Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 2 Read the excerpt below and answer the following questions: 1. When evaluating the performance of the 6 divisions, why did Vickie focus

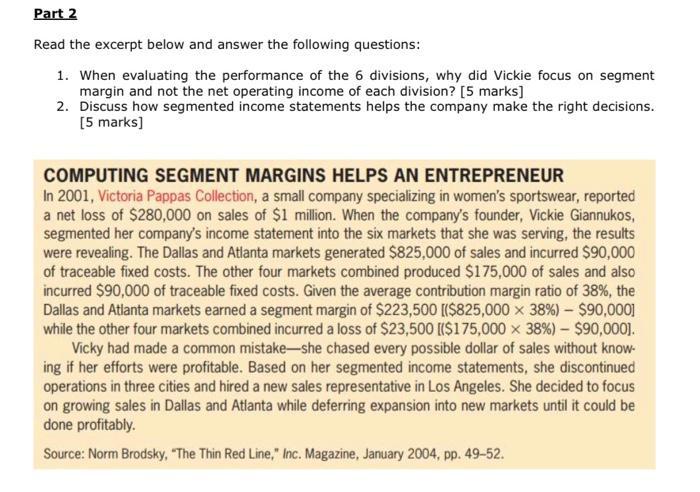

Part 2 Read the excerpt below and answer the following questions: 1. When evaluating the performance of the 6 divisions, why did Vickie focus on segment margin and not the net operating income of each division? [5 marks] 2. Discuss how segmented income statements helps the company make the right decisions. [5 marks] COMPUTING SEGMENT MARGINS HELPS AN ENTREPRENEUR In 2001, Victoria Pappas Collection, a small company specializing in women's sportswear, reported a net loss of $280,000 on sales of $1 million. When the company's founder, Vickie Giannukos, segmented her company's income statement into the six markets that she was serving, the results were revealing. The Dallas and Atlanta markets generated $825,000 of sales and incurred $90,000 of traceable fixed costs. The other four markets combined produced $175,000 of sales and also incurred $90,000 of traceable fixed costs. Given the average contribution margin ratio of 38%, the Dallas and Atlanta markets earned a segment margin of $223,500 [($825,000 38%) - $90,000] while the other four markets combined incurred a loss of $23,500 [($175,000 x 38%) - $90,000]. Vicky had made a common mistake-she chased every possible dollar of sales without know- ing if her efforts were profitable. Based on her segmented income statements, she discontinued operations in three cities and hired a new sales representative in Los Angeles. She decided to focus on growing sales in Dallas and Atlanta while deferring expansion into new markets until it could be done profitably. Source: Norm Brodsky, "The Thin Red Line," Inc. Magazine, January 2004, pp. 49-52.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1Vickie focused on segment margin because it provides a more accurate picture of the profitability of each division Net operating income includes all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started