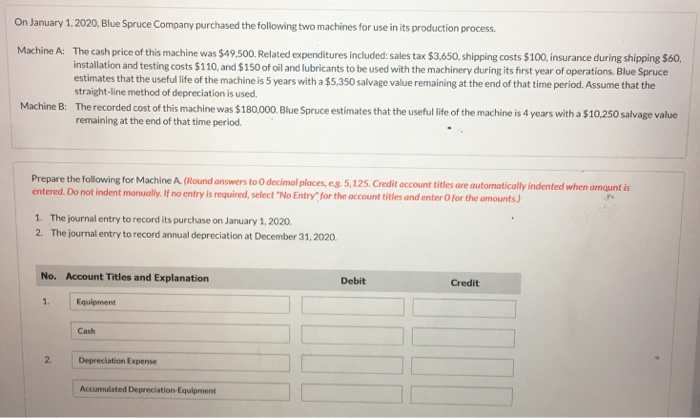

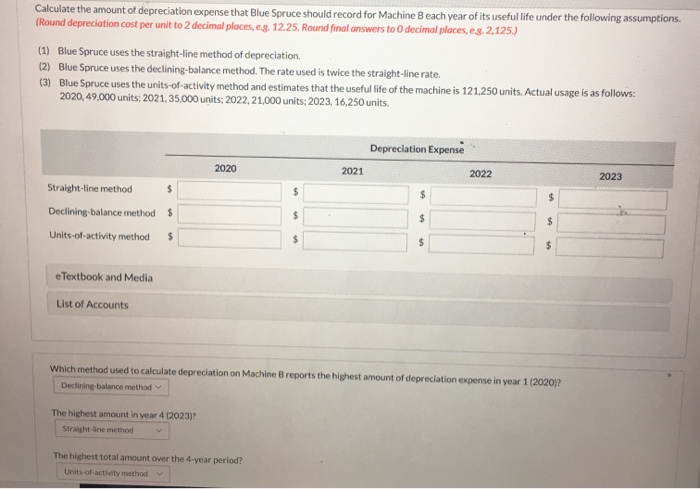

On January 1, 2020. Blue Spruce Company purchased the following two machines for use in its production process. Machine A: The cash price of this machine was $49.500. Related expenditures included: sales tax $3,650, shipping costs $100, insurance during shipping $60, installation and testing costs $110, and $150 of oil and lubricants to be used with the machinery during its first year of operations. Blue Spruce estimates that the useful life of the machine is 5 years with a $5,350 salvage value remaining at the end of that time period. Assume that the straight-line method of depreciation is used. Machine B: The recorded cost of this machine was $180,000. Blue Spruce estimates that the useful life of the machine is 4 years with a $10,250 salvage value remaining at the end of that time period. Prepare the following for Machine A (Round answers to decimal places, s. 5,125. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) 1. The journal entry to record its purchase on January 1, 2020 2. The journal entry to record annual depreciation at December 31, 2020 No. Account Titles and Explanation Debit Credit Equipment Cach Depreciation Expense Accumulated Depreciation Equipment Calculate the amount of depreciation expense that Blue Spruce should record for Machine Beach year of its useful life under the following assumptions. (Round depreciation cost per unit to 2 decimal places, eg 12.25. Round final answers to decimal places, es 2,125) (1) Blue Spruce uses the straight-line method of depreciation. (2) Blue Spruce uses the declining balance method. The rate used is twice the straight-line rate. (3) Blue Spruce uses the units-of-activity method and estimates that the useful life of the machine is 121.250 units. Actual usage is as follows: 2020,49,000 units: 2021, 35,000 units: 2022,21,000 units: 2023,16,250 units. Depreciation Expense 2020 2021 2022 2023 Straight-line method Declining balance method $ Units-of-activity method $ e Textbook and Media List of Accounts Which method used to calculate depreciation on Machine Breports the highest amount of depreciation expense in year 1 (202017 Declining balance method The highest amount in year 4 (2023)? Straight line method The highest total amount over the 4-year period? Units of activity method