Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, Natty Company (lessee) entered into a 5 year lease agreement with Fiona Company (as lessor) for machinery which had a

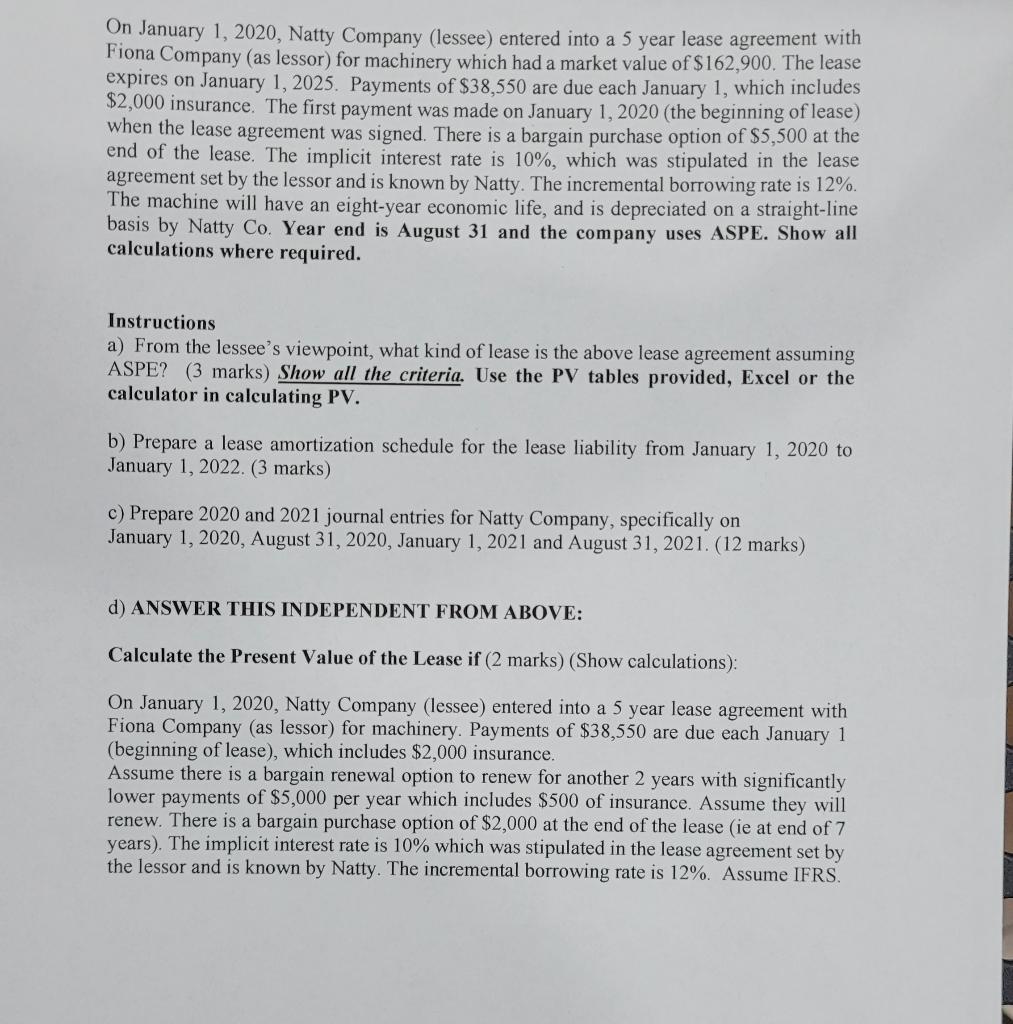

On January 1, 2020, Natty Company (lessee) entered into a 5 year lease agreement with Fiona Company (as lessor) for machinery which had a market value of $162,900. The lease expires on January 1, 2025. Payments of $38,550 are due each January 1, which includes $2,000 insurance. The first payment was made on January 1, 2020 (the beginning of lease) when the lease agreement was signed. There is a bargain purchase option of $5,500 at the end of the lease. The implicit interest rate is 10%, which was stipulated in the lease agreement set by the lessor and is known by Natty. The incremental borrowing rate is 12%. The machine will have an eight-year economic life, and is depreciated on a straight-line basis by Natty Co. Year end is August 31 and the company uses ASPE. Show all calculations where required. Instructions a) From the lessee's viewpoint, what kind of lease is the above lease agreement assuming ASPE? (3 marks) Show all the criteria. Use the PV tables provided, Excel or the calculator in calculating PV. b) Prepare a lease amortization schedule for the lease liability from January 1, 2020 to January 1, 2022. (3 marks) c) Prepare 2020 and 2021 journal entries for Natty Company, specifically on January 1, 2020, August 31, 2020, January 1, 2021 and August 31, 2021. (12 marks) d) ANSWER THIS INDEPENDENT FROM ABOVE: Calculate the Present Value of the Lease if (2 marks) (Show calculations): On January 1, 2020, Natty Company (lessee) entered into a 5 year lease agreement with Fiona Company (as lessor) for machinery. Payments of $38,550 are due each January 1 (beginning of lease), which includes $2,000 insurance. Assume there is a bargain renewal option to renew for another 2 years with significantly lower payments of $5,000 per year which includes $500 of insurance. Assume they will renew. There is a bargain purchase option of $2,000 at the end of the lease (ie at end of 7 years). The implicit interest rate is 10% which was stipulated in the lease agreement set by the lessor and is known by Natty. The incremental borrowing rate is 12%. Assume IFRS.

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The lease is an operating lease from the lessees viewpoint The criteria for an operating lease are The lease term is less than the economic life of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started