Question

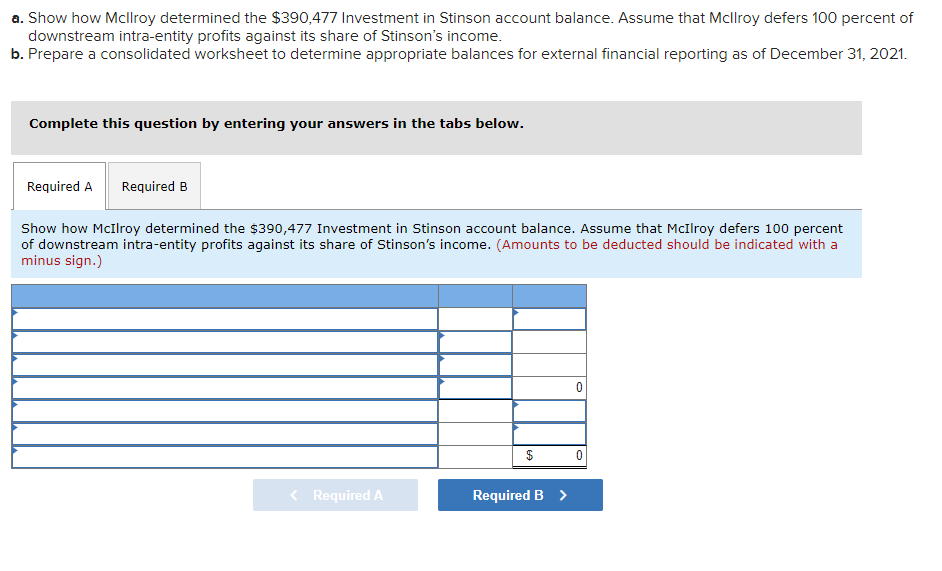

On January 1, 2020, McIlroy, Inc., acquired a 60 percent interest in the common stock of Stinson, Inc., for $334,200. Stinson's book value on that

On January 1, 2020, McIlroy, Inc., acquired a 60 percent interest in the common stock of Stinson, Inc., for $334,200. Stinson's book value on that date consisted of common stock of $100,000 and retained earnings of $197,600. Also, the acquisition-date fair value of the 40 percent noncontrolling interest was $222,800. The subsidiary held patents (with a 10-year remaining life) that were undervalued within the company's accounting records by $75,700 and an unrecorded customer list (15-year remaining life) assessed at a $51,300 fair value. Any remaining excess acquisition-date fair value was assigned to goodwill. Since acquisition, McIlroy has applied the equity method to its Investment in Stinson account and no goodwill impairment has occurred. At year-end, there are no intra-entity payables or receivables.

Intra-entity inventory sales between the two companies have been made as follows:

| Year | Cost to McIlroy | Transfer Price to Stinson | Ending Balance (at transfer price) |

| 2020 | $124,800 | $156,000 | $52,000 |

| 2021 | 112,500 | 150,000 | 37,500 |

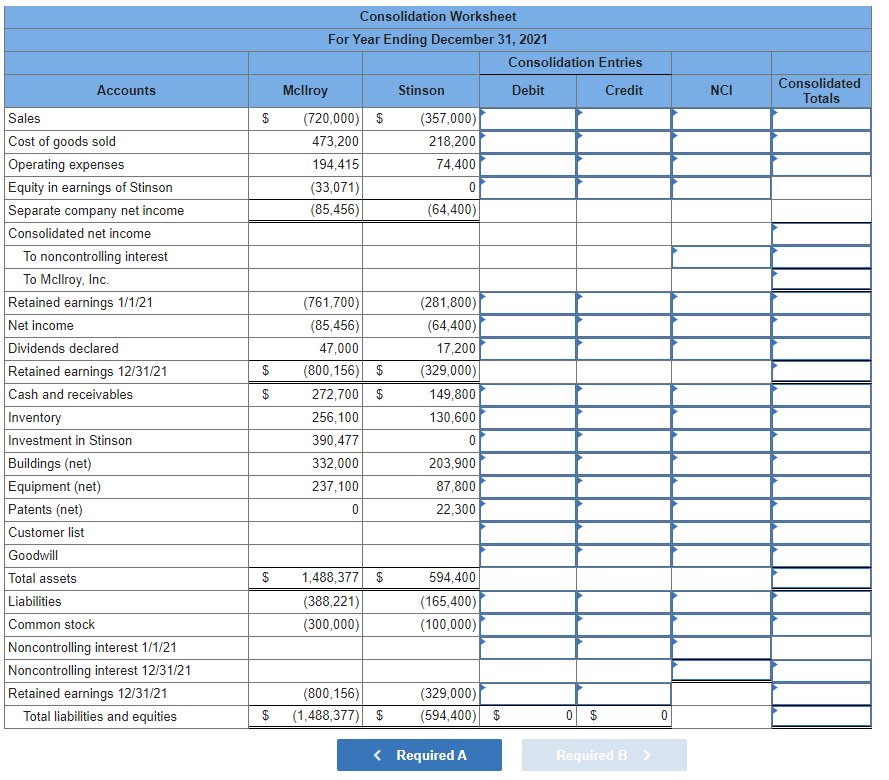

The individual financial statements for these two companies as of December 31, 2021, and the year then ended follow:

| McIlroy, Inc. | Stinson, Inc. | ||||||

| Sales | $ | (720,000 | ) | $ | (357,000 | ) | |

| Cost of goods sold | 473,200 | 218,200 | |||||

| Operating expenses | 194,415 | 74,400 | |||||

| Equity in earnings in Stinson | (33,071 | ) | 0 | ||||

| Net income | $ | (85,456 | ) | $ | (64,400 | ) | |

| Retained earnings, 1/1/21 | $ | (761,700 | ) | $ | (281,800 | ) | |

| Net income | (85,456 | ) | (64,400 | ) | |||

| Dividends declared | 47,000 | 17,200 | |||||

| Retained earnings, 12/31/21 | $ | (800,156 | ) | $ | (329,000 | ) | |

| Cash and receivables | $ | 272,700 | $ | 149,800 | |||

| Inventory | 256,100 | 130,600 | |||||

| Investment in Stinson | 390,477 | 0 | |||||

| Buildings (net) | 332,000 | 203,900 | |||||

| Equipment (net) | 237,100 | 87,800 | |||||

| Patents (net) | 0 | 22,300 | |||||

| Total assets | $ | 1,488,377 | $ | 594,400 | |||

| Liabilities | $ | (388,221 | ) | $ | (165,400 | ) | |

| Common stock | (300,000 | ) | (100,000 | ) | |||

| Retained earnings, 12/31/21 | (800,156 | ) | (329,000 | ) | |||

| Total liabilities and equities | $ | (1,488,377 | ) | $ | (594,400 | ) | |

show work details please. Getting ready for an exam. show work details please. Getting ready for an exam. | |||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started