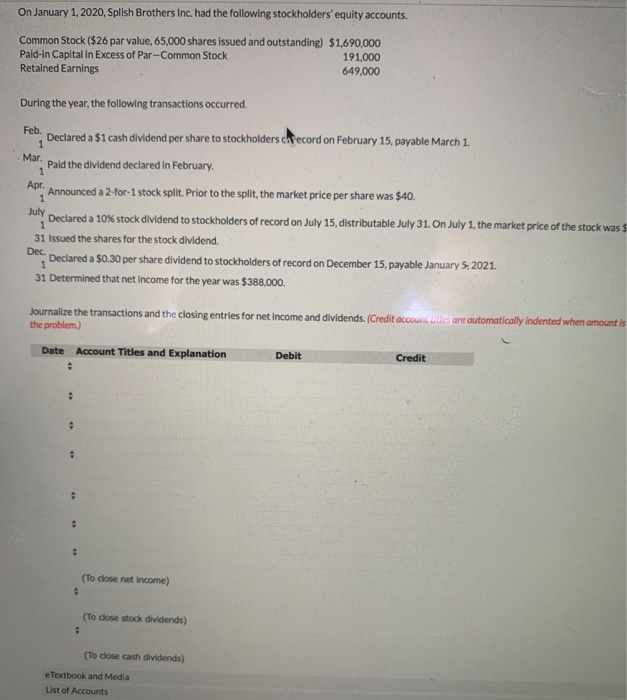

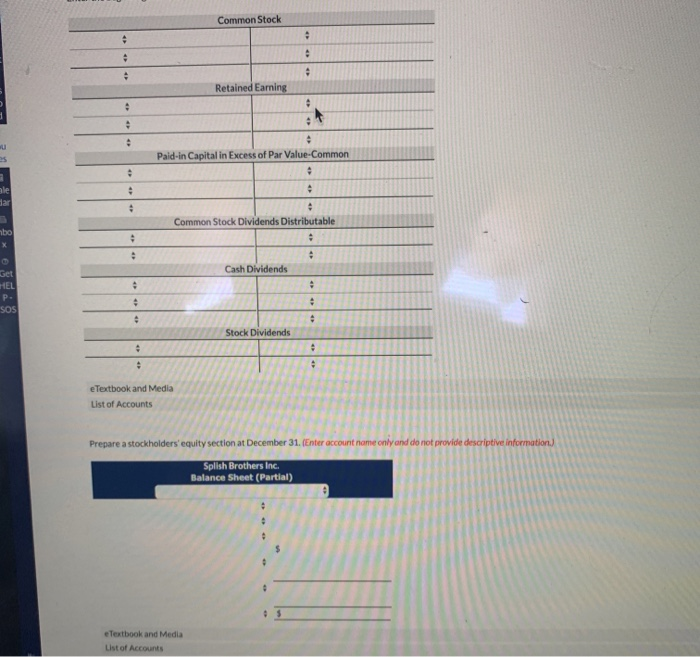

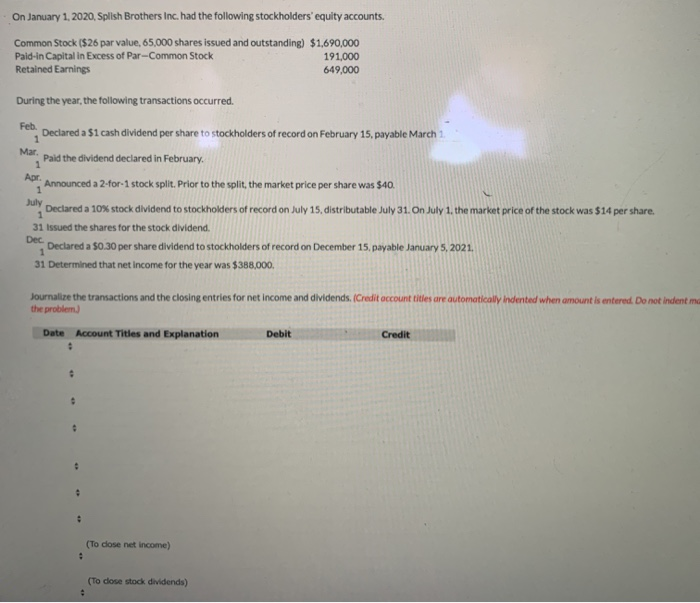

On January 1, 2020, Splish Brothers Inc. had the following stockholders' equity accounts. Common Stock ($26 par value, 65,000 shares issued and outstanding) $1,690,000 Pald-in Capital in Excess of Par-Common Stock 191,000 Retained Earnings 649.000 During the year, the following transactions occurred. e Declared a $1 cash dividend per share to stockholders Record on February 15, payable March 1 Paid the dividend declared in February Apr. Announced a 2-for-1 stock split. Prior to the split, the market price per share was $40. Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $ 31 Issued the shares for the stock dividend. Declared a $0,30 per share dividend to stockholders of record on December 15, payable January 5, 2021. 31 Determined that net income for the year was $388,000. Journalize the transactions and the closing entries for net income and dividends. (Credit accounts the problem.) are automatically indented when amount is Date Account Titles and Explanation Debit Credit (To close net income) (To dose stock dividends) (To cose cash dividends) eTextbook and Media List of Accounts Common Stock Retained Earning Paid-in Capital in Excess of Par Value-Common Common Stock Dividends Distributable Cash Dividends Stock Dividends e Textbook and Media List of Accounts Prepare a stockholders' equity section at December 31 Splish Brothers Inc Balance Sheet (Partial) e Textbook and Media List of Accounts On January 1, 2020, Splish Brothers Inc. had the following stockholders' equity accounts. Common Stock ($26 par value, 65,000 shares issued and outstanding) $1,690,000 Paid-in Capital in Excess of Par-Common Stock 191,000 Retained Earnings 649,000 During the year, the following transactions occurred. Declared a $1 cash dividend per share to stockholders of record on February 15, payable March 1 Paid the dividend declared in February Announced a 2-for-1 stock split. Prior to the split, the market price per share was $40. Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $14 per share. 31 Issued the shares for the stock dividend. Declared a $0,30 per share dividend to stockholders of record on December 15, payable January 5, 2021. 31 Determined that net income for the year was $388,000 Journalize the transactions and the closing entries for net income and dividends. (Credit account titles are automatically indented when amount is entered Do not indent me the problem.) Date Account Titles and Explanation Debit Credit (To cose net income) (To dose stock dividends)