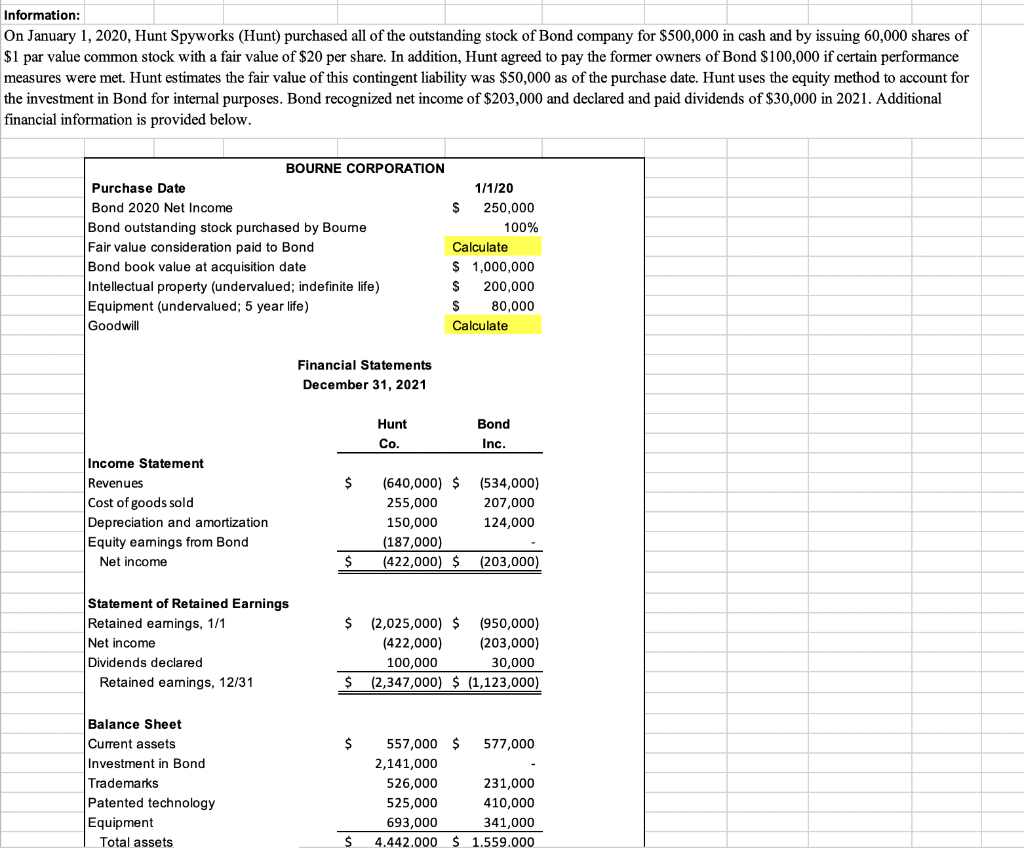

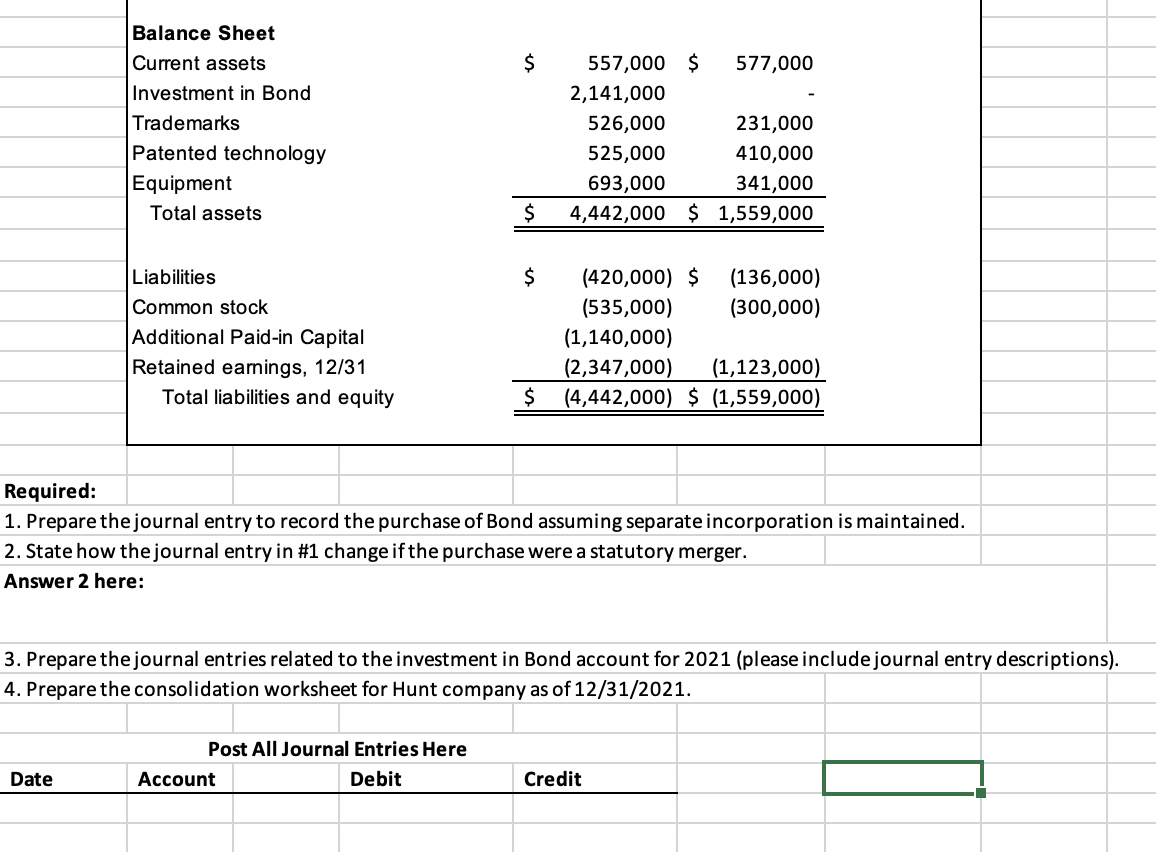

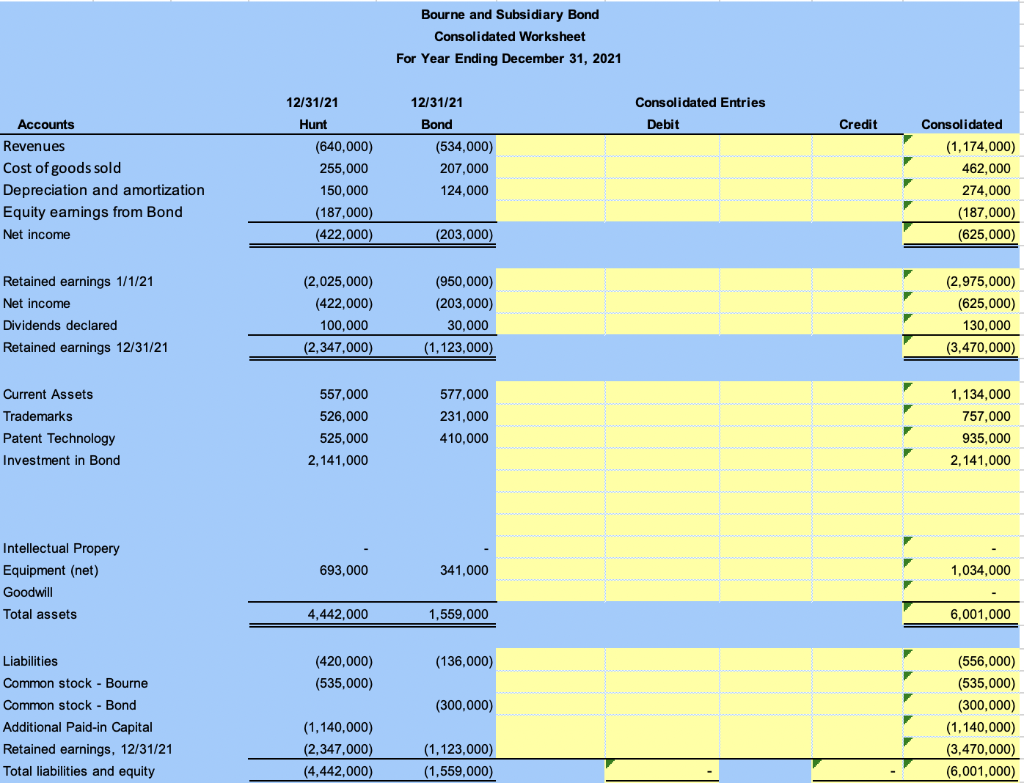

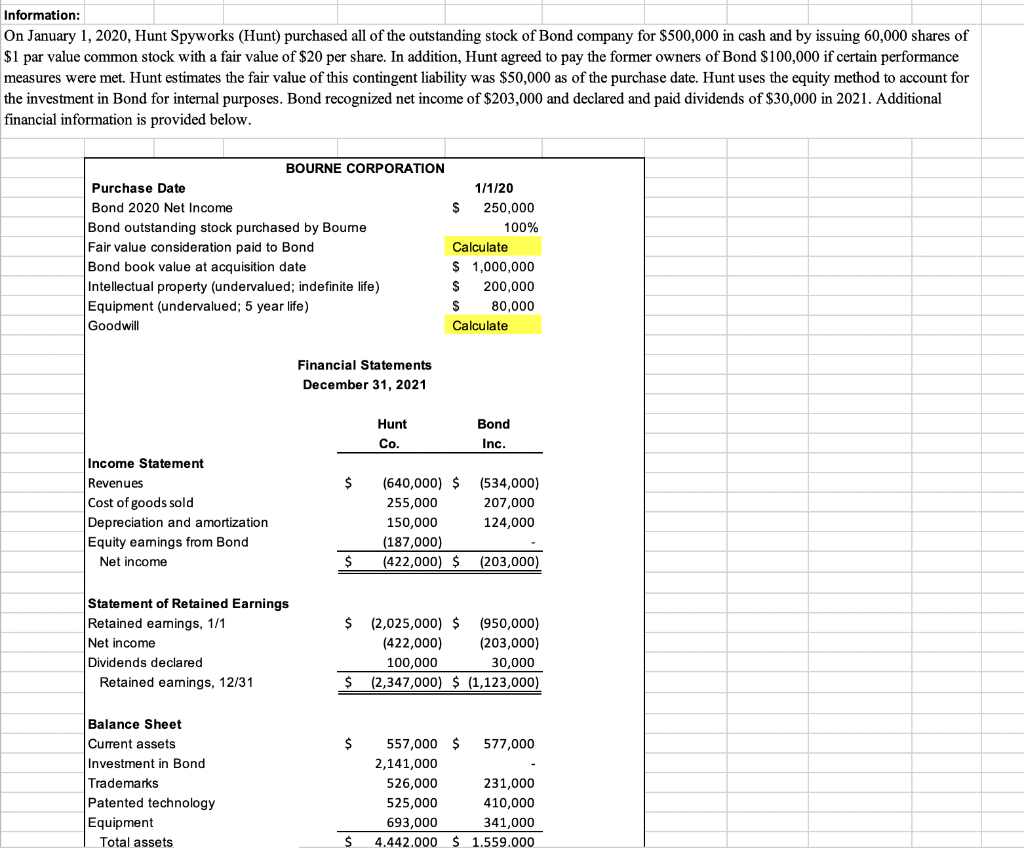

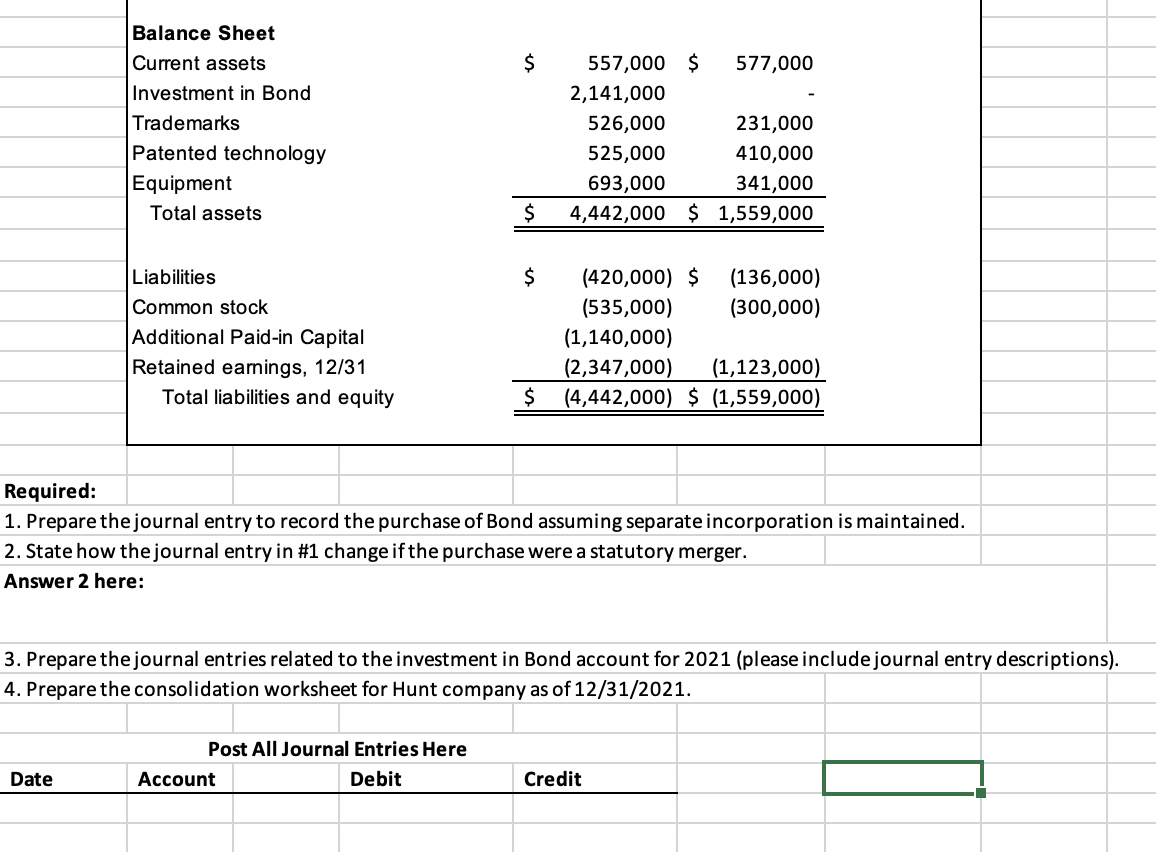

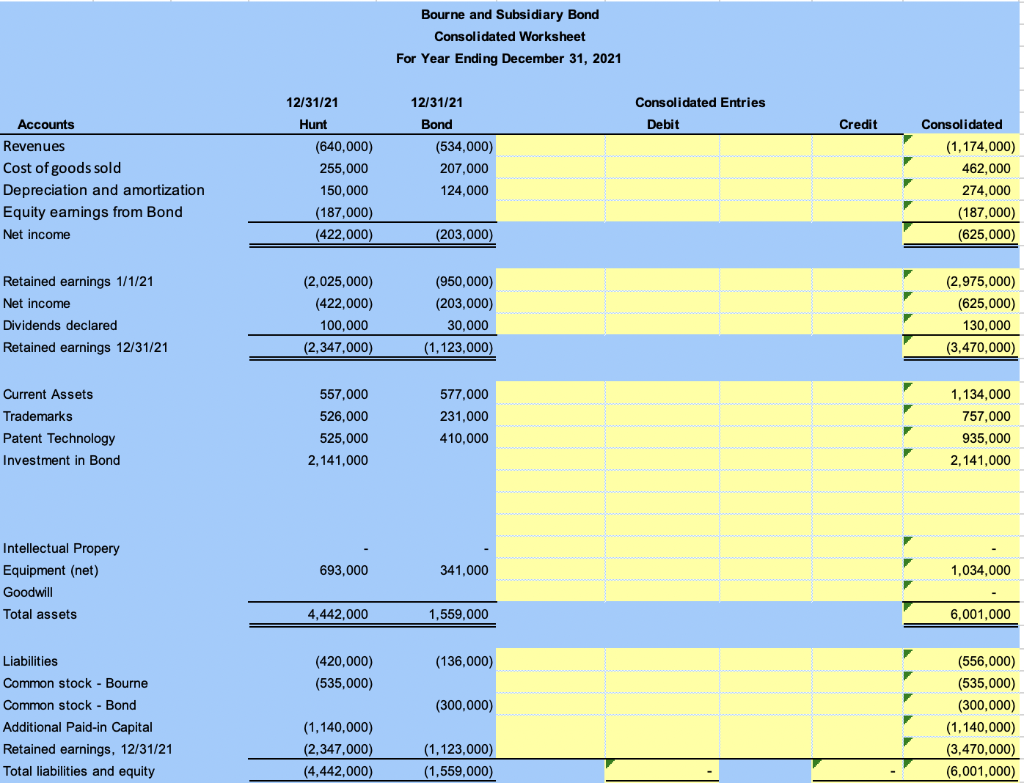

On January 1, 2020, Hunt Spyworks (Hunt) purchased all of the outstanding stock of Bond company for $500,000 in cash and by issuing 60,000 shares of 11 par value common stock with a fair value of $20 per share. In addition, Hunt agreed to pay the former owners of Bond $100,000 if certain performance neasures were met. Hunt estimates the fair value of this contingent liability was $50,000 as of the purchase date. Hunt uses the equity method to account for he investment in Bond for internal purposes. Bond recognized net income of $203,000 and declared and paid dividends of $30,000 in 2021 . Additional Balance Sheet \begin{tabular}{lrrrr} Current assets & $ & 557,000 & $577,000 \\ Investment in Bond & & 2,141,000 & & \\ Trademarks & & 526,000 & 231,000 \\ Patented technology & 525,000 & 410,000 \\ Equipment & & 693,000 & 341,000 \\ \hline Total assets & $4,442,000 & $1,559,000 \\ \cline { 4 - 5 } \end{tabular} Required: 1. Prepare the journal entry to record the purchase of Bond assuming separate incorporation is maintained. 2. State how the journal entry in \#1 change if the purchase were a statutory merger. Answer 2 here: 3. Prepare the journal entries related to the investment in Bond account for 2021 (please include journal entry descriptions). 4. Prepare the consolidation worksheet for Hunt company as of 12/31/2021. Post All Journal Entries Here \begin{tabular}{l|l|l|l|} Date & Account & Debit & Credit \\ \hline \end{tabular} Bourne and Subsidiary Bond On January 1, 2020, Hunt Spyworks (Hunt) purchased all of the outstanding stock of Bond company for $500,000 in cash and by issuing 60,000 shares of 11 par value common stock with a fair value of $20 per share. In addition, Hunt agreed to pay the former owners of Bond $100,000 if certain performance neasures were met. Hunt estimates the fair value of this contingent liability was $50,000 as of the purchase date. Hunt uses the equity method to account for he investment in Bond for internal purposes. Bond recognized net income of $203,000 and declared and paid dividends of $30,000 in 2021 . Additional Balance Sheet \begin{tabular}{lrrrr} Current assets & $ & 557,000 & $577,000 \\ Investment in Bond & & 2,141,000 & & \\ Trademarks & & 526,000 & 231,000 \\ Patented technology & 525,000 & 410,000 \\ Equipment & & 693,000 & 341,000 \\ \hline Total assets & $4,442,000 & $1,559,000 \\ \cline { 4 - 5 } \end{tabular} Required: 1. Prepare the journal entry to record the purchase of Bond assuming separate incorporation is maintained. 2. State how the journal entry in \#1 change if the purchase were a statutory merger. Answer 2 here: 3. Prepare the journal entries related to the investment in Bond account for 2021 (please include journal entry descriptions). 4. Prepare the consolidation worksheet for Hunt company as of 12/31/2021. Post All Journal Entries Here \begin{tabular}{l|l|l|l|} Date & Account & Debit & Credit \\ \hline \end{tabular} Bourne and Subsidiary Bond