Question

On January 1, 2020, Phoenix Corporation bought 100% of the stock of Sudan Corporation for $500,000 (with cash). The Balance Sheets of the two companies

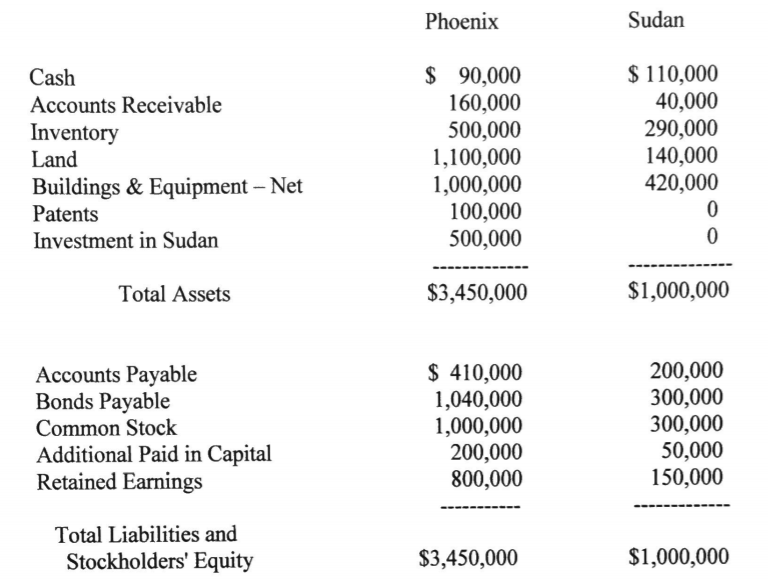

On January 1, 2020, Phoenix Corporation bought 100% of the stock of Sudan Corporation for $500,000 (with cash). The Balance Sheets of the two companies immediately after Phoenix acquired (January 1, 2020) Sudan Corp. showed the following amounts (all in millions US$):

At the date of acquisition, Phoenix owed Sudan $40,000. Also, on the date of acquisition the Book Value of Sudan equaled its Fair Value. At the end of the first year of combination, Phoenix expects a combined tax rate of 25%. Phoenix expects Sudan to have net income of $40,000 in 2020. The CEO of Sudan is a close friend of Phoenix CEO's father. Phoenix uses the equity method for its investment in Sudan.

Problems:

1. List all journal entries that Phoenix made to record its investment in Sudan on the date of acquisition.

2. List all Elimination Entries that would need to be made in order to prepare a workpaper for the consolidated Balance Sheet of Phoenix and Sudan immediately after the combination.

3. Prepare a workpaper for the consolidated Balance Sheet of Phoenix and Sudan immediately after the combination (January 1, 2020).

Phoenix Sudan as Accounts Receivable Inventory Land Buildings & Equipment - Net Patents Investment in Sudan S 90,000 160,000 500,000 1,100,000 1,000,000 100,000 500,000 $ 110,000 40,000 290,000 140,000 420,000 Total Assets S3,450,000 $1,000,000 Accounts Payable Bonds Payable Common Stock Additional Paid in Capital Retained Earnings S 410,000 1,040,000 1,000,000 200,000 800,000 200,000 300,000 300,000 50,000 150,000 Total Liabilities and Stockholders' Equity $3,450,000 $1,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started