Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Crane Ltd. acquires a building at a cost of $290,000. The building is expected to have a 20-year life and

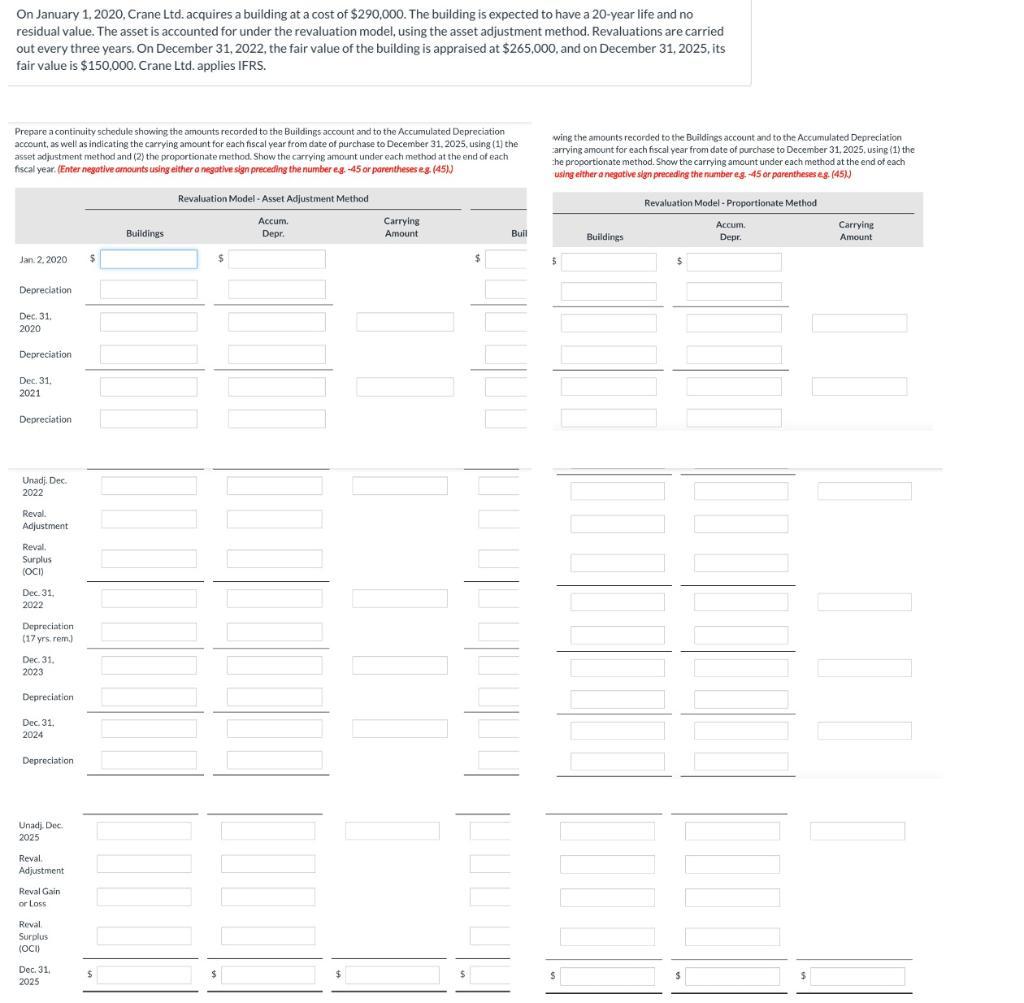

On January 1, 2020, Crane Ltd. acquires a building at a cost of $290,000. The building is expected to have a 20-year life and no residual value. The asset is accounted for under the revaluation model, using the asset adjustment method. Revaluations are carried out every three years. On December 31, 2022, the fair value of the building is appraised at $265,000, and on December 31, 2025, its fair value is $150,000. Crane Ltd. applies IFRS. Prepare a continuity schedule showing the amounts recorded to the Buildings account and to the Accumulated Depreciation account, as well as indicating the carrying amount for each fiscal year from date of purchase to December 31, 2025, using (1) the asset adjustment method and (2) the proportionate method. Show the carrying amount under each method at the end of each fiscal year. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses eg. (45)) Jan 2, 2020 Depreciation Dec. 31. 2020 Depreciation Dec. 31. 2021 Depreciation Unadj. Dec. 2022 Reval. Adjustment Reval. Surplus (OCI) Dec. 31, 2022 Depreciation (17 yrs, rem) Dec. 31. 2023 Depreciation Dec. 31. 2024 Depreciation Unadj. Dec. 2025 Reval. Adjustment Reval Gain or Loss Reval Surplus (OCI) Dec. 31, 2025 $ $ Buildings Revaluation Model - Asset Adjustment Method Accum. Depr. $ $ Carrying Amount Buil wing the amounts recorded to the Buildings account and to the Accumulated Depreciation carrying amount for each fiscal year from date of purchase to December 31, 2025, using (1) the the proportionate method. Show the carrying amount under each method at the end of each using either a negative sign preceding the number eg.-45 or parentheses eg. (45)) $ S Buildings Revaluation Model-Proportionate Method Accum. Depr. $ S $ Carrying Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal entries To record depreciation expense Date Accounts Title Ref Debit Credit Dec 312020 Depreciation expense 14500 Accumulated depreciation 145...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started