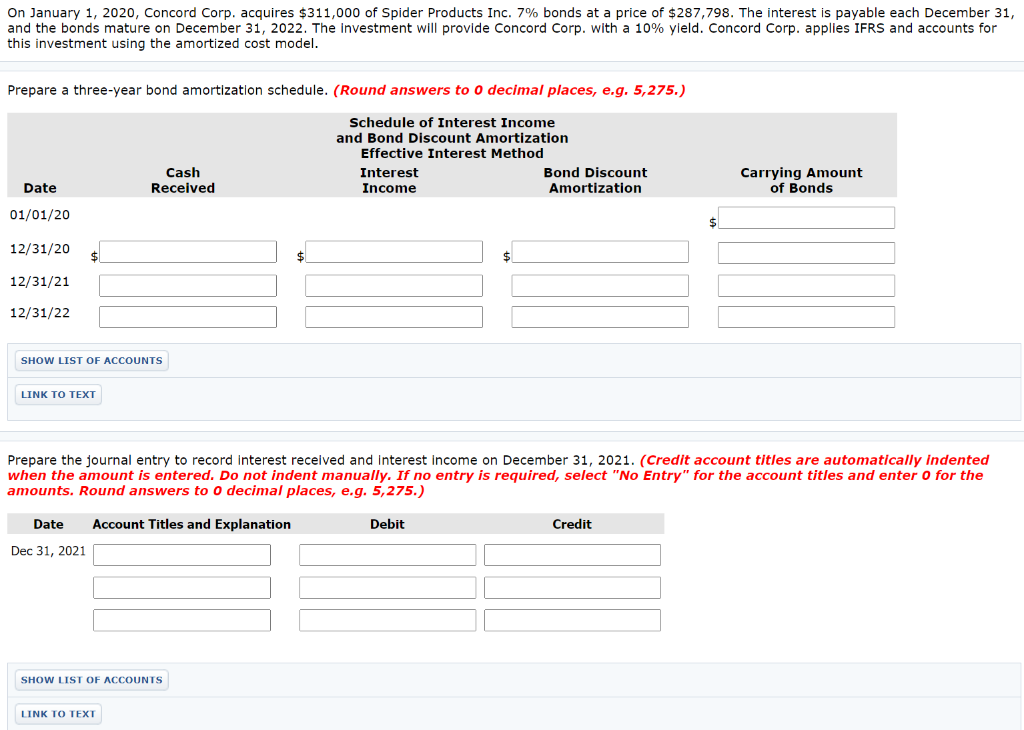

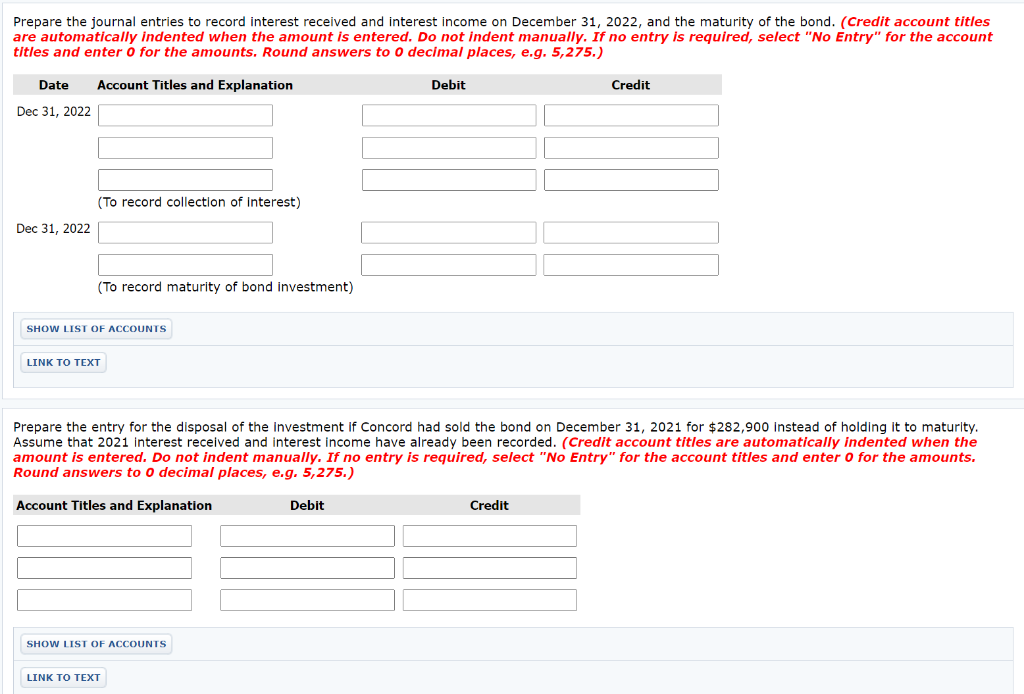

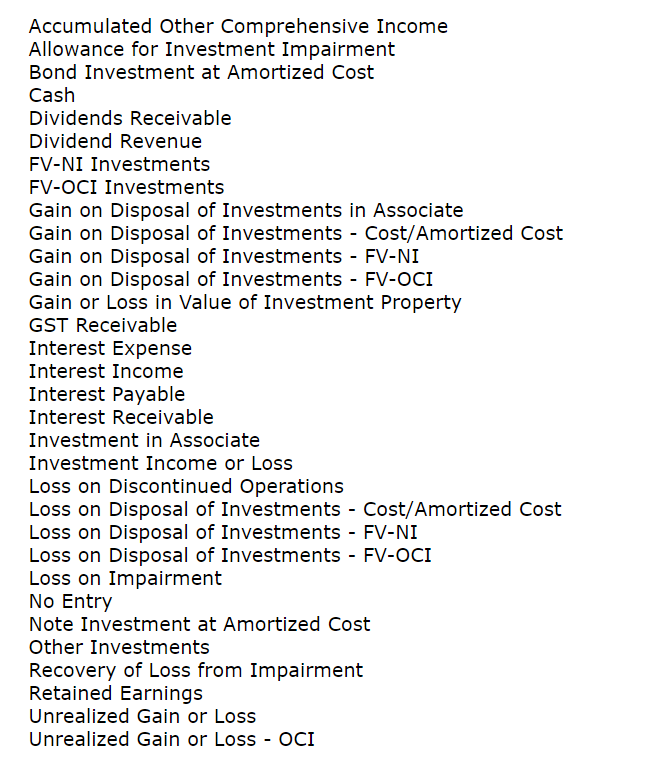

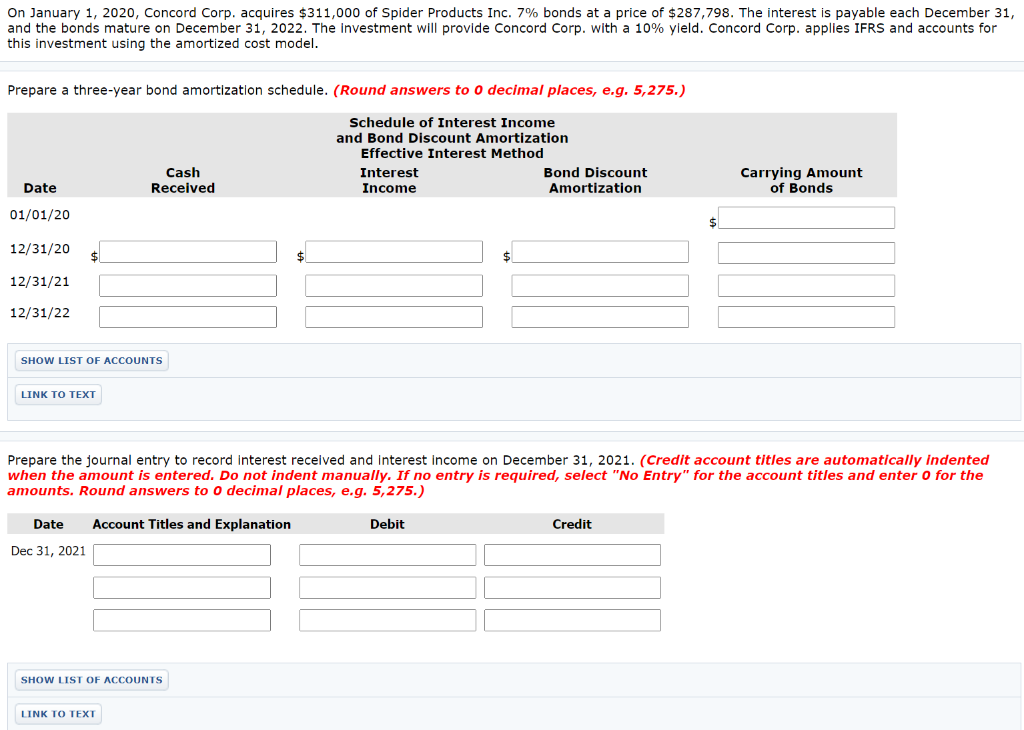

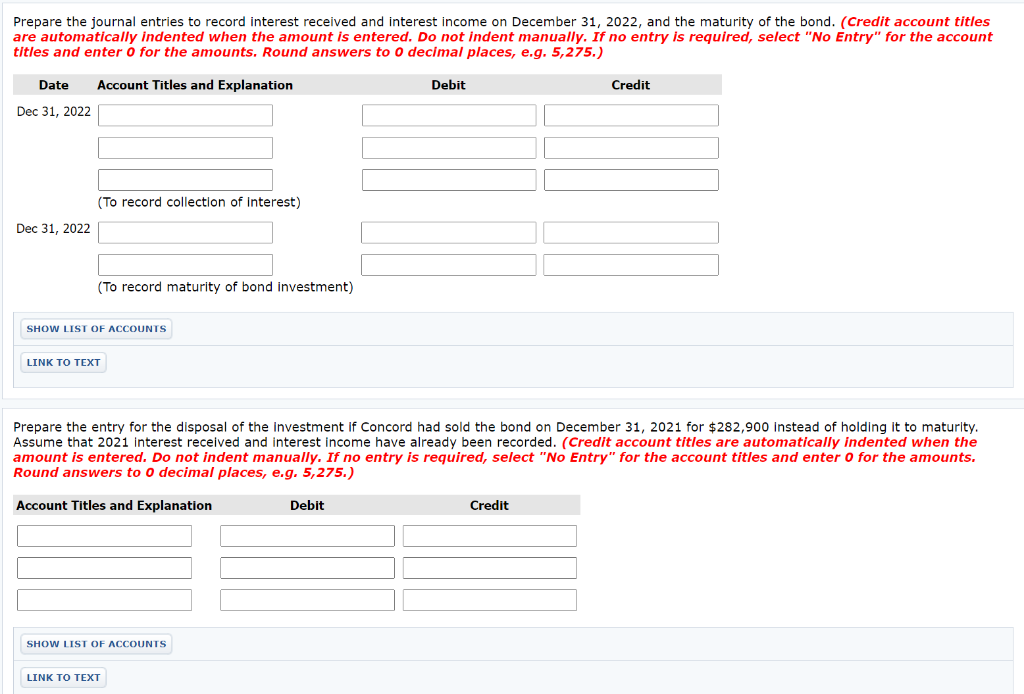

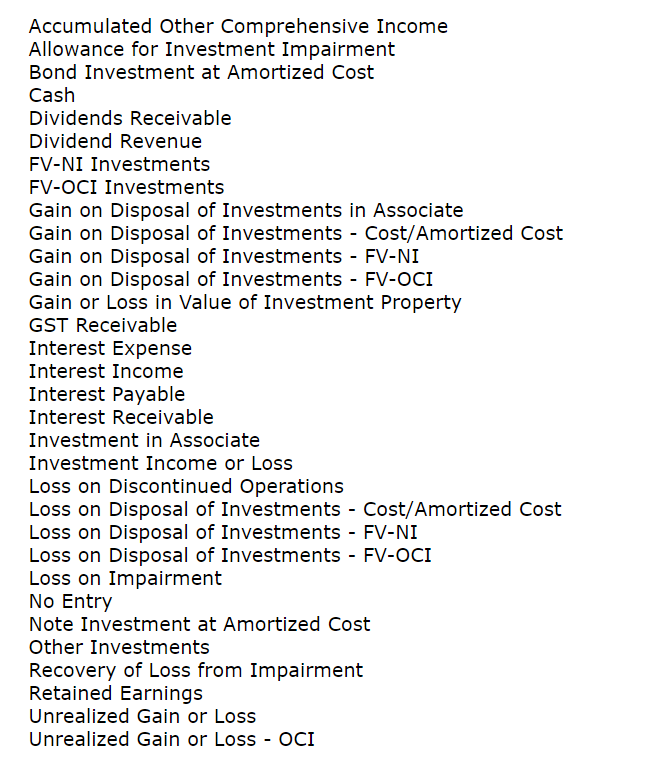

On January 1, 2020, Concord Corp. acquires $311,000 of Spider Products Inc. 7% bonds at a price of $287,798. The interest is payable each December 31, and the bonds mature on December 31, 2022. The investment will provide Concord Corp. with a 10% yield. Concord Corp. applies IFRS and accounts for this investment using the amortized cost model. Prepare a three-year bond amortization schedule. (Round answers o decimal places, e.g. 5,275.) Schedule of Interest Income and Bond Discount Amortization Effective Interest Method Interest Bond Discount Income Amortization Cash Received Carrying Amount of Bonds Date 01/01/20 $ 12/31/20 $ 12/31/21 12/31/22 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the journal entry to record interest received and interest income on December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to o decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Dec 31, 2021 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the journal entries to record interest received and interest income on December 31, 2022, and the maturity of the bond. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to O decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Dec 31, 2022 (To record collection of Interest) Dec 31, 2022 (To record maturity of bond investment) SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the entry for the disposal of the investment if Concord had sold the bond on December 31, 2021 for $282,900 instead of holding it to maturity. Assume that 2021 interest received and interest income have already been recorded. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to o decimal places, e.g. 5,275.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Dividends Receivable Dividend Revenue FV-NI Investments FV-OCI Investments Gain on Disposal of Investments in Associate Gain on Disposal of Investments - Cost/Amortized Cost Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain or Loss in Value of Investment Property GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments - Cost/Amortized Cost Loss on Disposal of Investments - FV-NI Loss on Disposal of Investments - FV-OCI Loss on Impairment No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss - OCI