Answered step by step

Verified Expert Solution

Question

1 Approved Answer

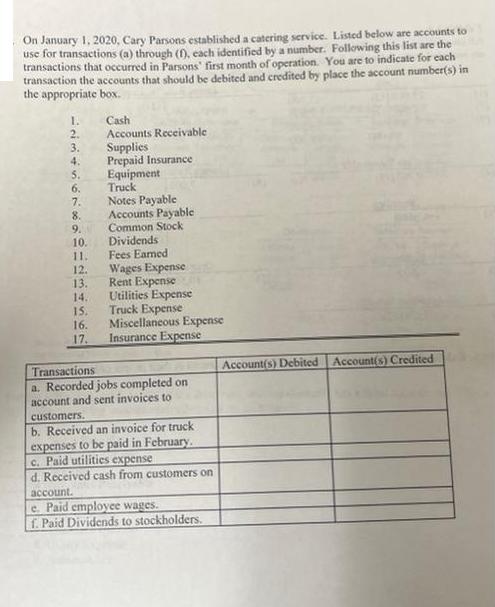

On January 1, 2020, Cary Parsons established a catering service. Listed below are accounts to use for transactions (a) through (f), each identified by

On January 1, 2020, Cary Parsons established a catering service. Listed below are accounts to use for transactions (a) through (f), each identified by a number. Following this list are the transactions that occurred in Parsons' first month of operation. You are to indicate for each transaction the accounts that should be debited and credited by place the account number(s) in the appropriate box. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Truck Notes Payable Accounts Payable Common Stock Dividends Fees Earned Wages Expense Rent Expense Utilities Expense Truck Expense Miscellaneous Expense Insurance Expense Transactions a. Recorded jobs completed on account and sent invoices to customers. b. Received an invoice for truck expenses to be paid in February. c. Paid utilities expense d. Received cash from customers on account. e. Paid employee wages. f. Paid Dividends to stockholders. Account(s) Debited Account(s) Credited

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started