple now has significant influence over Target and must apply the equity method of accounting. At June 30, 2021, Target's book value is $2,250,000 and has intangible assets with a book value of $50,000 and a fair value of $200,000. The intangibles have a 9 year life. Any other excess of fair value over book value is allocated to goodwill. During 2020, 2021 and 2022 the following activity occurred for Target: 2020 2021 Net Income (loss) $600,000 ($200,000) 2022 $80,000 Dividends paid 50,000 Fair value of stock at 12/31 2,400,000 50,000 2,500,000 50,000 3,200,000 Book value of equity 12/31 2,350,000 2,100,000 2,130,000 Target gross profit percentage 20% 15% 15% Target sells inventory to Apple. Apple holds Target inventory at the end of 2020, 2021 and 2022 valued at $10,000, $20,000 and $25,000, respectively. The inventory is consumed in the following year. Assume income is earned evenly throughout the year and dividends are paid only at year end. Apple and Target both have December 31 year ends. a. Prepare the journal entries to account for the investment under the fair value method - trading securities for 2020. b. At what amount is Apple's investment in Target reported on the balance sheet at December 31, 2020? How much income from Target is reported in Apple's 2020 income statement? c. Prepare the journal entry to record the increase in the investment account and change in accounting to the equity method at June 30, 2021. d. Allocate the purchase price to the fair value of the net assets acquired at June 30, 2021. e. Prepare the journal entries to account for the investment under the equity method for 2021 and 2022. f. Prepare the reconciliations of Target equity to Apple's equity investment account balance at December 31, 2021 and 2022. - g. Prepare the reconciliation of Target net income to Apple's equity investment income for the years ending December 31, 2021 and 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started