Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A floating rate mortgage loan is made for $145,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower

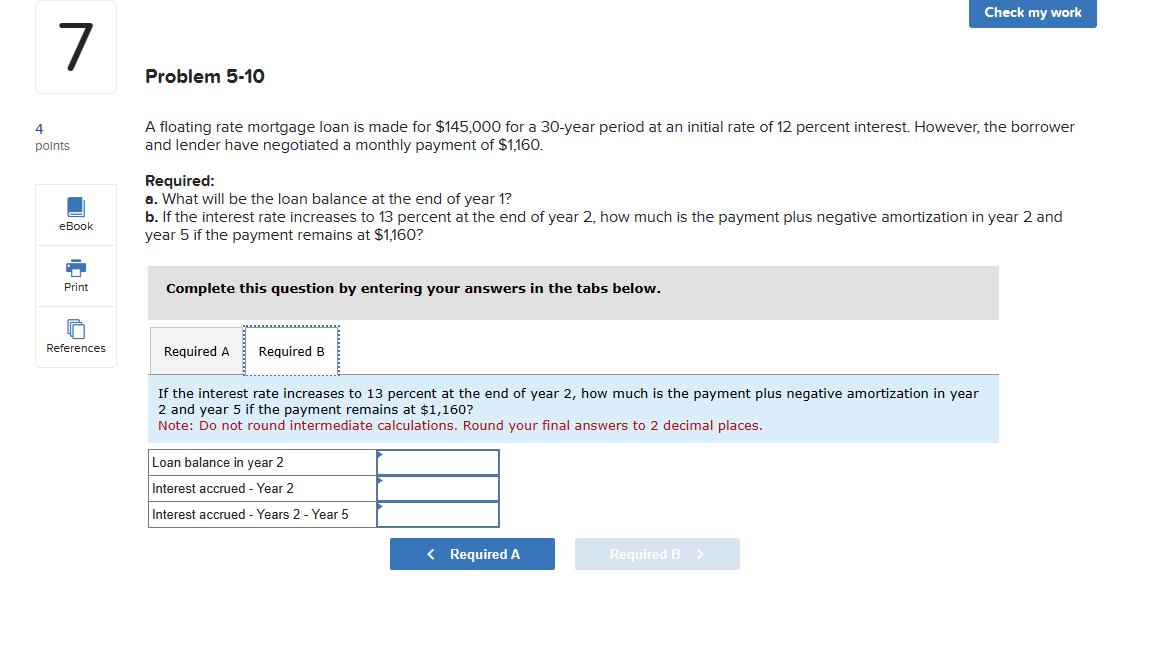

A floating rate mortgage loan is made for $145,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of $1,160. Required: a. What will be the loan balance at the end of year 1? b. If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,160? Complete this question by entering your answers in the tabs below. Required A Required B What will be the loan balance at the end of year 1? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Loan balance Required A Required B > 7 4 points eBook Print References Problem 5-10 A floating rate mortgage loan is made for $145,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of $1,160. Required: a. What will be the loan balance at the end of year 1? b. If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,160? Complete this question by entering your answers in the tabs below. Required A Required B If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,160? Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Loan in year 2 Interest accrued - Year 2 Interest accrued - Years 2 - Year 5 Check my work < Required A Required B >

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To find the loan balance at the end of year 1 we can use the formula for the present value of an annuity P A x 1 11rn r where P is the pres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started