Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Devour & Engulf Co. paid $1,657,500 for the mineral rights to an oil shale deposit for the next 10 years.

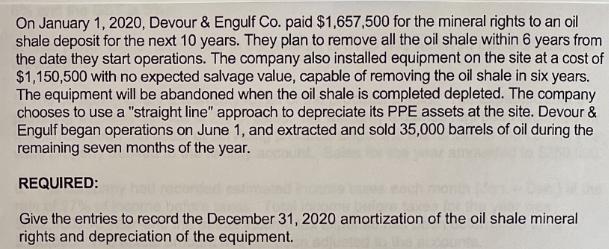

On January 1, 2020, Devour & Engulf Co. paid $1,657,500 for the mineral rights to an oil shale deposit for the next 10 years. They plan to remove all the oil shale within 6 years from the date they start operations. The company also installed equipment on the site at a cost of $1,150,500 with no expected salvage value, capable of removing the oil shale in six years. The equipment will be abandoned when the oil shale is completed depleted. The company chooses to use a "straight line" approach to depreciate its PPE assets at the site. Devour & Engulf began operations on June 1, and extracted and sold 35,000 barrels of oil during the remaining seven months of the year. REQUIRED: Give the entries to record the December 31, 2020 amortization of the oil shale mineral rights and depreciation of the equipment.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To record the December 31 2020 amortization of the oil shale mineral rights and depreciation of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started